ETF Trading and the Nasdaq: QQQQ, PSQ, QID, QLD

Short, leveraged, leveraged short or just playing it straight – exchange-traded funds create more than one way traders to wager on – or hedge against – the Nasdaq.

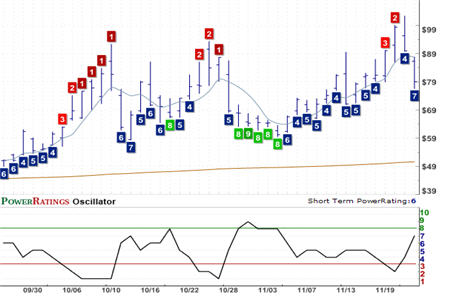

Stocks were up for a second day in a row on Monday and traders are wondering in this holiday-shortened week if buyers will be able to make it three days in a row. Such events have been mixed blessings in the Nasdaq. The last two times the Nasdaq earned three up days in a row came before significant corrections in late October and early November. Before that, we see a few scattered three-day rallies in August, while the Nasdaq was still ascending what we know realize was a diving platform.

Click here to order your copy of The VXX Trend Following Strategy today and be one of the very first traders to utilize these unique strategies. This guidebook will make you a better, more powerful trader.

Whether you think the Nasdaq will be heading higher, lower or nowhere over the next few days, one of the increasingly popular ways to invest, trade, speculate and hedge the Nasdaq is through exchange-traded funds (ETFs). ETFs allow investors and traders to get great exposure to entire market, sector or country’s stock market, in a vehicle that can be bought and sold as easily as stocks. Also unlike trading mutual funds, ETF trading involves great transparency. Traders can know exactly stocks they are buying or what indexes are being tracked inside their exchange-traded fund “package.”

What are some of the more popular ETFs for those interested in trading the Nasdaq? First up is, of course, the PowerShares Nasdaq 100 Trust ETF, QQQQ

(

QQQQ |

Quote |

Chart |

News |

PowerRating). The most widely traded Nasdaq ETF, the QQQQ tracks the Nasdaq 100 and is sought out not only for its liquidity, but for its ability to provide exposure to an index with heavy technology representation.

If you already own or trade a number of Nasdaq 100 stocks, then you might consider hedging your stock positions with an inverse or short ETF such as the PowerShares Short QQQ ETF, PSQ

(

PSQ |

Quote |

Chart |

News |

PowerRating) or the PowerShares UltraShort QQQ exchange-traded fund, QID

(

QID |

Quote |

Chart |

News |

PowerRating). These funds track the Nasdaq 100 also, but do so in an inverse fashion, moving higher as the Nasdaq 100 moves lower.

The UltraShort fund does this one better by not only tracking the inverse of the Nasdaq 100, but also by doing so on a 2 to 1 basis – providing a high-octane speculating vehicle, as well as a way to hedge positions with less capital deployed (though the risks are greater with the increased leverage).

Last but not least, one popular Nasdaq 100 ETF over the past few weeks has been the PowerShares Ultra QQQ, QLD

(

QLD |

Quote |

Chart |

News |

PowerRating). The QLD tracks the Nasdaq 100, but does so on a 2 to 1 basis. So the QLD is leveraged, but not a short/inverse fund. Traders speculating on a bottom in the Nasdaq 100 in recent weeks, for example, have turned to the QLD as a leveraged bet that the market would move higher, again without using as much capital as would be required for a similar trade using the “vanilla” QQQ.

The ETF market is the fastest growing market in the United States. According to a recent report, eight out of ten securities traded are exchange-traded funds. Want to learn how to trade them? Click here to find out what traders are saying about Larry Connors’ new book, Short Term Trading Strategies That Work: A Quantified Guide to Trading Stocks and ETFs!

David Penn is Editor in Chief at TradingMarkets.com.