Saving Greece & 3 Bearish PowerRatings Stocks

The financial woes of the Greek Isles are always mentioned as one of the causes of recent stocks sell offs in the United States. Investors fear a financial contagion spreading from this idyllic yet troubled land.

A domino effect taking down second and third tier economies around the globe is the prime concern. Even an economy as relatively small as Greece can have far reaching effects in this interconnected world. Talking with a variety of investors, I have discovered that most do not understand what is happening in Greece and the steps being taken to rescue this injured economy.

Debt is the primary cause of Greece’s troubles. Years of unfettered spending, during the global boom, led to a deficit higher than is permitted in the Eurozone. The explosive growth allowed Greece to effectively hide the skyrocketing debt with a little accounting sleight of hand.

Imagine using credit cards to pay off credit cards, as a personalized example of what occurred. As long as you keep getting credit offers in the mail, you can maintain the illusion of paying your debt and staying solvent. However, any stoppage of the credit offers would send you spiraling quickly off a cliff.

Greece’s credit rating, similar to a FICO or personal credit score for economies, was downgraded to the lowest in the Eurozone. This downgrade in debt rating prevented Greece from getting more capital from investors. The country was viewed as simply being too risky for prudent capital deployment.

Greek debt is currently at $413.6 billion. This is greater than the entire economy. Debt exceeds income by 12.7%. Using our personal example, this would be called being “upside down” in the consumer space.

As with any entity finally hit with the reality of excessive debt, Greece has started to slash expenses and raise income via taxation. To make matters worse, Greece’s population is rebelling against the changes with massive strikes.

Fortunately, 16 countries in the Eurozone have agreed to stand ready to bail out Greece when needed. Each country will contribute based on their GDP and population. Under this guideline, Germany and France will lead the effort. Around $26.8 billon dollars is planned on being raised by this unified effort. However, issues have arisen with this plan and are presently being debated.

This situation has hurt the Euro and put fear into equity markets around the world. I am confident that Greece will be saved but it may be tough road to travel. Be ready for additional shock waves before the final solution is finally reached.

Here are 3 bearish PowerRatings stocks for your short term watch lists:

^PPD^

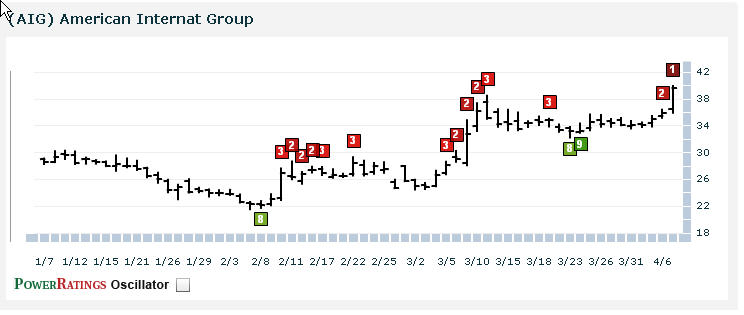

^AIG^

^HOG^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.