There’s A Flag On The Play

After an absolutely dismal 2000,

in which traders and investors watched the Nasdaq Composite lose nearly 40% of its value, there was a lot of optimism

about a “fresh start” in 2001. You know, wiping the slate clean, out with the old and in with the new. Right? Wrong.Â

How dare we feel optimistic at the beginning of this trading year. With a nearly 10% decline today in the

Nasdaq Composite, the Bears rang in the new year with more of the same. It seems like the “gloom and doom” crowd was out in full force today, citing

the next support levels on the Composite at 2000.Â

At one point, a television commentator actually said that some “technical

analysts” he spoke to responded with the words “What support?” Isn’t it fascinating that these

“neutral” market commentators can change their bias so quickly? Our job is to block out the noise and focus on what we see, not what we hear.

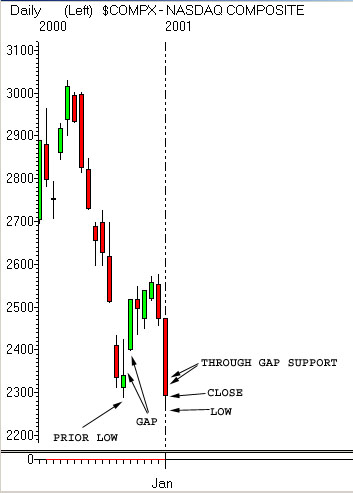

Let’s look at a daily chart of the Nasdaq Composite.

The gap from 12/21-12/22 seemed like an excellent area for the Nasdaq’s slide to find

support — this gap being in the 2340-2397 area. However, once this gap was violated, it was clear that the next area of potential (and I

stress the word “potential”) support would be at the lows of 12/21, which was 2288.Â

Having finally carved out a low of 2273 on the day before rallying

up anemically to close at 2291.86, I am not too excited about the Nasdaq’s prospects here. The inability of the Nasdaq to close above the 12/21 gap of

2340 definitely concerns me.Â

The demise of the “chosen ones”

today such as

(

JNPR |

Quote |

Chart |

News |

PowerRating),

(

BRCD |

Quote |

Chart |

News |

PowerRating),

(

VRTS |

Quote |

Chart |

News |

PowerRating),

(

CHKP |

Quote |

Chart |

News |

PowerRating),

(

BEAS |

Quote |

Chart |

News |

PowerRating), etc. was certainly not a positive development.

In my commentary last Thursday, I recommended short consideration of this group as they were demonstrating

“topping” action and were rallying into resistance. I never, ever, expected them to come down this violently. If you

rode them all the way down, congratulations!

Long/Short Watch:

Difficult to give any setups as shorts look very extended on the downside and very little is shaping up for long entries. Being a spectator at this

time is probably the safest place to be.

Let’s re-evaluate when things are a little clearer, however, don’t discount the possibility of

a fierce snap-back rally as we have seen this take place over the years the day after a precipitous decline.

Random Musings: Sorry about today‘s

headline — the 10 hours of football I watched yesterday had something to do with it.