Capre’s Forex Report Jan. 19th

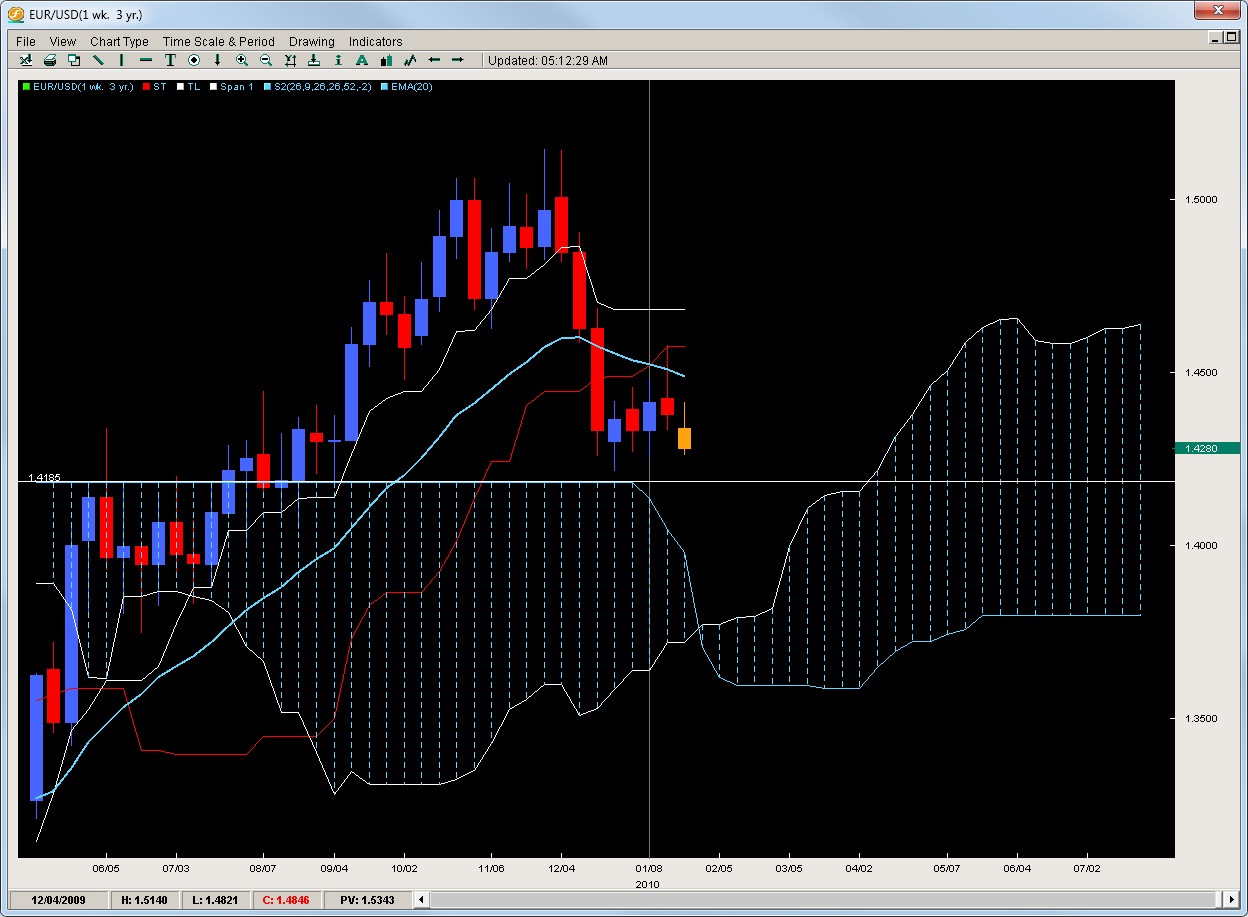

EUR/USD – Support Falling

As we wrote last week in our Ichimoku Report:

The pair will either maintain its corrective mode or start a strong sell-off towards the kumo top which has already fallen to 1.3760/80 level and will remain there till the end of Feb.

and

The line of least resistance will remain to the downside until 1.3760/80 level or until after Feb. 26th when the Kumo starts to climb and build a good base of support for months to come.

This is essentially exactly what has happened to the pair with it attempting a comeback only to get slammed by the weekly Kijun. The formation of this weekly candle and the strong rejection suggest the line of least resistance is clearly to the downside and any upside moves will have to contend with the Kijun and 20ema.

However, the Kumo paints the other side of the picture as its falling further and cannot offer any relief aid to the pair at least until the end of Feb. where it starts to pick up again. It should be noted the Kumo does not come in as potential support until 1.3800 so this should bode well for the USD in the next month or so. A break beyond 1.4185 suggest 1.4000 and 1.3800 will likely come under attack.

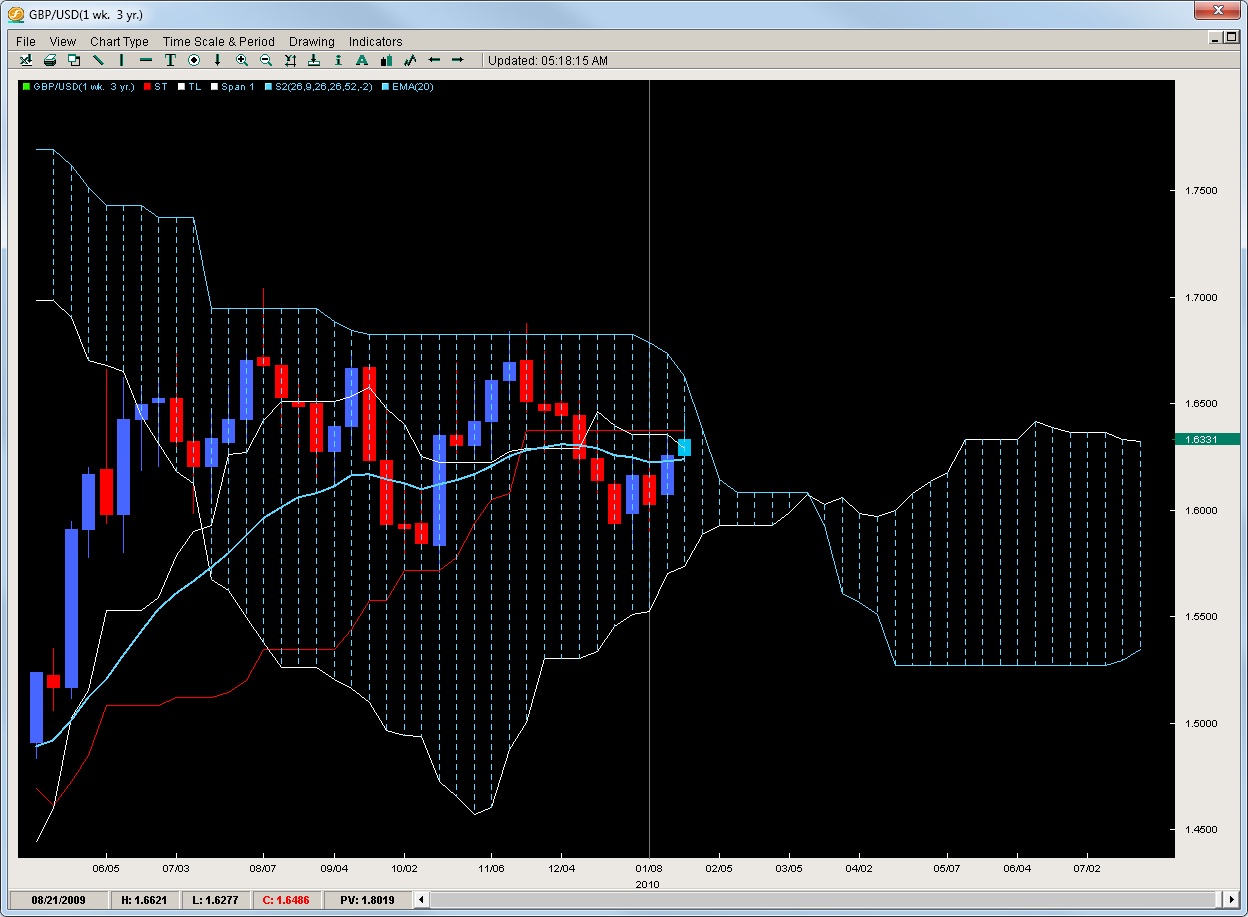

GBP/USD – Caught in a No-Fly Zone

An absolute mess of a pair trolling around the price levels like it has had one too many pints at the pub, the pair is caught in a completely inconsistent range and pattern which has formed a triangle within a triangle. These patterns are absolute drubbish from a position perspective and we suggest only taking intraday positions as any position held over a day or so is likely to reverse.

The pair is caught in the Bermuda triangle Kumo which is tailing off, getting smaller, and turning into a cone of sorts which then flips in mid-March. Overall, this type of Kumo formation suggests extreme caution and not to take heavy positions as the complex Kumo pattern combined with the flat lines all suggest the pair is not going anywhere soon. The only reason why its been climbing a tad as of late is the EUR/GBP sales which have been benefiting the GBP in the last two weeks. Support or Resistance is neither here nor there and only the wide range top of 1.6850 and the far away bottom at 1.5700 have any major attraction to institutionals.

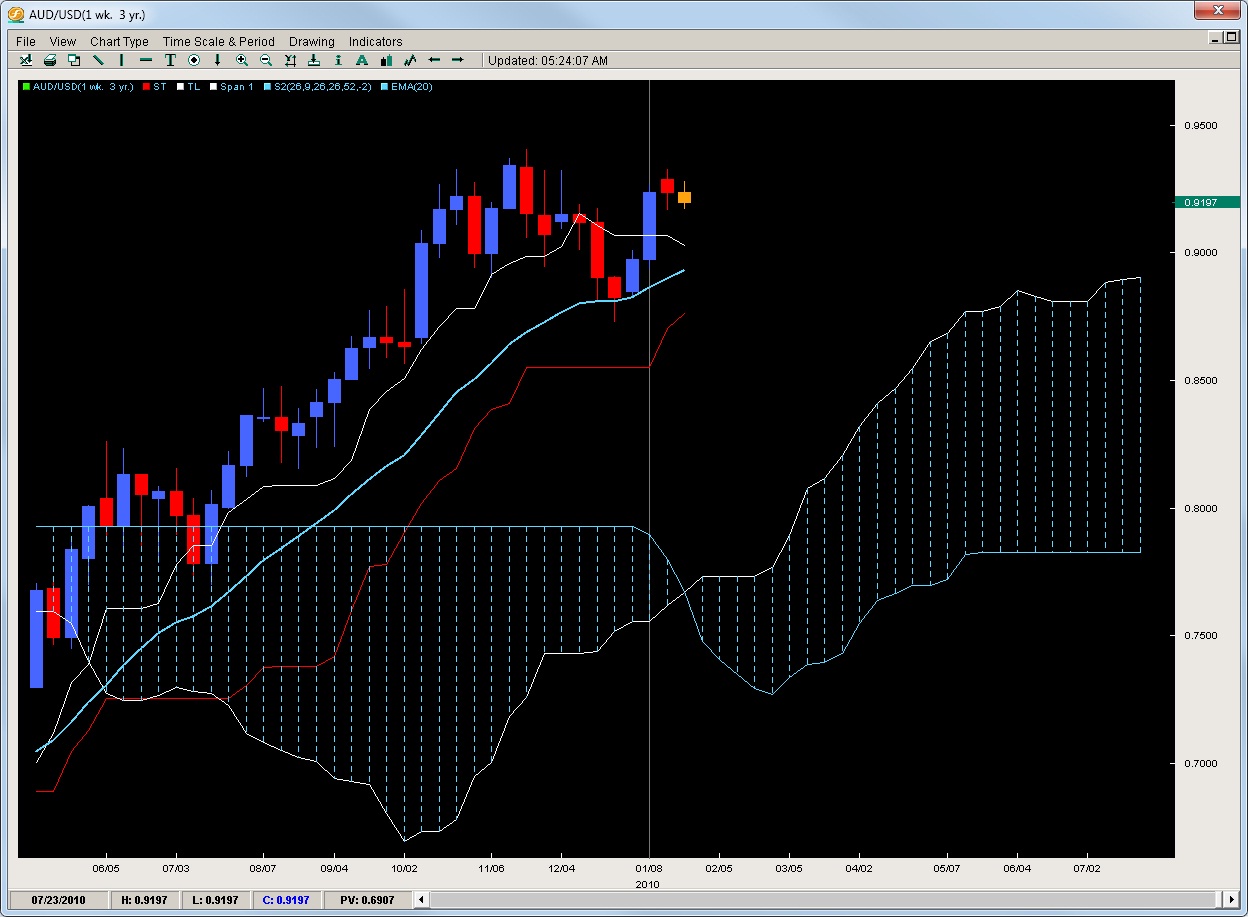

AUD/USD – Just Shy of the Double Top

Coming close but not taking home the cigar, the pair came about 100pips shy from the 09′ highs just piercing the 9300 barrier only to end the week in a sell-0ff. The pair last bounced off the 20ema which launched the pair 600 pips and now that the pair has failed at the top, should it post another weekly decline, we expect a 2nd test of the 20ema which we feel will be the most important one. The Tenkan is currently falling suggesting momentum is waning for this current upmove and since longs cannot add positions until a 09′ high break or another touch on the 20ema, we feel the pair will likely drift sideways or fall heavily to the 20ema but we do not expect massive buying to come in at this level so the short term outlook is at best neutral but more likely to the downside since bulls likely have lost a little confidence with the 2nd failed attempt to make a new high and are likely trimming some positions.

Overall, the larger uptrend structure is still in tact and the 20ema and Kijun offer nice levels to consider buying this pair if you are not already long. If you want to go short, it would be best to wait for a dip to the 20ema where positions will reset a bit, then sell between 9300-9400 for another move back down. Overall, shorts have a short term slight edge in this tug of war.

USD/CAD – The Truth Coming Soon

Its first attempt to break the 09′ lows at 1.0200 failed with the pair just coming within reach of it only to bounce. It then formed a higher low last week about 45pips from the 09′ low and has since bounced a tad. Last weeks candle has wicks on both sides of the market and the CAD Interest Rate Decision with the revisions to the GDP should be the main trigger which either causes a nice bounce in the pair or sends the pair reeling past the 09′ lows. Its kind of do-or-die for the bulls to mount any offense here and with the 20ema and Kijun falling, any rallies should get stymied. Bears have two options while bulls have one with potential risky buys off the 1.0200 level an option for the horns to have their play while the bears can wait for a weekly close below 1.0200 or another attempt towards the 20ema selling just shy of the line and targeting the 1.0200 level. Either way, the truth should be coming soon.

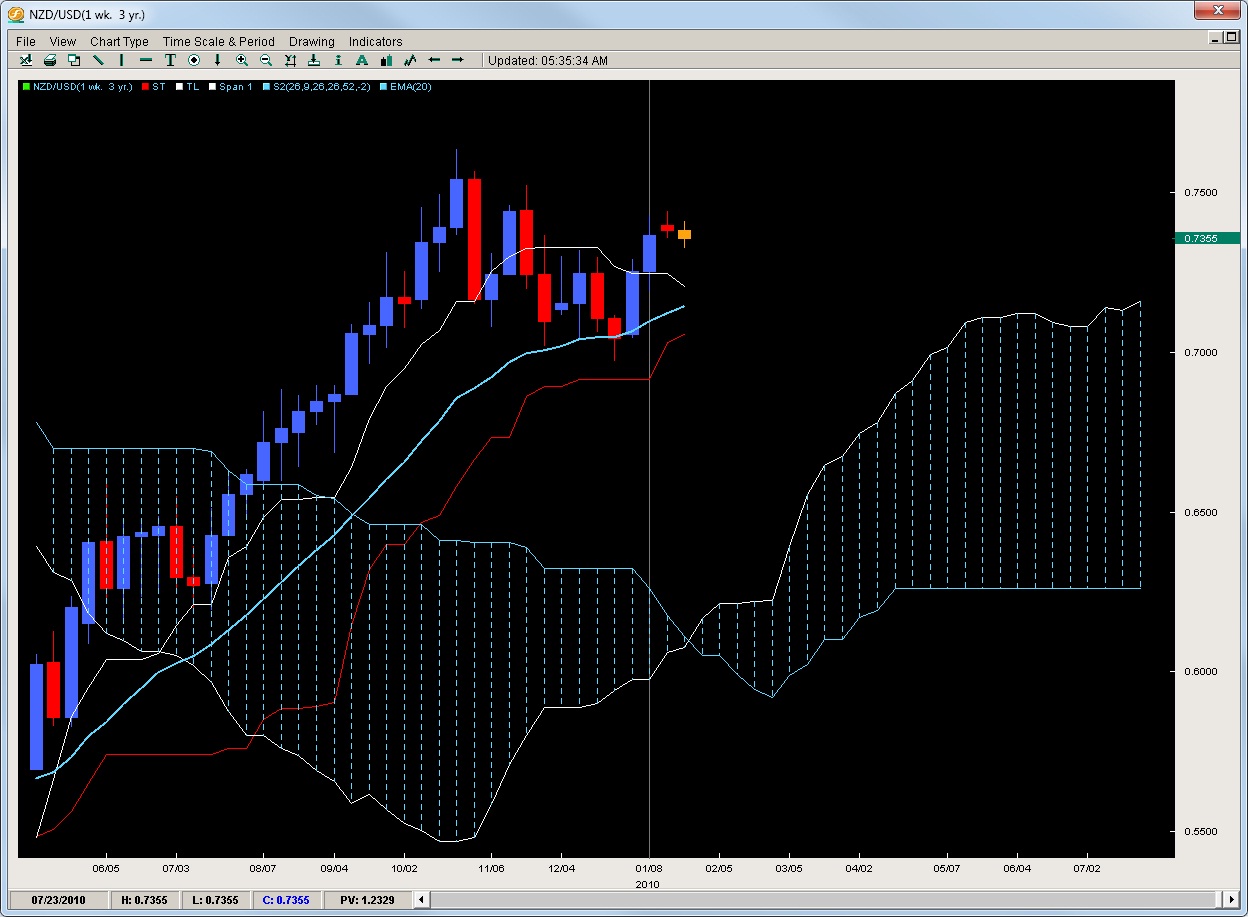

NZD/USD – 20EMA test Likely

After two straight impulsive bullish weeks for the pair to end 09 and start 2010, the pair has stuttered a bit well shy of the 09′ highs. It should be noted the sell-off was mild at best and barely sparked heavy interest. With the momentum and Tenkan declining, along with the recent successful test of the 20ema, we feel a 2nd one is in order as the pair is probably suffering from the solid USD gains against the other pairs. The picture on the Kiwi is too similar to the Aussie as no real buyers will come in until the 20ema while sellers want a higher price. Because the pair was that much farther away from the 09′ highs, we feel this is why last weeks price action was super mild as it could not garner any interest from both sides of the aisle. Mild buys at the 20ema are the only real play for the moment and until we see how the pair reacts to it, we will not have much of a direction on display so tread lightly.

Chris Capre is the current Fund Manager for White Knight Investments (www.whiteknightfxi.com/index.html). He specializes in the technical aspects of trading particularly using Ichimoku, Momentum, Bollinger Band, Pivot and Price Action models to trade the markets. He is considered to be at the cutting edge of Technical Analysis and is well regarded for his Ichimoku Analysis, along with building trading systems and Risk Reduction in trading applications. For more information about his services or his company, visit www.2ndskies.com.