What’s Up, What’s Down: Financials and Energies in Today’s Spotlight

Comments for Monday, September 13, 2010

Looking Ahead to Today by Reflecting Back at Friday’s Price Action

Futures and options trading is speculative in nature and involves substantial risk of loss. Futures and options trading is not suitable for all investors.

ENERGIES:

Higher closes last Friday for crude and heating oil along with the rbob and natural gas. The crude, heat and rbob continue to show very choppy action while in sideways trends since late May and early June forcing me to remove my sell signals for the crude and heat standing aside for now. The gas has been consolidating over the last two weeks but also is in a BEAR TRIANGLE which should signify a continuation of its downtrend. SELL SIGNAL FOR THE NATURAL GAS. CALL FOR DETAILS!

FINANCIALS:

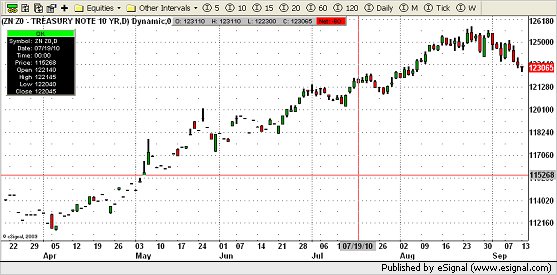

Higher closes for the Eurodollars while lower for the notes and bonds. The Eurodollar continues to be in a basically sideways pattern since the end of July ending my buy signal while the notes made their lowest low and close since August 6th and the bonds since August 11th both giving me SELL SIGNALS. SELL SIGNALS FOR THE NOTES AND BONDS. CALL FOR DETAILS!

There has been a lot of talk and advertising for Gold exchange traded funds (ETFs). Do you understand the difference, from a trader’s point of view, between gold futures and gold ETFs? Download my comparative evaluation report at https://www.zaner.com/3.0/ralexGold.asp.

Rick Alexander has been a broker and analyst in the futures business for over thirty years. He is a Vice-President for Sales and Trading at the Zaner Group (www.zaner.com) a Chicago-based futures brokerage firm. Email Rick at ralexander@zaner.com.

The information in this Report and the opinions expressed are subject to change without notice. Neither the information nor any opinion expressed constitutes a solicitation by Rick Alexander or the Zaner Group of the purchase or sale of any futures or options. Futures and options trading is speculative in nature and involves risks. Spread trading is not necessarily less risky than outright positions. Futures and options trading is not suitable for all investors.