2 ways to play the tech led rally

Breakouts Abound in Tech

Last week started out quite boring. Overall, the market seemed to have stalled.

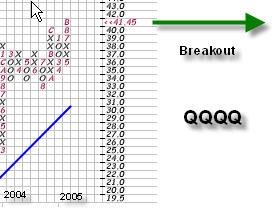

But, on Thursday, the NASDAQ 100 Shares

(

QQQQ |

Quote |

Chart |

News |

PowerRating) broke out to $41.00. This

was the level that I mentioned last week as actionable for buys into this ETF.

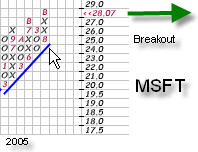

In conjunction with the breakout in the QQQQ, we also saw

Microsoft

(

MSFT |

Quote |

Chart |

News |

PowerRating) break out. For a more precise entry point on either of

these, you should wait for a slight pullback in them. However, if you are

willing to live with possible short-term losses right at the beginning of your

holding period, then you could go ahead and take a long position. Because MSFT

pays a higher dividend than QQQQ, you may decide to just buy the individual

stock and not an ETF.

This would be up to each investor’s choice (based on risk

tolerance and other factors), but remember that MSFT has Xbox 360 coming out.

With the breakout ahead of the release of the gaming system, it could make for

an extra interesting Christmas season for the company.

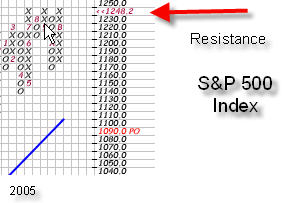

Another interesting thing to note is that even though the NASDAQ Composite broke

out last week, the S&P 500 remains at a point of resistance. I wouldn’t be

surprised if this index is also able to break out to 1250 this week (maybe even

today).

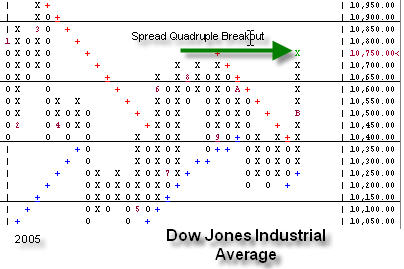

However, more fuel to the fire for technology is the fact that

the NASDAQ broke out before either of the other major indexes (Dow and S&P). The

Dow Jones Industrials

(

DJX |

Quote |

Chart |

News |

PowerRating) broke out on Friday when it hit and closed above

10750. I still have some concern over the breadth of the rally, but all in all

things are looking pretty good.

Sara Conway is a

registered representative at a well-known national firm. Her duties

involve managing money for affluent individuals on a discretionary basis.

Currently, she manages about $150 million using various tools of technical

analysis. Mrs. Conway is pursuing her Chartered Market Technician (CMT)

designation and is in the final leg of that pursuit. She uses the Point and

Figure Method as the basis for most of her investment and trading decisions, and

invests based on mostly intermediate and long-term trends. Mrs. Conway

graduated magna cum laude from East Carolina University with a BSBA in finance.