Pullback Time

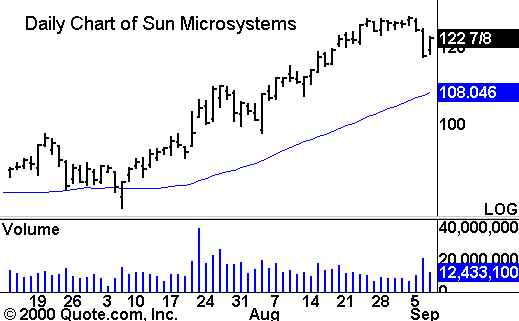

I am not a big pullback trader, but today seems to be a pullback day, so why

do we not take a look at a few setups? There was a significant pullback in some

of the big names yesterday, but many quickly rebounded, including Sun

Microsystems

(

SUNW |

Quote |

Chart |

News |

PowerRating).

Today’s Update:

(

WCII |

Quote |

Chart |

News |

PowerRating)

Winstar Comunications

(

WCII |

Quote |

Chart |

News |

PowerRating) broke

through Wednesday’s low, which was a potential short entry point. Remember to

trail your stops.

Today’s Watchlist:Â

(

LWIN |

Quote |

Chart |

News |

PowerRating),

(

SLR |

Quote |

Chart |

News |

PowerRating),

(

ALGX |

Quote |

Chart |

News |

PowerRating)

Leap Wireless

(

LWIN |

Quote |

Chart |

News |

PowerRating) is an example of

a pullback. It retraced to a near-term support level for the second time

following its low-level breakout on Thursday. Depending on the price action of

the stock, it could be either a short or long play. If the stock bounces off

this level, watch for a move above the recent highs to offer a long opportunity.

This may just a flushing out of the weak hands. On the other hand, a close below

support may offer the aggressive trader a short opportunity. I say aggressive

trader because it may be somewhat choppy on the way down.

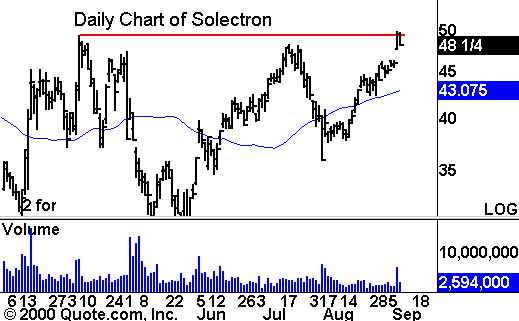

Solectron

(

SLR |

Quote |

Chart |

News |

PowerRating) tested

a high on Wednesday and is showing an inside day on Thursday. If it holds up,

watch for another move above the high to offer a long opportunity. The volume on

Wednesday was news driven, but still, many shares traded hands, so the support

and resistance levels are still affected. The stock has been making a series of

higher lows on each “major” pullback, which is also somewhat positive.

When trading this stock, keep in mind that it is not a high flyer, so it will

not move like SDLI. In many cases, that’s much easier.

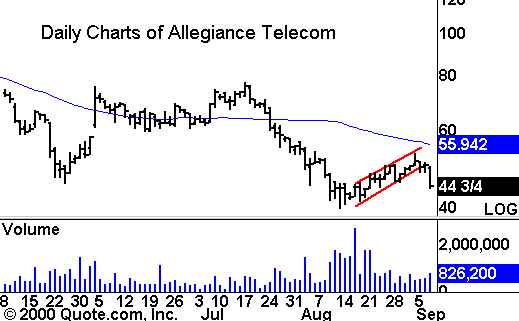

Allegiance Telecom

(

ALGX |

Quote |

Chart |

News |

PowerRating) looks like

it is breaking down from a bearish flag formation. Thursday is the first

potential closing move outside of the range. If it closes below the bottom

trendline, look for a continuation move on Friday. The strong volume on Thursday

suggests that more trouble may be coming. If you take a short position, look for

support near 40.

Until later,Â