Health Care Reform, the Market & 3 PowerRatings Stocks

After an incredible amount of wrangling, the House finally passed a version of Obama’s Health Care Reform Bill.

The country still appears to be split over the changes. Even a cursory listen to the popular conservative talk radio hosts, like Rush Limbaugh’s program, one would hear these political taste makers’ strong aversions to the reform. They obviously believe the bill will spell disaster for the American people.

These commentators only see the potential for an increased deficit, lack of medical choice, and a ruining of what they consider an excellent system of care the way it is currently. Sometimes it is tough to tell if these talking heads truly believe what they say, or if they simply hate Obama to the degree that they would counter any of his proposals as a matter of course.

The other side of the debate sees expanded coverage and better care for those who can’t afford or are otherwise locked out of the current system. Perhaps, the truth lies someplace in the middle of the two extreme viewpoints.

Regardless, the facts are the changes will likely take effect in 2014. Longer term investors should be thinking who will profit the most from the sweeping reform measures. No matter how dire some believe the situation appears, there are always companies that will benefit from change.

This is one of the beauties of the capitalistic system. The expanding pool of coverage should benefit acute care hospitals and Medicaid managed health care companies. It’s even possible that pharmaceutical companies will benefit as they should sell more product as the number of people insured will increase. Right now the reform measures seem guaranteed to happen, however it’s important to keep in mind, things could change between now and 2014.

Most importantly, short term traders really don’t need to be concerned about the effect of the bill on their trade selection. However, short term traders do need a proven system to help locate companies poised for gains. Our PowerRatings is one such proven and effective stock locating system.

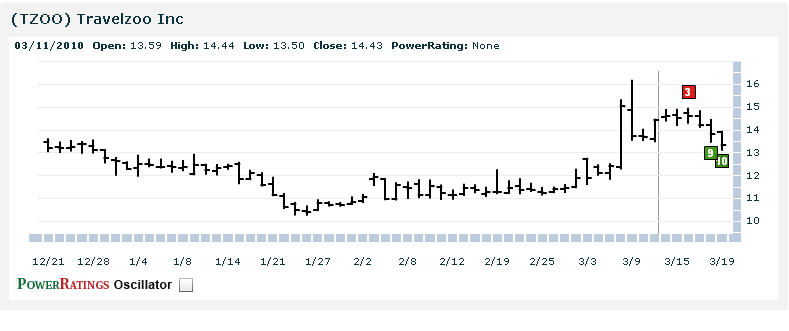

They are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short term gains and 10 proven to be the most probable for gains over the next 5-days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short term.

Here are 3 top rated PowerRatings stocks for your consideration:

^TZOO^

^TRA^

^AMR^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

>

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.