Oh, L’Amour!

Lately I have been hearing that people are having trouble

finding patterns, due to the choppiness. I think that the problem is related to

the fact that people have fallen in love with certain stocks. We all go through

this. We trade a stock, we make money on it, and we think that we can continue

to trade it forever. Or, we trade a stock, we lose money, and we think that we

have to trade the same stock again to make back our money.

When I first realized that I had this problem, I started making

lists of new stocks every day to watch. Eventually, I started switching

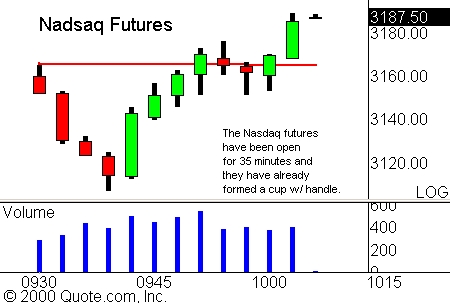

markets. I find that when I have trouble finding setups in the stock

market, I can often find something in the futures market.

Today’s Tech Watchlist:

(

AMAT |

Quote |

Chart |

News |

PowerRating),

(

DITC |

Quote |

Chart |

News |

PowerRating)

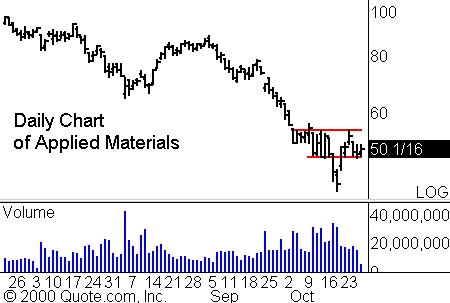

Applied Materials

(

AMAT |

Quote |

Chart |

News |

PowerRating)

has been hurting with the rest of the chip makers. But, unlike most of the names

in this group, it actually held up quite well on Wednesday.

After taking a significant

dip last week, it re-entered its near-term trading range. Based on the move that

we saw last week, it’s clear that there is likely to be opportunity on a move

outside of the range. Set your alerts near both the top and bottom of the range.

The overall feeling toward

the chip- and chip-equipment makers appears to be negative, thus it appears more

likely that we wil see a move downside. But, it is important to always keep in

mind that this pattern has no directional bias.

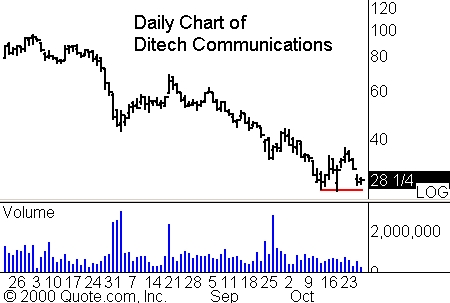

DiTech

(

DITC |

Quote |

Chart |

News |

PowerRating) rallied off its lows last week by almost 20%.

Sadly, it has returned to test its lows once again. Currently, DITC is

completing an upside-down cup pattern. Watch for a break of the support level

that I have highlighted below. Volume has been consistent, so watch for a volume

spike on a breakdown.

Until later,Â