Greenspan Says Go & 3 PowerRatings Stocks

Alan Greenspan, the former Fed Chief and notorious anti Obama libertarian, has become bullish on the U.S. economy. It was truly refreshing hearing positive words from this icon of the American right.

His politics are diametrically opposed to the Obama regime’s policies. Yet he is speaking out on the dramatic improvement triggered by such intervention. This is an incredibly genuine signal of sea change.

Greenspan stated in an interview with ABC’s This Week, “There is a momentum building up which is really just beginning and it’s got a way to go.” He believes the economy is approaching a massive increase in inventories thus creating a self reinforcing cycle of growth. I take this as being a hyper-positive indication for the future. Something is working with the stock market, which is responding in kind.

As you know, the stock market is an anticipatory mechanism. This means that it reacts now to what it anticipates will occur in the future. Investor’s perception of the news is more important than the actual news itself. This is why the way news is spun in the various outlets has as much or more of an effect than the unbiased story in and of itself. With this said, the Greenspan opinion may be signaling the beginning of a long term bull and not the end as the perma-bears are preaching.

If, in fact, Greenspan is correctly anticipating the future course of the economy, how can short term traders jump aboard the soon to be runaway train before it’s too late? We have created an easy to use, simple 3 step plan to help you locate stocks ready to make short term bullish moves.

The first and most critical step is to only look at stocks trading above their 200-day Simple Moving Average. This assures that a strong, long term up trend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this fly in the face of conventional wisdom of buying stocks as they climb higher. However, as previously stated, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

The third and final step is a combination of whittling the list down even further by looking for names whose 2-Period RSI (RSI)2 is less than 2 (for additional information on this proven indicator click here) and the Short Term PowerRating is 8 or higher.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame.

Here are 3 top ranked PowerRatings Stocks fulfilling each and every step of the above system:

^AXL^

^ICOC^

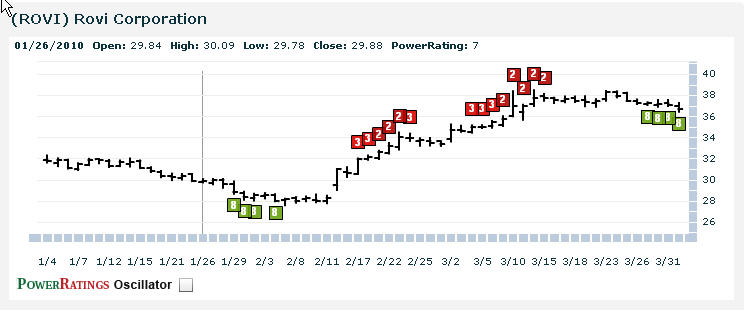

^ROVI^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.