Pump Up The Volume

As I said last week, while I do think that volume will return after Labor Day, I do not think that

it will be immediate. Again, because of the uncertainty of the market as seen by the

general public, not traders, I think that people will start wading in slowly, to

get a feel for the situation. If we do not see very strong volume at first, do

not panic, these things take time.

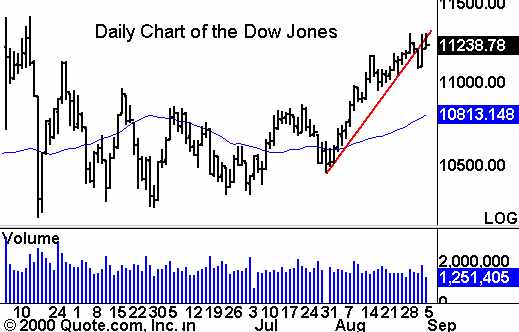

Let’s also take a quick look at the Dow

Jones. Notice that is on the wrong side of the trendline.

Today’s Watchlist:Â

(

BMET |

Quote |

Chart |

News |

PowerRating),

(

PXCM |

Quote |

Chart |

News |

PowerRating),

(

MCDT |

Quote |

Chart |

News |

PowerRating)

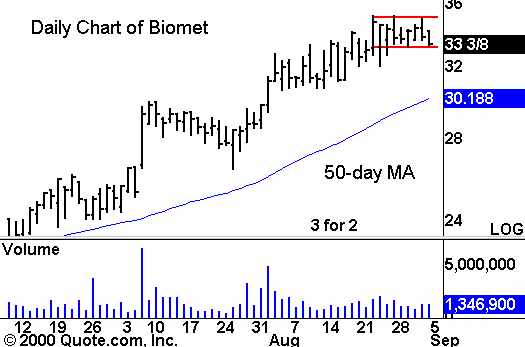

Biomet

(

BMET |

Quote |

Chart |

News |

PowerRating) was a

good breakout play in July, but it did not go too far following the initial

move. Currently it is sitting in a consolidation pattern, trading near its

highs. Set your alerts near the top of the trading range and watch for a

breakout. Look for closing move outside of the range followed by a continuation.

Normally, I would watch for a move through the bottom of the range as well, but

there are several support levels just underneath, so it might bounce too often

for a solid trade.

Â

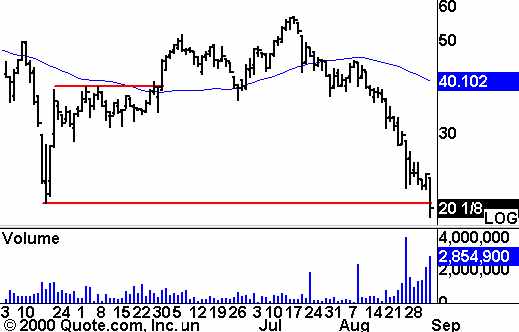

On the short-side, let’s

take a look at Proxicom

(

PXCM |

Quote |

Chart |

News |

PowerRating). Proxicom closed at a new six-month low on

Friday. While the recent volume pick up may be a sign of a potential

capitulation, the ADX reading of 52 suggests that the trend may continue. Watch

for a move below Friday’s intraday low to offer a potential short opportunity.

Should PXCM rebound, look for it to find resistance near 22 1/4, which is the

low of the ascending triangle formation from August..

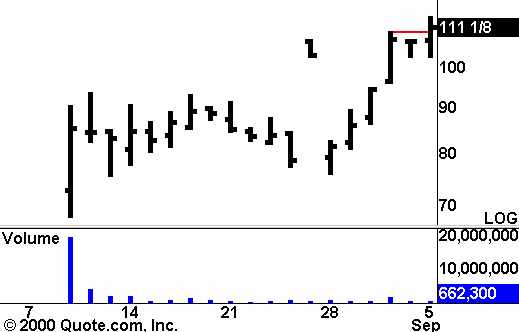

McDATA

(

MCD |

Quote |

Chart |

News |

PowerRating), a

recent IPO, broke out from the very short-term pattern that it formed.

While its currently trading at a new high, the market has not closed, so we will

have to keep watching. If it can hold this level, watch for another move higher,

on strong volume, on Wednesday. Remember that this is a recent IPO, so the

trading may be a bit choppy.

Until later,Â