World Bomb

Each morning this

list will contain those stocks with the potential to make a quick but tradable

move in the first hour. The information listed here is designed for the

trader who catches the early morning momentum, between the first five and 45

minutes of trading. Many stocks open each morning, run for several points and

then reverse. I will cover stocks with this potential and highlight possible

reversal points and resistance areas. These points need to be monitored closely,

as the stocks may turn quickly here. Be ready to lock in profits quickly.

Morning Outlook

The

S&P futures are down 9 points and the Nasdaq futures are down 59 points. Watch for a turnaround in the first 10-30

minutes of trading. Keep an eye on the stocks that gap the most in the morning.

Use the Nasdaq tracking stock (QQQ)

or futures as leading indicators.

Getting hit

this morning are Altera

(

ALTR |

Quote |

Chart |

News |

PowerRating) and Worldcom

(

WCOM |

Quote |

Chart |

News |

PowerRating). Look for trouble

in the chip group.

The Nasdaq

100, the NDX, is set to open down roughly 70 points.

Trading

the Open Watchlist:

(

MANU |

Quote |

Chart |

News |

PowerRating),

(

WATR |

Quote |

Chart |

News |

PowerRating)

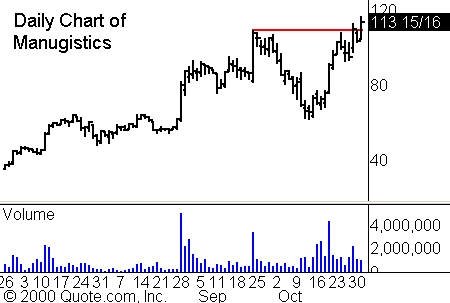

Manugistics

(

MANU |

Quote |

Chart |

News |

PowerRating) spent

the last few weeks tracing out a lovely cup with handle formation. It finally

rallied above resistance for a second new high closing in a five-day period.

With the first continuation day following the breakout now in place, we will

watch for more upside. Should the stock retrace, look for former resistance to

become support, near 110. The volume on Tuesday was nothing to write home about,

it was merely average, but there may be more gusto left in the morning.

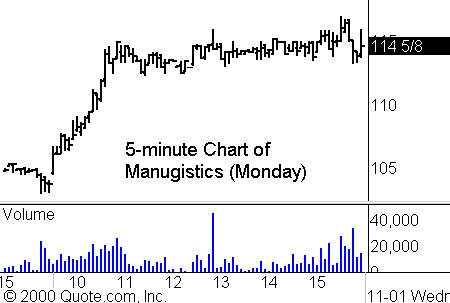

Manugistics

(

MANU |

Quote |

Chart |

News |

PowerRating) is known to make a large portion of its

move, when there is one, in the first hour of trading. This chart from Monday

demonstrates that.

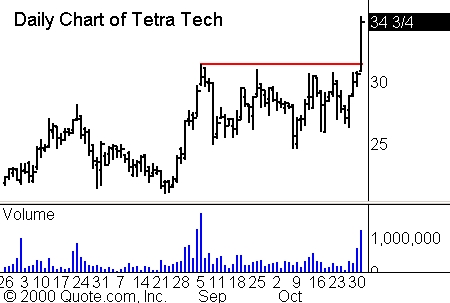

A second name to watch this morning is Tetra Tech

(

WATR |

Quote |

Chart |

News |

PowerRating),

which broke out to a new high on Tuesday. There was quite a bit of excitement on

Monday, as it traded 400% of its average volume. Closing just a bit under its

high, it will have a chance to breathe before making another move. Set your alerts

near Tuesday’s intraday high and watch for a continuation. Should it open

significantly over the intraday high, be very careful about market makers fading

the open. They have been known to do that.

Until then,