Idle Hands

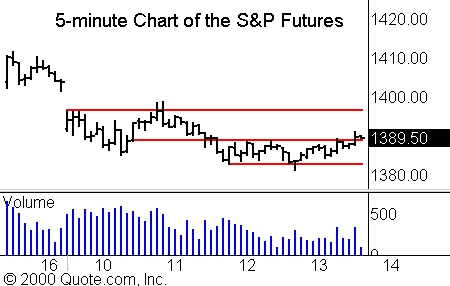

Today is the ideal day to take a nap. In the four hours that the market has

been open, the futures have primarily been in the same consolidation pattern,

with few, if any, breakouts or pullback plays based on moves in the indices

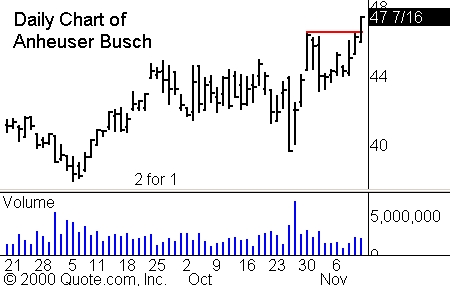

If you are wondering, “Wassssup?” with Anheuser-Busch

(

BUD |

Quote |

Chart |

News |

PowerRating),

people are buying the defensive name. Watch this one for a continuation move on

Monday.

Â

Today’s Watchlist:Â

(

QCOM |

Quote |

Chart |

News |

PowerRating).

(

IWOV |

Quote |

Chart |

News |

PowerRating),

(

JDSU |

Quote |

Chart |

News |

PowerRating)

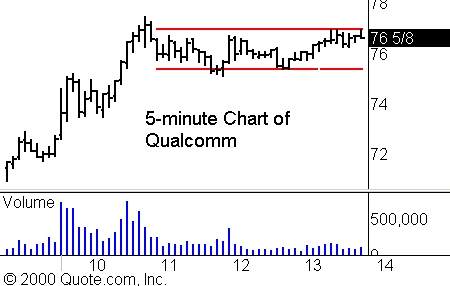

Interestingly strong once again on

Friday is Qualcomm

(

QCOM |

Quote |

Chart |

News |

PowerRating). It has been trading higher despite other market

trends. Currently, it is in a consolidation pattern not far from its highs. Set

your alerts near the intraday high as well as near the low of the consolidation

and watch for moves out of this trading range. If it breaks to the downside,

watch for potential support near the intraday consolidation that took place

earlier this morning. If it breaks to the upside, remember to trail your stops,

because the market is weak, and it may pull back.

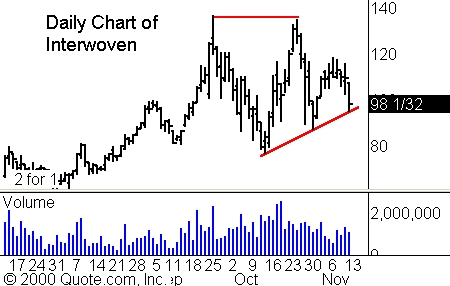

Interwoven

(

IWOV |

Quote |

Chart |

News |

PowerRating), like many tech names, is testing support

levels. In this case, it’s a trendline which formed after the two most recent

pullbacks. Many stocks in the software group have been weak of late, and have

destroyed the potential breakout patterns that they had formed, such as Siebel

Systems

(

SEBL |

Quote |

Chart |

News |

PowerRating). Note that IWOV is now trading below its 50-day MA of 103.

Set your alerts near 95 and watch for another move south in a weak market.

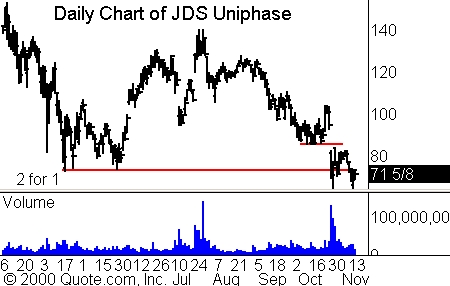

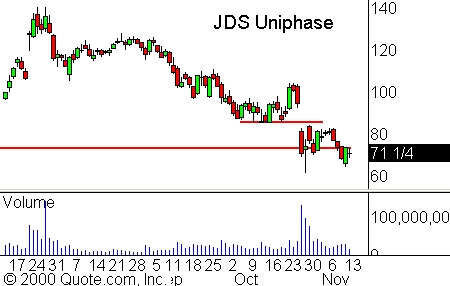

JDS Uniphase

(

JDSU |

Quote |

Chart |

News |

PowerRating), in the same group as Ciena, continues

to be hurt. After breaking through the support levels that formed in April, it has been unable to make a recovery.

The daily candlestick chart shows just how many of the days have

actually been negative. This is helpful, because when looking for shorts, it is

best to look for the weakest names over the near-term. Add this one to your

near-term short list and watch for more weakess.

Hopefully there will be some sort of resolution before the

weekend is over, but do not count on it. Otherwise, expect similar volatility

again on Monday.

Until Monday,

Do you have a follow-up question about something in this column or other questions about trading stocks, futures, options or funds? Let our expert contributors provide answers in the TradingMarkets Question & Answer section! E-mail your question to questions@tradingmarkets.com.

For the latest answers to subscriber questions, check out the Q&A section, linked at the bottom-right section of the TradingMarkets.com home page.