Monday Stock Movers: 3 Stocks for Swing Traders

Stocks are flying off the shelves in the first few hours of trading on Monday, as the news of the taxpayer-funded Citigroup bailout, has opened the door to risk-taking once again.

Traders have been waiting for signs of a bottom ever since the market made its October lows. Typically, when it comes to trading, the notion that a watched pot never boils translates into the idea that a market bottom that is widely anticipated often ends up not being much of a bottom, at all.

Cubist Pharmaceuticals

(

CBST |

Quote |

Chart |

News |

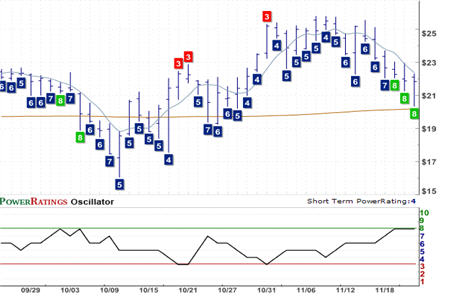

PowerRating) Short Term PowerRating 8. RSI(2): 5.06

Additionally, markets tend to develop when bad news happens and markets respond positively. The biggest headline news over the past few days however has been the appointment of New York Fed President Timothy Geithner to be the new Treasury secretary and, as I mentioned, the Citigroup bailout.

Hanger Orthopedic Grou

(

HGR |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 1.98

However positive these two items may be for the markets in the short term – or even the long term, the intermediate term picture remains unclear. Already critics and detractors are taking a closer look at Geithner’s opinions during the Lehman implosion, for example, and questioning whether he is more likely to advocate for more aggressive – and more generous — bailouts of financial institutions.

NPS Pharmaceuticals Inc.

(

NPSP |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 3.93

But so far the markets are moving dramatically higher, with the S&P 500 up more than 4% after an hour’s worth of trading on Monday. As such, many of the oversold stocks I spotted early this morning have moved higher. Three of the stocks – all drug-related stocks interestingly enough – that have yet to lose their oversold status – or their high Short Term PowerRatings – are noted here and are worth continued attention, especially if the bullishness we are seeing early on Monday begins to wane over the course of the trading day.

Back by popular demand, our momentum trading strategy, the 5x5x5 Portfolio Method, has had an average compound annual return of 118.79% for more than 7 years, with 71% profitable trades since 2001. Click here to find out more about the 5x5x5 Portfolio Method Today!

David Penn is Editor in Chief at TradingMarkets.com.