NTAP’ped Out

Each morning this

list will contain those stocks with the potential to make a quick but tradable

move in the first hour. The information listed here is designed for the

trader who catches the early morning momentum, between the first five and 45

minutes of trading. Many stocks open each morning, run for several points and

then reverse. I will cover stocks with this potential and highlight possible

reversal points and resistance areas. These points need to be monitored closely,

as the stocks may turn quickly here. Be ready to lock in profits quickly.

Morning Outlook

Watch for a turnaround in the first 10-30

minutes of trading. Keep an eye on the stocks that gap the most in the morning.

Use the Nasdaq tracking stock (QQQ)

or futures as leading indicators.

It looks like

another choppy day in the markets. Have you ever noticed that when it rains it

pours? First it’s the economy, then it’s earnings, now it’s the presidential

race. What next? I’m sure that there will be something.

One To

Watch:

(

NTAP |

Quote |

Chart |

News |

PowerRating)

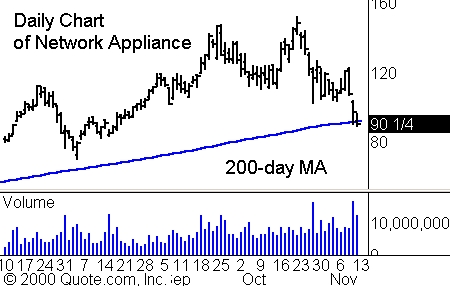

Network

Appliance

(

NTAP |

Quote |

Chart |

News |

PowerRating) closed just under its 200-day MA on Friday. After forming

a double-top pattern over the course of September and October, NTAP traded lower

and entered a consolidation pattern. On Thursday and Friday it broke down from

this consolidation and crossed the tape several million more times that normal.

Toward the close, it made one attempt at a relief rally and

retook its 200-day MA, but not long after the sellers returned and pushed it

lower, again on heavy volume. This type of activity suggests that there may be

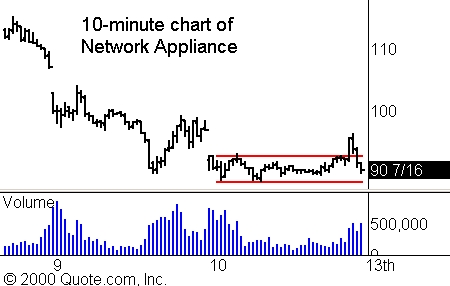

continued weakness. The 10-minute chart from Friday, showed that there is

some support near 90, based on the consolidation that took place all day.

Watch for NTAP to provide another short opportunity based on a

breakdown below intraday support. Set your alerts near Friday’s low .