Bull Profit Taking Tools & 3 PowerRatings Stocks

Just like this massive bull advance is filling the coiffures of the big players, many individual investors are benefiting from the same positive wave. However, individuals and institutions also face the same dilemma when dealing with profits from this bullish advance. The dilemma — when and how to take the profits.

Remember, profits are merely speculative until they are realized. What’s the best way to take profits from this bull market? Our research has uncovered 3 optimal tools for making the most of your short term gains.

Our research has discovered that using a dynamic rule based exit method is the ideal for maximum profits. I am not talking about trailing stops here. In fact, the research clearly showed that stops failed to consistently improve the results of any system. Dynamic means that the exit strategy adjusts to price therefore isn’t a fixed percentage or number away from the current price. Unlike most stop loss tactics that lock in losses; the exit method should sell into strength to obtain the maximum gains.

Here are 3 quantified tactics to optimally lock in your profits.

- The First Up Close Exit: This method was first made popular by trading promoter and student, Larry Williams. It entails exiting the trade after the stock had its first daily up close over the previous day. This is the simplest to understand strategy yet stood up very well to extensive testing.

- Close Above The Moving Average Strategy: Based on this rule, you would exit the trade on its first close above the 5-day Simple Moving Average. In the testing, out of 63,101 trades, 70% of the exits locked in the max gains with an average profit of 2.65%. The 10 day Moving Average can also be used but the percentage correct drops by 1% but the average gain increases by 0.15%.

- The 2-Period RSI Exit Strategy: The trade is closed when the RSI(2) closes above 65, 70, or 75 on the day. The tests results out of the same sample size were 70% correct with a profit factor of up to 2.93%.

The primary lesson learned in the testing is to always sell into strength. The stronger the move, the more you should lock in the gains and stick with your exit rules.

Here are 3 top bullish PowerRatings stocks poised for short term gains:

^APKT^

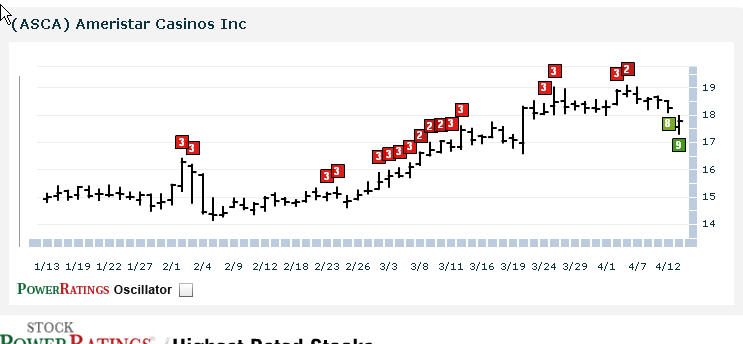

^ASCA^

^LMIA^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

Backtested on over 17,000 trades test this new trading indicator for Leveraged ETFs and find high probability setups daily – click here now.

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.