10 Steps to Successful Day Trading, Part 2

In part 1 of our series, Peter Reznicek shares his philosophy on day-trading to help you control your risk and improve your chances of success. To read Part 1, click here. Reznicek concludes his series with these following trading strategies:

6. Stay Away from the “Cheapies”

By the cheapies we mean the stocks that are under $10 per share. While we’re at it, since this is an article on day-trading, stay away from stocks under $20 per share too. Cheap stocks are cheap for a reason. Cheap stocks only seem like they are going to give a lot of bang for the buck when newer traders start calculating future large profits in their heads due to the large share size that can be purchased due to the stock being of low price. This is a trap and I urge you not to fall into it.

Click here to learn how to utilize Bollinger Bands with a quantified, structured approach to increase your trading edges and secure greater gains with Trading with Bollinger Bands® – A Quantified Guide.

First, these stocks are not good investments even for a longer term. The market is generally efficient so you can be sure that they are priced correctly. Secondly, they tend to not respect technicals. By this phrase, I mean that patterns tend to not follow through. In the same manner that there is a certain hierarchy to chart patterns in terms of timeframes where a pattern on each subsequent longer timeframe is more powerful than the preceding shorter timeframe, there is a built-in weakness in patterns on very cheap stocks. This is due to the increased amount of retail traders who are throwing money at these issues in a random fashion (often news driven) and the fact that these stocks are 100% unsupported by institutions.

No fund would ever touch these stocks because they know that they could never get in with size without bulling the stock much higher just on their own buying nor get back out without crushing it back down to nothing. You are working against yourself if you take the time to do a top down analysis and then select a stock that is under $20 per share for day-trading. In my experience, I have found that somewhere between $30 and $100 per share is the sweet spot for intraday trading. Stocks generally move a certain amount per day which can be called “average true range” or “ATR”. Generally, the larger the stock price the larger the ATR.

For day-trading, you want to grab stocks that have at least $1.00 of ATR. Meaning that on average the stock can move up or down at least 1 full dollar from highs to lows during an average day’s trade. Stocks that are very expensive (i.e.: over $100 per share) should be played selectively and only by very experienced players. These issues tend to have wider spreads and have much bigger swings in price which may be unmanageable to a newer trader.

7. Always Include Volume in Every Analysis

This is a pretty simple one. Volume is the fuel that keeps moves going. When entering intraday and planning on getting out some minutes or hours later, it’s absolutely imperative that you have what we are referring to as “follow through” in the stock you are trading. Stocks that are moving on large volume tend to keep going in the same direction that they started in. Stocks with small volume don’t. There are two ways to look at this.

The first point is that you want to only day-trade stocks that are doing at least 500,000 shares per day. The more, the better. Large overall daily volume in the stock makes it easier for you to get in and get out in rapid fashion which is of the utmost importance when your timeframe for holding the trade is short. If the stock is not trading much, you do not want to be the one holding the bag when you cannot get out because there is just nobody supporting the bid.

The second factor when bringing volume into your analysis is that you would like to confine your entries to stocks that are trading much larger amounts of volume that particular day then they usually average. If a stock generally does 1 to 1.5 million shares a day, but has already traded that by 10:30am on the day you are looking at it, then you know “something is up”. There is huge interest in either buying or selling this stock on that day and it should continue throughout the session. If you are using a scanner to find patterns, add a volume filter to it and look for stocks trading about 4-5 times their daily average volume.

In a nutshell, in the same way that you will stay away from the “cheapies”, stay away from stocks that trade little volume. Remember, this is day-trading so you are looking to get out as quickly as minutes later. You absolutely cannot afford to not have a market for the merchandise you want to unload quickly when it reaches your target price.

8. “How Much Can I Lose?”

Ask yourself the above question before every single trade. This is extremely important and may involve a certain shift in mindset which is of the utmost importance before entering. What I mean specifically by this is that every single trade must be analyzed first in terms of what is the maximum loss both in cents/dollars per share and total dollars before entering. Most newer traders never think this through enough, only thinking about “How much can I make?” before entering the trade. What matters much more is where the stop loss is in relation to the entry and how much of a dollar loss will it incur at the selected share size if gets hit. Enter every trade with the attitude of what could possibly go wrong. Remember that in trading even the best laid plans generally fail about 40-50% of the time. Your job is to simply make a little more on the times that it goes according to plan while keeping the losses steady at the same amounts or less each time.

9. Use Hard Physical Stops

This one might also seem obvious but it gets ignored. When holding stocks overnight, as long as you are an active market participant it’s usually not a good idea to put in hard physical stops due to gaps that can take you out of your position on the open and then reverse course taking you back into what would have been either break-even or a profit zone. This is due to the enormous flow of orders that are hitting the market both before the open and right at the open. The phrase “professionals rule the close, amateurs rule the open” is a fitting one.

That being said, the longer your timeframe the more you can do with the stock as it approaches your stop. For example in a gap down situation where price opens under your stop we often advocate using a 5 or 15 minute rule strategy where stocks are allowed to trade for a set length of time and then stops are moved under lows of those candles. Or you may find support on the stock on any number of different timeframes to put your stop under. These could be hourly 20 period moving averages, lows of daily bars, lows of weekly bars, etc. Alerts can be set when stocks move close to these pivots and then the finger can be on the button without putting in a hard, physical stop that might get ‘run’ in an undercut of that particular pivot which is common.

The point that I am getting to in a rather circular fashion is that in day-trading when your timeframe is very short, you do NOT have this luxury. You cannot under any circumstances give the stock very much leeway beyond your stop. Remember that because your timeframe is short there is very often just ONE prior reference point on the intraday chart that is going to act as your pivot. This could be literally something as small as the high or low of a prior five minute bar. Never forget that a thousand other intraday players are looking at the same picture and will also not let their trade run past that point.

In summary, the shorter the timeframe, the tighter the leash you must keep on your trades. The way to keep a tight leash is to use a hard, physical (actually entered as a working order) stop. This will also keep you from jumping the gun on killing the trade before it has a chance to work out. You know your stop is in and the stock can do all manner of things between the stop and your target. You’ll rest easier knowing it’s there. Moreover, if you’ve followed commandments 6 and 7 and are only day-trading “thick” issues that are at least $30 and trade volume, your slippage should be minimal.

10. Keep a Journal of Trades

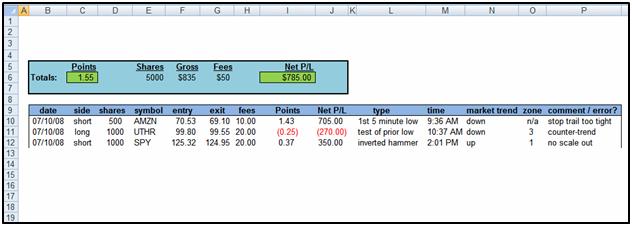

It is only by looking in the rear-view mirror and analyzing your trades in detail that you can improve. You need to know everything about every single trade you take. The more information you can pack into the journal the better. It can be as simple as just putting in entry, exit and size or as comprehensive as you like. In my opinion, the more the better. Put in time of day, what was the market doing at the time of trade, how did I feel that day, what strategy was I employing on the trade, etc. Any way you can qualify a trade in some way that will allow you to analyze it better later is of use.

Once you have a matrix in place of all of these different factors in your journal, you will see how quickly your mistakes jump out at you. You will be surprised to find out what you learn about your strategies and yourself. Do I tend to make money in the morning and lose in the afternoon? Do my pullback trades work out 80% of the time while my breakout trades work 20% of the time? Every time I trade BIDU I lose money. Hmmm… There is an endless amount of analysis that you can do once you have all of this very important information in place. In this way you can eliminate trading errors and strategies which have proven to have low probability of success systematically. Below is a sample journal that you can easily duplicate in excel for yourself.

The above is simply a sample to get you started in thinking about journaling your trades. In your own trading, feel free to add more columns and also keep a written journal that goes together with your trading blotter which can help you to sort out thoughts on trading. There are many books and resources on trading psychology out there but a simple trading journal might just be more powerful and useful to you then all of them put together. Writing down each individual trade in a log gives the trade “weight” and can make you think more before putting it on because you know that at the end of the day you’ll have your trading journal to answer to and the numbers will never lie or paint any picture that is not 100% accurate.

While the above rules are certainly not a full explanation of how intraday trading works, nor are they any discussion of specific strategies, they are a great place to start for newer traders who are looking to shorten the learning curve. I invite you to check out our site at www.shadowtrader.net. Once there, click on the archives tab where you’ll find an education section with many other free reports and recordings which may be of further help to you. I wish you good trading.

Peter Reznicek is the founder and head trader of both RBC Asset Management, a Philadelphia-based asset management firm, and ShadowTrader.net, an advisory firm, launched in 2005 that provides daily recommendations and analysis of equities and foreign exchange pairs. Mr. Reznicek also educates more than 16,000 ShadowTrader.net subscribers each weekend through his free Sunday presentation, the “ShadowTrader Video Weekly”, and also as editor of their flagship publication, the ShadowTraderPro Swing Trader. He has also hosted a popular call-in show on Philadelphia radio, and has had his commentary published on several popular financial websites.