Optimizing Leveraged ETF Returns

With all the media coverage of the leveraged ETF controversy that has been brewing over the past several months, it is becoming increasingly difficult to separate the facts from the fiction. As firm after firm bans the use of these funds, a growing number of investors are unable to utilize leveraged ETFs. For those who do retain the ability to use these funds, the horror stories of return erosion and a flood of lawsuits might cause even the most sophisticated investors to steer clear. While the dangers of leveraged ETFs (if used by those who fail to understand their risk profile) are very real, the potential upsides can be equally spectacular.

Of the countless misconceptions about leveraged ETFs, perhaps the most damaging is the notion that the returns on these products become wildly unpredictable when held over multiple trading sessions due to the daily compounding of returns. While this can occur in certain markets, investors can implement a fairly simple process to ensure that leveraged funds will track the target multiple of their benchmark over longer time periods.

Most traders move in and out of leveraged ETF positions within a single trading session, worried about the effects of compounding returns. But an increasing number of investors have begun using leveraged ETFs over extended time periods to generate amplified returns on trends that may not play out in a single trading session. Since leveraged ETFs compound daily returns, returns over multiple trading sessions can often result in unpredictable returns, particularly in seesawing markets. But by using a rebalancing plan, traders can guarantee leveraged results over longer periods, setting themselves up for excess returns.

Leveraged ETFs 101

Leveraged ETFs use complex financial instruments, such as swaps and futures, to magnify the daily returns on a benchmark. For example, Direxion Daily Large Cap Bull 3x Shares [BGU|BGU] seeks to provide daily returns corresponding to 300% of the daily return on the Russell 1000 Index. If the Russell 1000 rises 1% for a single trading session, BGU should be expected to rise by about 3%.

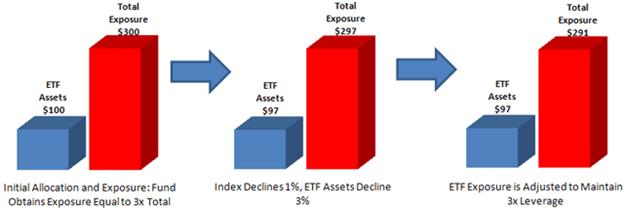

Because leveraged ETFs seek to amplify daily returns, these funds reset their exposure on a daily basis. It is for this reason that when held for multiple trading sessions, the return on the leveraged ETF may deviate from the multiple of the return on the underlying index, particularly in oscillating markets. A leveraged ETF increases its exposure as its price rises and decreases its exposure as its price falls, leading to potentially undesirable results in a volatile, nontrending market.

Not Rocket Science

Many analysts and journalists convey leveraged ETFs as a mysterious black box that implements strategies beyond the grasp of most investors to generate erratic, unpredictable returns. In reality, the concept behind leveraged ETFs is easy to understand, and the consistency with which the funds achieve their stated objectives is rather impressive. Leveraged ETFs reset their market exposure on a daily basis, meaning that they are generally intended to be short term investments.

Another misconception regarding leveraged ETFs relates to their performance. The financial press has furthered a notion that leveraged ETFs don’t perform as advertised. This is patently false. Leveraged ETFs have an excellent track record at accomplishing their stated objectives. These funds may not perform as some investors expect them to, but on the whole they perform exactly as advertised.

How to Optimize Leveraged ETF Returns

Some coverage on leveraged ETFs is correct: the effects on a portfolio in certain markets can be devastating if used incorrectly. But if used correctly, these ETFs can be powerful tools that can lead to a big payday even beyond a single trading session. Traders shouldn’t be scared of investing in leveraged ETFs for multiple sessions, but they should do so with an understanding of the fundamentals behind leveraged ETFs and with the help of a rebalancing plan.

Leveraged ETFs are appropriate only for a relatively exclusive universe of investors for two primary reasons. The first is that since these funds are designed to amplify returns, they are likely to significantly increase the volatility of any portfolio that includes them, which may be inappropriate for risk-averse investors. Second, these ETFs require daily monitoring, since their performance over multiple trading sessions depends on the direction of the market (among several other factors). Investors without the time or resources to monitor leveraged ETF investments on a daily basis should stay away from these products. The “set it and forget it” approach may work for long-term buy-and-holding, but it won’t work with leveraged investing.

Develop and Implement a Rebalancing Plan

With as much attention as leveraged ETFs have been receiving lately, it’s particularly amazing that more investors aren’t aware of the benefits of developing and implementing a plan to rebalance leveraged ETF investments on a regular basis. As discussed above, leveraged ETFs operate with daily returns in mind, so bull funds must increase their exposure as the underlying index rises and decrease exposure as the markets fall. As a result, in seesawing markets leveraged funds will tend to return less than the multiple on the underlying benchmark when held for multiple periods.

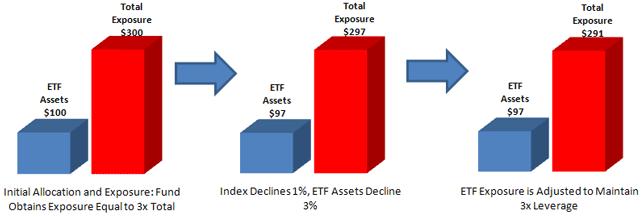

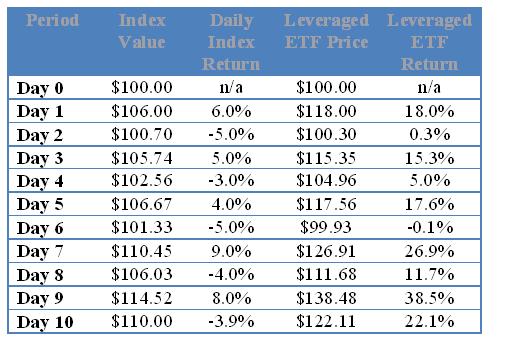

Consider this hypothetical example:

As shown above, the market rises 10% over a 10-day period, but a hypothetical 3x leveraged ETF tracking the benchmark would only rise 22.1%, or about 2.2x the return on the index. Depending on the level of volatility and period in question, returns on leveraged funds can deviate even further from the multiple on the underlying benchmark (note that on Day 6 the leveraged ETF had actually generated a negative return when the underlying index is up).

Again, since leveraged ETFs operate with daily returns in mind, their performance over multiple trading sessions can digress from the multiple on the underlying benchmark.

Rebalancing is the Key

Contrary to popular belief, leveraged ETFs can be used to generate amplified returns over an extended period of time. But they can’t do it alone. (i.e., a “set it and forget it” approach won’t do the trick.) By implementing relatively simple rebalancing strategies, leveraged ETF investors can more closely approximate an amplified return on leveraged ETFs over multiple trading sessions.

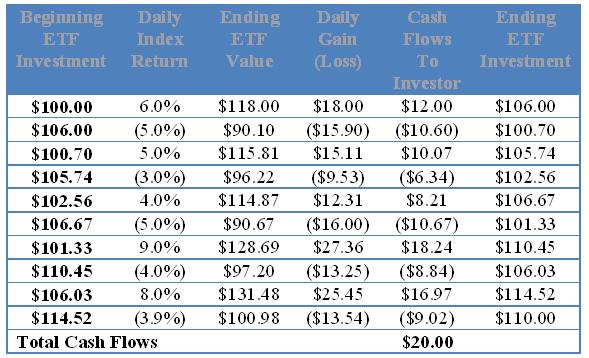

By their very nature, bull leveraged ETFs increase exposure following increases in the benchmark index and decrease exposure when the index declines (as shown above). In order to achieve leveraged results beyond the short term, however, investors want to do the exact opposite. As the underlying index increases, advisors should reduce exposure by selling shares. As the index declines, advisors should increase exposure by purchasing additional shares. Consider the implementation of such a strategy assuming the same 10-day period:

After the leveraged ETF rises on day 1, traders should reduce their position in the fund by pulling out two-thirds of the daily gain. After a decline on day 2, an additional cash infusion (again, equal to two-thirds of the daily loss) is required.

The strategy summarized above rebalances on a daily basis such that the ending exposure in the leveraged ETF is equal to the value of the index on that day. (Note that the far right column on the above table is equal to the second column on the first table.) After 10 days of volatile market returns, the investment in the leveraged ETF has increased from $100 to $110, and the investor has received $20 in cash flows, for a total return of $30, exactly equal to 3x the return on the index over the period.

The obvious oversight in this example is fees and expenses that would be incurred by such frequent rebalancing. This example is extreme in the sense that it implements a daily rebalancing strategy. The less frequent the rebalancing, the greater the tracking error and the lower the fees. In reality, it may be more sensible to set a “trigger point” at which point leveraged ETFs should be rebalanced (i.e., a deviation between the returns on the index and the return on the ETF). Unfortunately, there is no way around a trade-off between expenses and tracking accuracy when dealing with leveraged ETFs.

The Verdict on Leveraged ETFs

Leveraged ETFs will always be used most widely by short-term traders looking to turn a quick profit on intraday market movements, and most investors will have closed out their positions before they head home for the day. But more and more risk-hungry traders are embracing leveraged ETFs as a way to amplify returns over a few days or weeks. As long as they do so with caution, these funds can be very powerful tools for investors with a strong opinion on market movements and an even stronger appetite for risk.

Michael Johnston is the senior analyst and founder of ETF Database, a Web-based investment resource providing actionable ETF investment ideas. Johnston has completed the Chartered Financial Analyst (CFA) program, and obtained his bachelor’s degree in finance from the University of Notre Dame. Prior to founding ETF Database, Michael worked in a private client service group performing valuations of companies operating in a wide range of industries.