Fallen

The Morgan Stanley High Tech Index was holding strong until it closed below

the trendline on Thursday. We will have to see where it goes on Friday to know

if this move below the support level is for real. It broke through two support

levels on Thursday when it moved below 1095.

Today’s Watchlist:Â

(

AUDC |

Quote |

Chart |

News |

PowerRating),

(

WIND |

Quote |

Chart |

News |

PowerRating),

(

CPN |

Quote |

Chart |

News |

PowerRating)

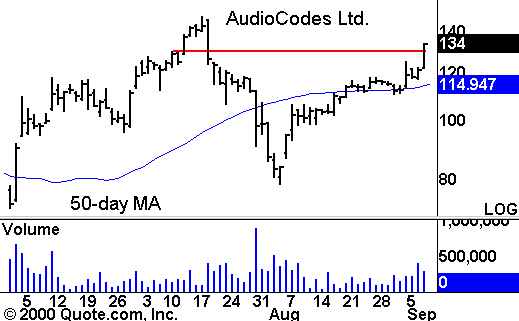

AudioCodes

(

AUDC |

Quote |

Chart |

News |

PowerRating)

broke out from a low-level resistance area. An aggressive trader may want to

watch for a long opportunity based on a move above Thursday’s intraday high. The

more conservative trader should set alerts near the June highs and watch for a

breakout. Over the near-term, watch for resistance near the low of the

consolidation area from July 16 to July 20. Although I kept the 50-day MA on the

chart, it has not had a strong effect on the chart.

Wind River Systems

(

WIND |

Quote |

Chart |

News |

PowerRating) may be tracing out a bullish flag

following its high volume move on Friday. The stock has been retracing a small

percentage on declining volume for the last three days. Set your alerts near 50

and watch for a move above the flag pole. I prefer to watch for a closing move

above the flag pole followed by a continuation on the following day.

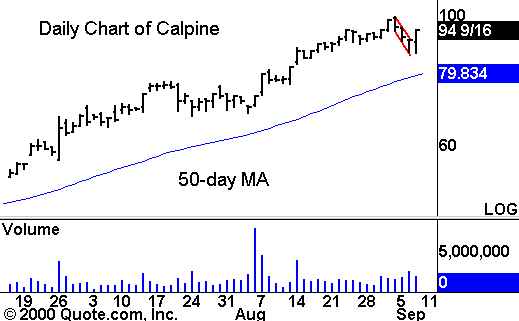

Calpine

(

CPN |

Quote |

Chart |

News |

PowerRating) has rallied out of a three-day pullback move.

The strong move above the high of the third day is a positive sign. Watch for a

continuation move back toward 100 to offer a potential long opportunity. Set

your alerts near Thursday’s intraday high and watch for a continuation. Look for

resistance near 100 as it is both the all-time high and psychological

resistance.

Until later,Â