5 Stocks for Swing Traders: UFI, NJR, NAFC, HMSY, CBST

Stocks are off to a soft start in the hour after the bell as the selling indicated by the premarket futures has led to lower prices across the board in the Dow, Nasdaq and S&P 500.

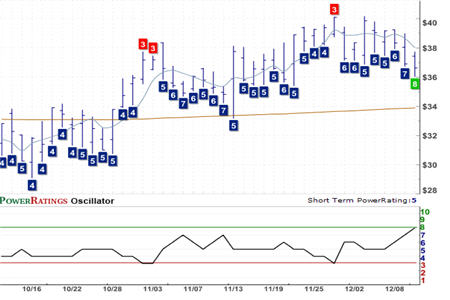

Unifi Inc.

(

UFI |

Quote |

Chart |

News |

PowerRating) Short Term PowerRatings 8. RSI(2): 25.35

In my last PowerRatings Daily Analysis column, “Longs for Your Shorts” I noted that among the number of short or inverse ETFs that we were seeing in our Top 25 PowerRatings stocks, we were also noticing a small number of stocks that were both trading above their 200-day moving averages as well as pulling back into oversold territory.

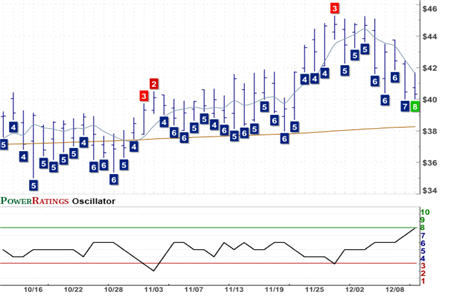

New Jersey Resources Corporation

(

NJR |

Quote |

Chart |

News |

PowerRating) Short Term PowerRatings 8. RSI(2): 25.46

The stocks in today’s report are a mixed blend of clothing, energy, food, and pharmaceuticals plays — all with Short Term PowerRatings of 8. Our research into short term stock price behavior indicates that stocks with Short Term PowerRatings of 8 have outperformed the average stock by a margin of more than 8 to 1 after five days.

Nash-Finch Company

(

NAFC |

Quote |

Chart |

News |

PowerRating) Short Term PowerRatings 8.

RSI(2): 24.35

The fact that there are opportunities to the long side at the same time that we are still seeing a healthy amount of short or inverse funds in our Top 25 PowerRatings roster should not confuse traders.

While stocks tend to follow the broader market of stocks, there are quite often stocks that are moving on their own accord, based on traders’ specific perceptions of how these stocks are faring in their own right.

HMS Holding Corporation

(

HMSY |

Quote |

Chart |

News |

PowerRating) Short Term PowerRatings 8. RSI(2): 37.28

Clearly, the bear market has produced fewer stocks that are capable of “going their own way.” But, as our Short Term PowerRatings help reveal, these stocks do exist and can afford stock traders with opportunities that might otherwise go overlooked.

Cubist Pharmaceuticals Inc.

(

CBST |

Quote |

Chart |

News |

PowerRating) Short Term PowerRatings 8. RSI(2): 23.83

According to a recent report, eight out of ten securities traded are exchange-traded funds. Want to learn how to trade them? Click

here to find out what traders are saying about Larry Connors’ new book, Short Term Trading Strategies That Work: A Quantified Guide to Trading Stocks and ETFs!

David Penn is Editor in Chief at TradingMarkets.com.