“The” Non-Tech

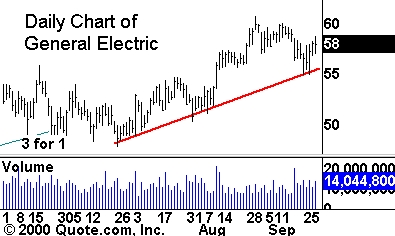

This morning I looked at the stock that is often considered a key indicator

of the status of the tech sector, Cisco Systems. Now I want to take a look at

the stock that use as an indicator of the status of the Dow and S&P, General

Electric.

General Electric

(

GE |

Quote |

Chart |

News |

PowerRating) has held up quite well. Since coming off its lows in

June, it has established an upward trend following each breakout. Currently, it

is trading a few percent off its high, following another bounce off of the

trendline.

Today’s Watchlist:Â

(

VERT |

Quote |

Chart |

News |

PowerRating),

(

BVSN |

Quote |

Chart |

News |

PowerRating)

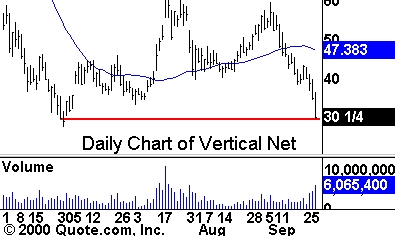

VerticalNet

(

VERT |

Quote |

Chart |

News |

PowerRating)

used to be one of my favorite stocks to daytrade, because the breakouts had such

solid follow through. In recent times, the stock has not been acting as well. Based

on the near-term action, VerticalNet is poised to break down below another

support level, offering a short opportunity. There may be more buyers lurking

near the low from May, so use some caution. Waiting for a move below this level

would be the most conservative way to play the stock.

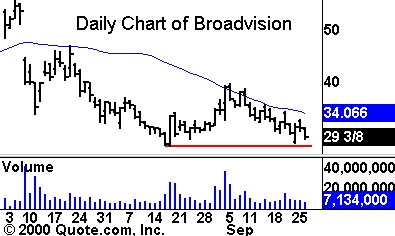

Broadvision

(

BVSN |

Quote |

Chart |

News |

PowerRating) is also trading near support. Once a

high-flyer, BVSN was unable to mount a serious comeback during the last broader

market rally. Watch for a move under the lows from July for a short

opportunity. With the market acting so indecisively, consider trading based only

on moves backed by strong volume. The volume has been trading consistently for

the last month, so a series move is likely to see heavy trade.

Â

Until later,Â