ETF Trading and PowerRatings: SKF, RWM, SSG

Stocks are hovering around break even levels on the final trading day of

the week and month – a trading day which coincides with both Black Friday,

the traditional start of the holiday shopping season, and a three-day rally

in the S&P 500 and Dow that many are hoping extends to a fourth day.

Not to be the ones to put coals in the stockings of holiday bulls, but a

rising, overbought stock market below the 200-day moving average is not the

kind of market that is likely to bring much holiday cheer – at least for

those committed to the long side.

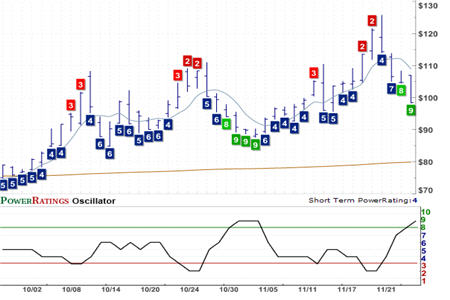

ProShares UltraShort Financials ETF

(

SKF |

Quote |

Chart |

News |

PowerRating) Short Term

PowerRating 9. RSI(2): 8.43

However, for swing traders more willing to look at opportunities in both

markets that are moving down as well as up, there seems to be more and more

reason to turn to the world of ETF trading in general and short/inverse ETF

trading in specific. Our Top 25 PowerRatings Stocks are filled with not

only high PowerRating ETFs, but high PowerRating short and inverse ETFs that

allow traders to buy (instead of borrowing and selling short) in order to

get exposure to potentially falling markets.

ProShares UltraShort Russell 2000 ETF

(

RWM |

Quote |

Chart |

News |

PowerRating) Short Term

PowerRating 9. RSI(2): 7.30

I have included three of the more widely-traded and more compelling

inverse ETFs on the market here in this report. But swing traders looking

at trading ETFs should know that the options are not limited to the three

high Short Term PowerRating ETFs shown here. Located mostly in the

ProShares family of short/inverse ETFs, we are spotting high Short Term

PowerRatings in inverse funds that track such markets and sectors as

industrials, basic materials, and the Nasdaq 100.

ProShares UltraShort Semiconductor ETF

(

SSG |

Quote |

Chart |

News |

PowerRating) Short Term

PowerRating 8. RSI(2): 14.19

Single stock risk has encouraged more and more traders to look at ETF

trading – and not just to avoid meltdowns like Bear Stearns or Washington

Mutual. The volatility we have seen in recent months is such that stocks

have moved both up and down in sharp, unpredictable ways. Trading ETFs,

instead of single stocks, is one way to take advantage of this volatility –

in both directions – without having too much exposure to the potential

reversals of fortune in any given stock.

According to a recent report, eight out of ten securities traded are

exchange-traded funds. Want to learn how to trade them?