Become a Recessionista? Not in This Stock Market

“Become the Recessionista your parents always wanted” screamed the billboard on the New Jersey Turnpike. In fact, there is a series of these types of “recession motivation” billboards all around New York City. My first questions were what is this all about, who spent the money to put these signs up? There is no signature, websites, or names under the clever saying.

Maybe it’s the dark lord, George Soros or another bored billionaire trying to keep the population upbeat. Maybe it’s some kind of cult or Tony Robbins seminar marketing tactic? Perhaps a new political party who will rise up with solutions to the economic situation? All these thoughts entered my mind prior to making it home to do a bit of research on these unusually clever economically minded signs. Well, the truth is, none of my first thoughts were correct. The signs are from the Outdoor Advertising Association as a public service campaign. There is a private donor, but this person’s mission is simply not to sell anything other than the American spirit. It is actually a very cool idea, in my opinion.

While job losses have many Americans feeling the economic pinch of a recession right now, obviously the stock market has been immune from the down turn this year. As long as interest rates remain near zero, and government stimulus doesn’t cease, stocks have a clear potential of continuing their bullish run into the near future. While this doesn’t mean there will be no pullbacks, there will likely be sharp ones; it does mean that the overall move should continue on a bullish tilt.

Picking the correct stocks for short-term investments remains the paramount concern for short-term stock traders. Regardless of the overall market, there will always be those stocks that outperform, match the market, and underperform in the short and long-term. The key is to locate those stocks most likely to experience short-term gains prior to the fact. We have discovered a simple three step system for identifying those companies primed for short-term gains. This article will explain the easy to use, simple system and provide 3 names for your consideration.

The first and most critical step is to only look at stocks trading above their 200-day Simple Moving Average. This assures that a strong, long term up trend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this fly in the face of conventional wisdom of buying stocks as they climb higher. However, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

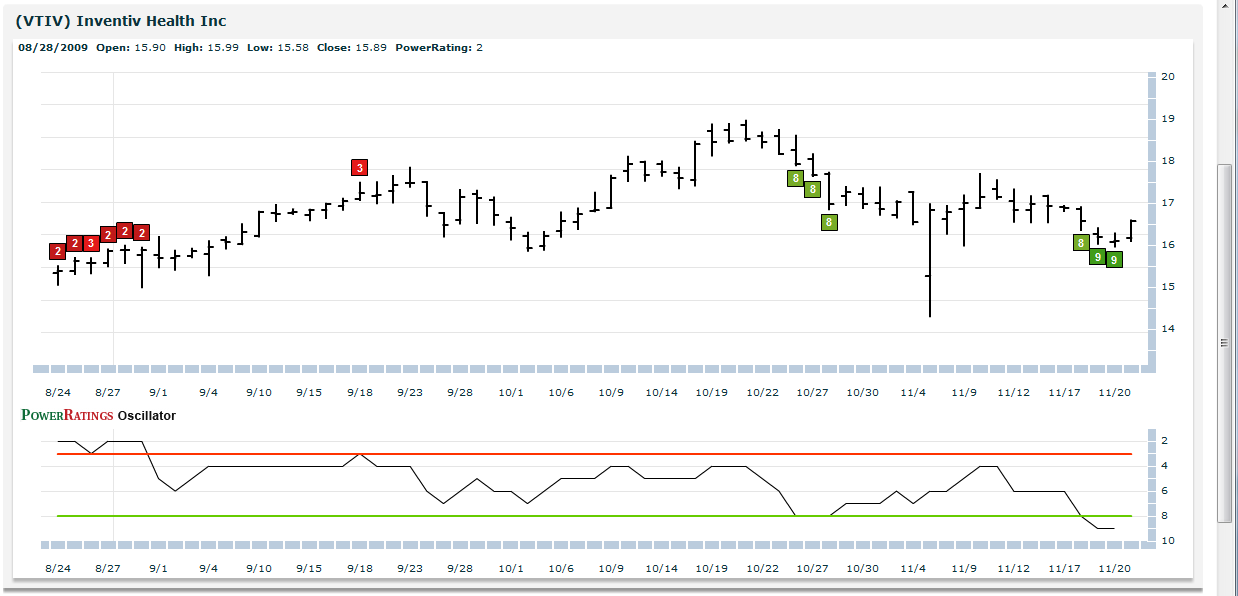

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is less than 2 (for additional information on this proven indicator click here) and the Stock PowerRating is 8 or higher.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short term.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame.

Here are 3 stocks fitting the criteria therefore primed for gains:

Ariad Pharmaceuticals

(

ARIA |

Quote |

Chart |

News |

PowerRating)

Inventiv Health

(

VTIV |

Quote |

Chart |

News |

PowerRating)

Vertex Pharmaceuticals

(

VRTX |

Quote |

Chart |

News |

PowerRating)

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.