How to Navigate the Raging Bull: Friday’s PowerRatings 3 Pack

It seems nothing can keep the market down. This morning’s shockingly negative payroll report only temporally knocked shares for a loop. It is amazing that a release depicting the worse unemployment since 1983 would be seen as a buying opportunity for the stock market. Every pullback, regardless of underlying cause, is currently triggering a buying frenzy among the bulls. This is a sure sign of a raging bull market.

Optimism has truly run amok with even economy crushing bad news being spun with a positive tilt. Even earnings have been incredibly positive despite the truth of cost cutting and reshuffling being the prime movers, not actual improvement. Regardless of the cause, our job as short-term investors and traders is to distinguish stocks most likely to outperform in the short-term for our portfolios. In other words, successful navigation of the raging bull market is the key to profits.

This morning’s action taught a valuable lesson that sell offs are often bought, particularly during these times of the out of control bull. This buying after a sell off applies in the macro as well as the individual stock or micro sense. Smart money and bargain hunters of all stripes wait for moments of weakness to jump on board thus their combined buying power pushing shares back up. This is a basic rule of market behavior. It is guaranteed to happen in most cases and all market types. The trick is locating stocks that are most likely to attract the bargain hunting crowd during bull markets.

We have developed a simple to use, easy to follow 3 step plan for locating these stocks before the crowd does, as by that time, it’s simply too late. Although no stock picking system is fool proof, our extensive testing since 1995 across all market conditions has proven the effectiveness of the 3 step process. This article will lay out the 3 step stock picking system and provide 3 names fitting the criteria.

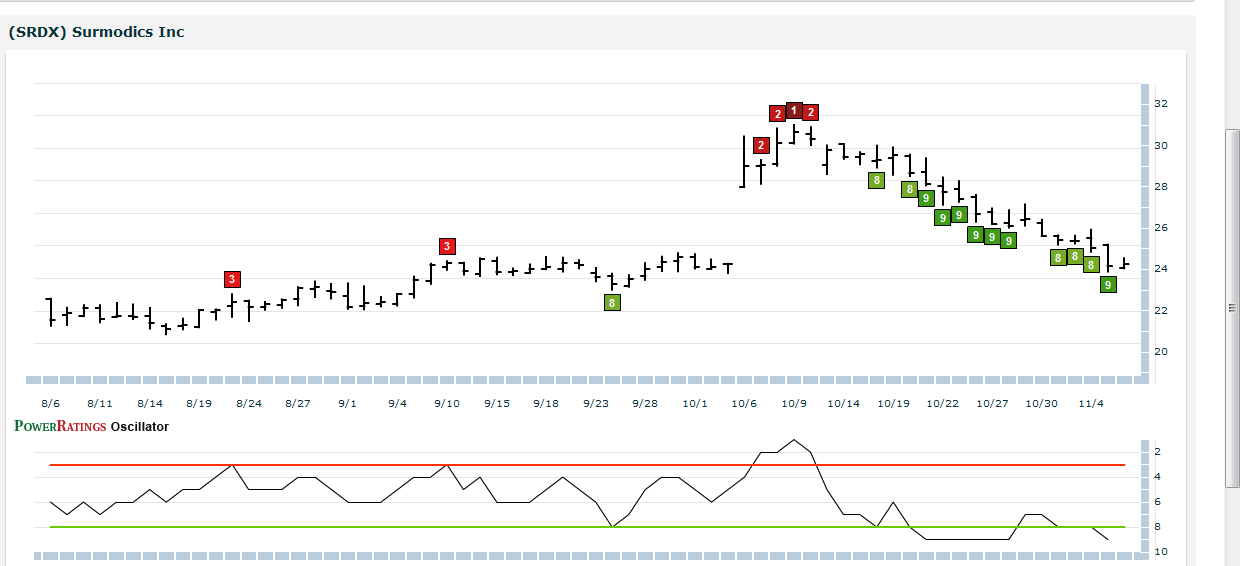

The first and most critical step is to only look at stocks trading above their 200-day simple moving average. This assures that a strong, long-term uptrend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this fly in the face of conventional wisdom of buying stocks as they climb higher. However, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is less than 2 (for additional information on this proven indicator click here) and the Stock PowerRating is 8 or higher.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short-term.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame.

Here is the Friday 3 pack of stocks:

SurModics Inc

(

SRDX |

Quote |

Chart |

News |

PowerRating)

JC Penney

(

JCP |

Quote |

Chart |

News |

PowerRating)

Kendle International

(

KNDL |

Quote |

Chart |

News |

PowerRating)

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.