3 Keys to Flawless Execution

“The proper execution of your trades is one of the most fundamental components of becoming a successful trader and probably the most difficult to learn. Most traders find it is much easier to identify something in the market that represents an opportunity, than it is to act upon it.” — Mark Douglas

Click here to order your copy of The VXX Trend Following Strategy today and be one of the very first traders to utilize these unique strategies. This guidebook will make you a better, more powerful trader.

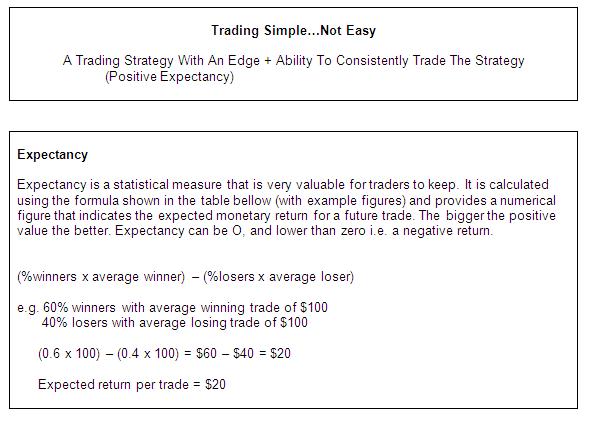

The Two Keys To Successful Trading

If we consider that the two key variables to achieving trading profitability are having a trading strategy with edge and positive expectancy combined with the ability to consistently execute that strategy, then assuming a trader has the first one (and developing this is a primary concern) then it is the consistency of execution that becomes the key focus; and indeed the main challenge for many traders.

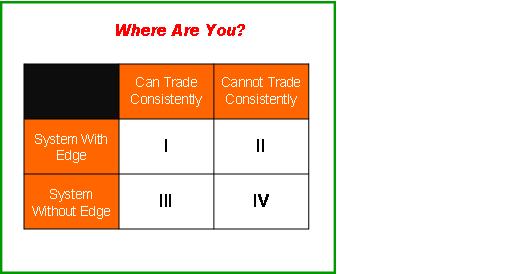

It is useful at this stage to reflect on where you are at with your trading in relation to these two variables. Take a look at the diagram below and see which quadrant you are in. If you are in 3 or 4 then your primary goal is the development of a trading system/strategy with an edge in the market. If you are in 1 then you should theoretically be returning profits over time and the challenge for you is sustaining this level of performance. If you are in quadrant 2 then the primary challenge is execution. Identifying where you are, is stage one; stage two is then setting some appropriate goals and targets to move you towards quadrant one.

Flawless Execution

In my work with traders I have seen many of them find this consistent execution challenging. One of the key aspects that seems to distract traders is excessive focus on P&L and the outcome and results of the trade. That is the trader is so distracted by thoughts around outcome and money to be made/lost that they do not have sufficient focus on the key components of executing their trade to achieve the best outcome. Likewise traders who are low in confidence fail to execute their trades and take opportunities when they arise losing valuable potential profits.

To help with the above two challenges I encourage the traders that I work with to focus on the flawless execution of their trading strategy as opposed to overly focusing on P&L and results.

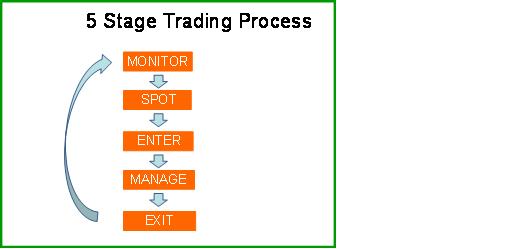

In the trading process we have 5 core components:

- Monitor – watching the markets

- Spot – spotting a trading opportunity

- Enter – enter the market, place the trade

- Manage – management of the position

- Exit – close the position out

In flawless execution the trader focuses on the process of each of the 5 steps and aims to do each one as well as they possibly can. They evaluate their trading performance against the quality of their execution of the trade alongside it’s profitability.

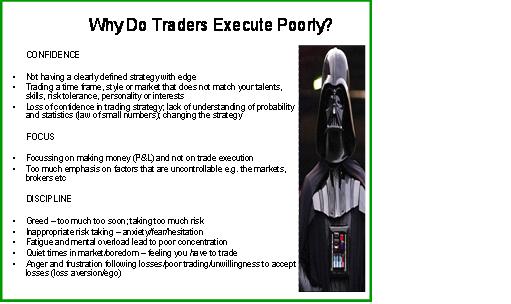

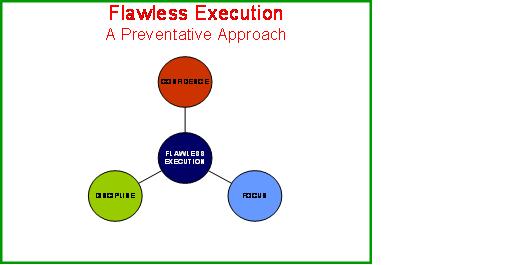

Three key factors enable flawless execution – confidence, focus and discipline. Many traders inconsistent execution of their strategies can be linked back to factors that are encompassed under these three headings

By developing these three areas and shifting your mindset to that of ‘flawless execution’ you may find that the quality of your trading improves and you experience less high negative emotional states such as fear and anxiety. A focus on flawless execution is actually a preventative approach to many of the common challenges and barriers faced by the majority of traders.

Nine Practical Strategies To Enhance Flawless Execution

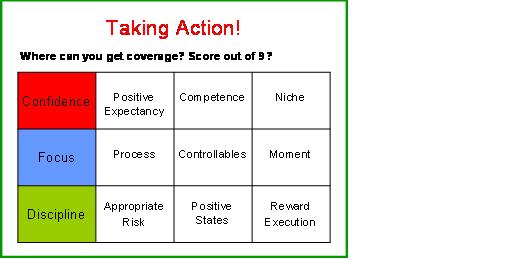

Below are the three areas of confidence, focus and discipline with some bullet point practical tips that you can take away and implement within your own trading to improve the execution of your trading strategy.

Confidence

- Profitable Trading Strategy With Edge In The Market (Positive Expectancy)

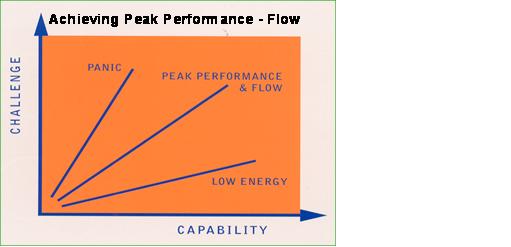

- Trade In Line With Your Current Ability Level – recognize where you are (beginner, novice, competent, expert, master) and trade an approach that is appropriate for your level of skill, knowledge and understanding. Anxiety and fear increase and confidence decreases when we are exposed to challenges that are too great for our perceived capabilities (See table below). The development of competence through ongoing education, coaching, mentoring and self-learning is absolutely critical in underpinning your confidence levels. Confidence is greatly underpinned by your competence!

- Trading In Line With Your Strengths, Interests and Best Potential For Profitability

Matching challenge and capability enables you to enter the flow state and trade at a higher level of performance. Where challenge exceeds capability anxiety, panic and worry are natural. Where challenge is too low for capability then boredom and apathy are usual.

Focus

- Process – focus on quality execution of each of the five stages of the trade model – what states and what actions

- Controllables – only aim to control what you can control!

- In The Present Moment – thoughts about the past and the future are not helpful in the moments of execution. Keep your attention in the now. Try this – get a ball or similar; throw it in the air; catch it. When the ball was in the air what were you focused on? Catching the ball hopefully! Not dropping it, or the shopping, or what you will be wearing tomorrow – your attention was in the moment.

Discipline

- Take Appropriate Risk (Low Risk for most people!) – high risk (outside of your psychological and financial thresholds) creates high emotion and specifically fear and anxiety – it stops many traders from entering trades, and it stops others from executing their stop losses and also encourages the taking of profits early. Low risk trading in line with your own personal threshold and trading capital and personal wealth makes for a less emotional more confident trading experience. A large majority of beginner traders who come to me regarding experiencing anxiety and fear in trading are simply taking too much risk!

- Trade In Positive States – tiredness, anger, frustration, stress are all states that are limiting to you trading to your full potential. High negative states impact on your ability to think rationally, to make objective decisions and to apply your strategy as blood flow to the ‘smart brain’ is reduced during these ‘negative’ emotional responses and your ’emotional’ brain starts to run the show! Aim to trade when you are at your best, or close too! Think about a 1-10 scale where 10 is your Ideal Trading State and 1 is ‘get me away from a trading screen now!’ – notice the levels at which you feel confident to trade at and also those scores which are a definite no trade zone.

- Reward good trading and not P&L. Many traders feel good when they make money, and this feeling is often greater than the feeling of executing well but losing money. The focus here is on the monetary reward and not on the execution. This may sound OK to you right? If our goal is to condition flawless execution then we need to reward flawless execution. It is possible to make money through poor execution, through random gambles in the market – should these be rewarded? We need to associate ‘pain’ to poor trading behaviors and ‘pleasure’ to positive trading behaviors regardless of financial outcome. This is a challenging concept for many people and requires a change of thinking and mindset – however consider this… the difference between the best traders and the rest is that the best traders think differently! (Mark Douglas, Disciplined Trader).

Below is a table of the nine practical strategies. Take some time to reflect on which ones you have in place (perhaps mark this on the table) and then have a look at where there are areas for improvement. Select one that you feel will have an impact on your trading in the short term and set the implementation of that as a short term trading goal. When you are happy that is ingrained into your trading process come back to the table and select another one. Your goal is to cover all nine areas – be focused on flawless execution and see your performance improve.

Conclusion

Flawless execution is an approach to trading – a philosophy. It is all about setting yourself up to be successful and to focusing on execution and not on P&L. This approach may not be for everyone, however from the work I have done in training and coaching traders I know that for the vast majority of people the impact on your trading is likely to be extremely positive!

Focus on ‘Flawless Execution’ and feel the difference.

Steve Ward is a trader performance and psychology coach at Trade With Precision. He has over 15 years of teaching, training and coaching experience and has worked with home, proprietary and institutional traders and groups across Europe, USA and Asia including consulting on trader recruitment, selection, assessment, training and development. He is an active FX trader and a regular trainer at the London Stock Exchange. His book ‘High Performance Trading’ is due for publication in November 2009.

Find out more about his highly successful trading psychology webinar programmed at www.tradewithprecision.com/ptp.