Monday Stock Movers: 3 Stocks for Traders to Avoid

Stocks are off to a strong start on Monday morning, following through on Friday’s strong, week-ending rally.

What is our strategy for trading stocks? First and foremost, we look to buy strong stocks and sell weak stocks. In this, our approach to trading using Short Term PowerRatings is little different from the approaches to trading taken by most, if not all, short term traders.

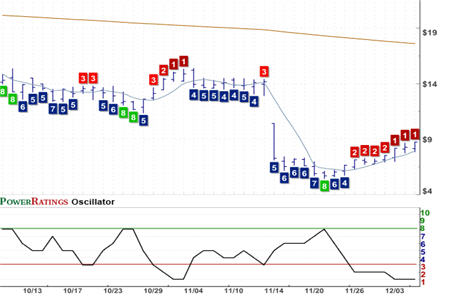

Medcath Corporation

(

MDTH |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 1. RSI(2): 98.95

Where we differ with our colleagues who use other trading approaches lies in how we determine which stocks are strong and which stocks are weak — and when the best time to buy (or sell) these stocks is. We think these differences are a part of our edge, an edge that has allowed us to continue trading successfully in the midst of a year featuring unprecedented volatility.

We buy stocks and ETFs that are trading above their 200-day moving averages. We have found that there is simply no edge in consistently buying stocks and ETFs that are trading below their 200-day moving averages. We consider those securities that are trading above their 200-day moving averages to be, on balance, strong stocks and funds.

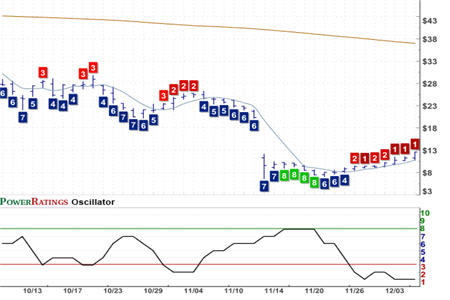

Oriental Financial Group

(

OFG |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 1. RSI(2): 94.84

Once we’ve figured out where the quality stocks and ETFs are, the next question is when to buy them. Our research indicates that buying quality stocks on pullback provides short term traders with a powerful edge as opposed to buying these exact same stocks when they are already showing strength, breaking out to new highs and already supersaturated with buyers.

The opposite is true when we look to sell stocks or ETFs short.

In this case, we want weak stocks or ETFs, those that have demonstrated their weakness by closing below their 200-day moving average. This is the “bad merchandise” for lack of a better phrase.

Wellcare Health Plans

(

WCG |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 1. RSI(2): 99.34

How do we take best advantage of bad merchandise on the shelves? We wait for that merchandise to be in high demand, for there to be lines around the block filled with shoppers looking for inventory that we are more than happy to sell them at what we believe — and our research suggests — are often wildly inflated prices.

The three stocks in today’s Monday Stock Movers belong to this latter group. All three have Short Term PowerRatings of 1 — our lowest rating — suggesting that all three are likely to dramatically underperform the average stock over the next few days. All three stocks in today’s report are not only trading below their 200-day moving averages. They also have extremely high 2-period RSI values — indicating stocks that are overbought — and have moved higher by 10% or more in the past five days.

This set of characteristics are those we look for in short selling candidates and the three stocks in today’s report have those featured in abundance. For short term stock and ETF traders not willing to wait a few days for potentially better opportunities in short/inverse ETFs, these three stocks may be worth watching.

According to a recent report, eight out of ten securities traded are exchange-traded funds. Want to learn how to trade them? Click here to find out what traders are saying about Larry Connors’ new book, Short Term Trading Strategies That Work: A Quanitified Guide to Trading Stocks and ETFs!

David Penn is Editor in Chief at TradingMarkets.com.