Bell Underwethers

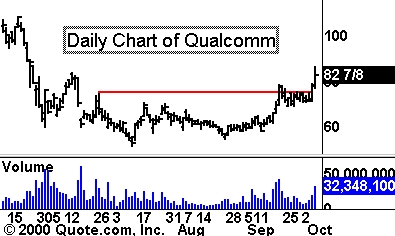

Qualcomm

(

QCOM |

Quote |

Chart |

News |

PowerRating), which I mentioned in Thursday’s PM article, broke out as I

hoped. The stock took out Wednesday’s intraday high with little trouble and quickly traded higher. If you were able to catch that move, you would most

likely have been taken out before the close with a trailing stop. QCOM hit

resistance from April/May. Friday, we will watch for a breakout above that key

resistance level to offer another short-term trading opportunity.

Today’s Tech Watchlist:

(

SCMR |

Quote |

Chart |

News |

PowerRating),

(

PMCS |

Quote |

Chart |

News |

PowerRating)

The continued weakness in

the leaders of the last tech rally continues to hold down the indices. Let’s

take a look at two of those names today.

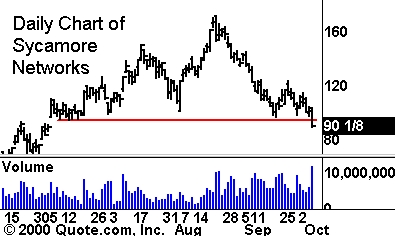

Sycamore Networks

(

SCMR |

Quote |

Chart |

News |

PowerRating)

systems moved lower on thick trade on Thursday. The close below the support

level which bolstered the stock on several occasions may provide a short

opportunity. Bigger-picture charts trace out somewhat of a head-and-shoulders

pattern. Thursday’s price action reflects a break of the neckline. The volume

action suggests that the move may continue. Set your alerts near Thursday’s

intraday low and watch for a continuation move lower to lead to a short

opportunity.Â

Â

Â

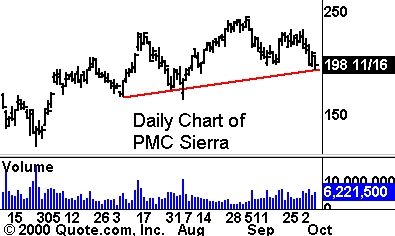

PMC Sierra

(

PMCS |

Quote |

Chart |

News |

PowerRating)

closed just over support on Thursday after bouncing a bit during the close. This

is the third test of this near-term trendline. The break of psychological

support at 200 was quick and painful. I watched the stop orders flood my time

and sales screen with a sea of red. A few buyers came into the stock at the

intraday low and pushed it higher.Â

At this point, we will

watch for a break of this near-term support level to offer a short opportunity.

If PMCS musters some strength, it will most likely have a bit of trouble near

200. In a weak market, it will be unable to take out this level and possibly

retest the intraday low from Thursday. Set your alerts near this level and watch

for a short opportunity based on a breakdown.

Â

Until later,Â