Daytrading and Swing Trading Direxion

Direxion Shares Exchange Traded Funds allow investors to gain three times exposure to an underlying index to magnify possible gains or losses.

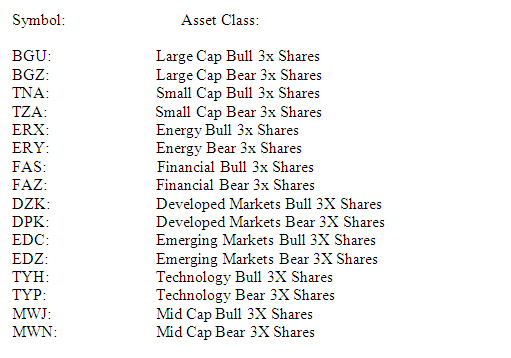

In November, 2008, Direxion launched this series of Exchange Traded Funds that offer three times exposure to underlying indexes and sectors and since then the market response has been nothing short of phenomenal. The company’s initial offerings focus on major market indexes, and 3X ETFs are available in the following categories:

So active traders now have a full menu of trading opportunities, and down the road, Direxion plans further offerings in indexes like the Nikkei, China, India and Real Estate so there will be an even more comprehensive suite of major index and sector 3X ETFs available to adventuresome investors.

Of course, leverage like this comes with distinct advantages as well as disadvantages. These ETFs allow investors to gain 3X leveraged exposure to markets and so amplify their returns, or losses, allow investors the opportunity to manage their capital for improved risk adjusted returns, and present the opportunity to profit in both bull and bear markets.

Success in this arena requires a disciplined trading plan and the will to execute it no matter what. Gains can come and go quickly and losses can accelerate rapidly if and when this amplified leverage starts working against you. Average daily high to low swings in these ETFs are routinely in the double digits and so you must be ready for a fast paced and challenging trading environment to succeed in this marketplace.

As Direxion says on its website, “Direxion Shares are leveraged Exchange-Traded Funds (ETFs) designed to seek daily investment results, before fees and expenses, of 300% of the performance (or 300% of the inverse of the performance, in the case of a bear fund), of the benchmark index that they track. There is no guarantee that the funds will achieve their objective. These funds are intended for use only by sophisticated investors who: (a) understand the risks associated with the use of leverage; (b) understand the consequences of seeking daily leveraged investment results; and (c) intend to actively monitor and manage their investments.”

Direxion’s performance goals do not apply to long periods of time and the longer you hold your position, the more likely it is that you’ll see variances in results. Sometimes this could be to your advantage and other times it will work against you and so you must be prepared to actively trade these funds as market conditions change.

And due to high volatility you can possibly find yourself buying the shares at a large price premium relative to the fund’s NAV. So you can actually pay more than the actual net asset value per share. And in highly volatile markets like we see today, the Bull and Bear funds that track the same index can both have positive or negative rates of return for the same period which seems impossible but can happen with these exotic products.

So as with any investment, it is important to educate yourself and have a sound plan before going into battle.

2 Potential Trading Plans

To trade these funds successfully, you must first decide if you’re going to be a day trader or position trader. I’m not usually a day trader, however, one simple strategy for day trading would be to use a simple MACD buy and sell signal based on a very short time frame of your choosing.

An example of this is illustrated in the 30 minute chart below:

In this chart you can see that the FAZ, Financial Bear 3X ETF, was extremely oversold in the period around April 13th and then the MACD and RSI turned up to indicate rising prices and the “buy” signal on April 14th would’ve resulted in a nice gain by April 15th.

So you can see how quickly these prices can move, and I’ve also found that these funds tend to routinely open the morning trade with extreme volatility with moves of 3-5% that can either work for or against you as you enter and exit your positions. Therefore it’s important to use limit orders, and many experienced traders wait for the market to open and then settle down and execute their entries or exits sometime within the first hour after the initial volatility has passed.

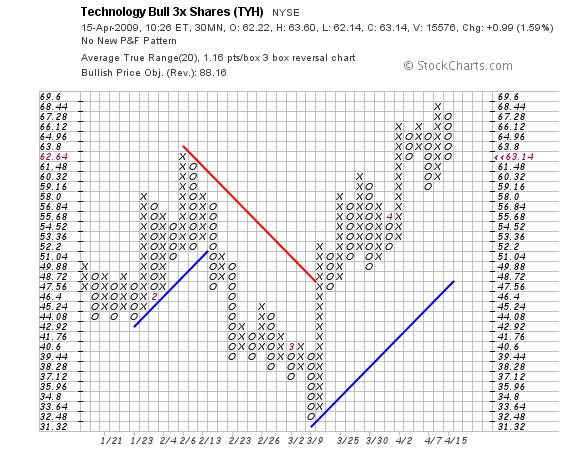

I’m a student of Point and Figure Charting, and in my personal trading I’ve found that this methodology can provide you a simple but effective way to take short term trades of a few days with these leveraged funds.

In the chart above, you can see that TYH, the Technology Bull 3X ETF is in an uptrend and recently had a “buy” signal from the highest column of Xs that’s second in from the right. Using Point and Figure charting techniques, you could easily enter on a “buy” signal” and exit on a “sell” signal and set your stop loss points below support levels as indicated on the chart.

Point and Figure signals take all of the “noise” out of the marketplace and just tell you in a very clear format whether supply or demand is in control of your fund. Also, higher confidence trades could be found when the ETF is trading above its bullish support line, the blue line on the chart above.

And for day traders, Point and Figure charts can be set on short time intervals and so give you confirmation of planned entry or exit points, as well.

So these funds give you the opportunity to significantly amplify potential returns, but you must understand that in this arena you’re playing with the big boys and you must come fully armed and prepared for battle.

However, judging from the daily volume and rapid growth of these high octane offerings, it appears that both institutions and individuals alike have quickly embraced these new products in search of potential Triple X returns.

John Nyaradi is Publisher of Wall Street Sector Selector, an online newsletter specializing in sector rotation trading using Exchange Traded Funds.