3 UnBuffett-Like Stocks Poised to Outperform

Warren Buffett aka the Oracle of Omaha is clearly the most respected living stock picker and investor. His picks have made millionaires out of countless small time stock players and billions upon billions for his shareholders. However, not all of his investments have paid off handsomely. Most notably, his bets on U.S. Airways, Pier 1 Imports and most recently ConocoPhillips backfired rather substantially.

He relies on an uncanny business sense and basic fundamental analysis to pick his investments. He called his latest and biggest bet so far in Burlington Northern Santa Fe Railroad, “A bet on the economic future of America”. It’s almost like he is relying on cheerleading to justify his overpayment for the remainder of the company. He paid 18.2 times the estimated 2010 earnings which is higher than S&P multiple. This is unusual for someone well known for buying things at a discount. Â Â Is this a last ditch attempt to bring confidence back into the economy or a savvy business move based on hidden factors that only the Oracle can see?

Time will tell, but however you look at it, this bet may be Buffett’s greatest miss or go down in history as his most successful wager of all time.

While most of us are not privy to the teams of analysts and information flow needed to step into the fray like a Buffett, there are simple tactics to put the short term odds of success in your corner. We have developed a 3 step stock picking method that have proven in extensive testing, since 1995, to locate companies poised for gains over the 1, 2 and 5-day time frames. You don’t need to be a Buffett to understand and follow this simple 3 step plan.

The first and most critical step is to only look at stocks trading above their 200-day simple moving average. This assures that a strong, long term up trend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this fly in the face of conventional wisdom of buying stocks as they climb higher. However, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

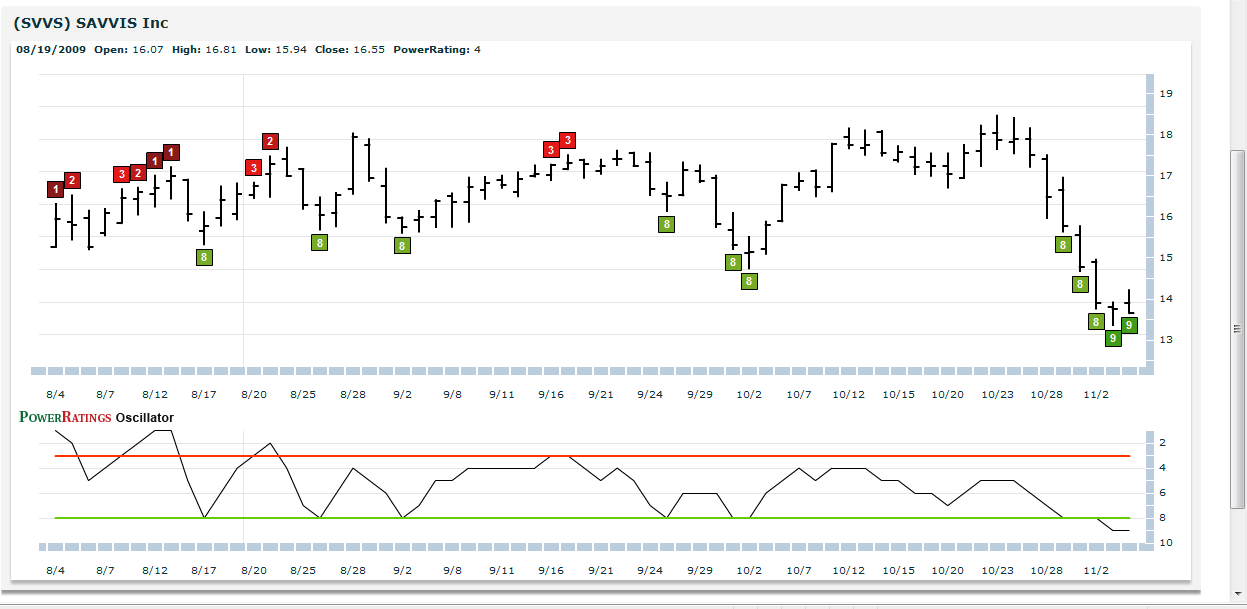

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is less than 2 (for additional information on this proven indicator click here) and the Stock PowerRating is 8 or higher.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short-term.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame.

Here are 3 unBuffett-like stocks fulfilling each of the 3 steps right now:

Furniture Brands

(

FBN |

Quote |

Chart |

News |

PowerRating)

SAVVIS Inc

(

SVVS |

Quote |

Chart |

News |

PowerRating)

Unifirst

(

UNF |

Quote |

Chart |

News |

PowerRating)

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.