Snow Balling Stocks While Catching Short Term Profits

There is no question about it; the stock market is in snow ball mode. It is pushing ever higher toward yearly highs that may even be taken out today provided a little more impetus. The fact of every single pull back being bought and every bit of bad news being counteracted quickly by waves of positive data remains the fuel triggering the snow ball effect.

While there is plenty of negative news to feed the bears, such as the employment dilemma and the credit situation, stocks remain in a full out, consequences be damned, bull frenzy. What will it take to melt this ever growing snow ball of a runaway stock market? No one knows for certain, but one thing is self evident, it may be dramatic!Â

Even though the overall market is pushing ever higher, choosing individual stocks for short term investment remains a difficult game for many traders.

We have developed an easy to use, fully tested system to help you locate these shares regardless of overall market conditions or how high the market climbs. It is a simple 3 step process for picking stocks most likely for gains over the next week timeframe. This article will explain this simple technique and provide 3 companies fitting each of the steps for your consideration.

The first and most critical step is to only look at stocks trading above their 200-day Simple Moving Average. This assures that a strong, long term up trend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this is counter-intuitive of conventional wisdom of buying stocks as they climb higher. However, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is less than 2 (for additional information on this proven indicator click here) and the Stock PowerRating is 8 or higher.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short term.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame

Here are 3 stocks for your consideration in this snow balling market:

Ares Capital

(

ARCC |

Quote |

Chart |

News |

PowerRating)

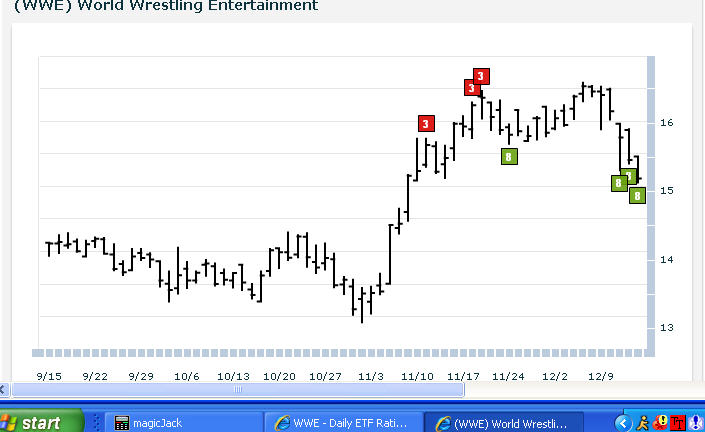

World Wrestling Entertainment

(

WWE |

Quote |

Chart |

News |

PowerRating)

Tibco

(

TIBX |

Quote |

Chart |

News |

PowerRating)

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.