Bernanke’s Double Edged Sword and 3 Shortable PowerRatings Stocks

Bernanke has a major dilemma staring him in the face. While it appears the stimulus injections are working and the dire employment situation may have finally started to improve; the U.S. dollar has been walloped.

The quick fix to the dollar problem is to raise interest rates. However, as you know, even a hint of increasing rates sends equities spiraling downward. Improvement in the economy has caused many investors to become nervous of a pending rate hike. This is despite the Fed’s insistence that there will be no increase in the near future. However, some analysts believe that they may be forced into a rate increase regardless of the rhetoric to the contrary.

This situation is truly a double edged sword for Bernanke. We may get some additional hints today during his talk at the Economic Club of Washington. Stocks are already acting erratically in preparation.

Fortunately, short term stock traders don’t need to predict interest rates, news or Bernanke’s next move. As a short term investor, your goal is to locate those stocks most likely to move in the desired direction over the next 5 trading days. We have developed an easy to use, highly effective 3 step system to locate stocks likely to make moves on the short or long side in the short-term.

Provided the fact that many stocks are overbought right now, today will focus on how to find stocks ready to drop for you to short sell over the next 5-day time frame.

This article will lay out the 3 step plan to locate companies ready to drop and provide 3 stocks fitting the criteria for your consideration:

The first and most critical step is to only look at stocks trading below their 200-day Simple Moving Average. This assures that the stock isn’t in a long term uptrend that may likely continue.

The second step is to drill deeper into the list locating stocks that have climbed 5 or more days in a row, experienced 5 plus consecutive higher highs, or are up 10% or more. Yes, you heard me right, stocks that are climbing. I know this doesn’t seem to make initial sense. However, our studies have clearly proven that stocks are more likely to fall in value after a period of up days than after a period of down days.

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is greater than 97 (for additional information on this proven indicator click here) and the Stock PowerRating is 3 or lower.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and most likely for short term drops and 10 proven to be the most probable for gains over the next 5 days.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of dropping in value over the 1 day, 2 day and 1 week time frame.

Here are 3 names ready to dip after being higher:

InterMune

(

ITMN |

Quote |

Chart |

News |

PowerRating)

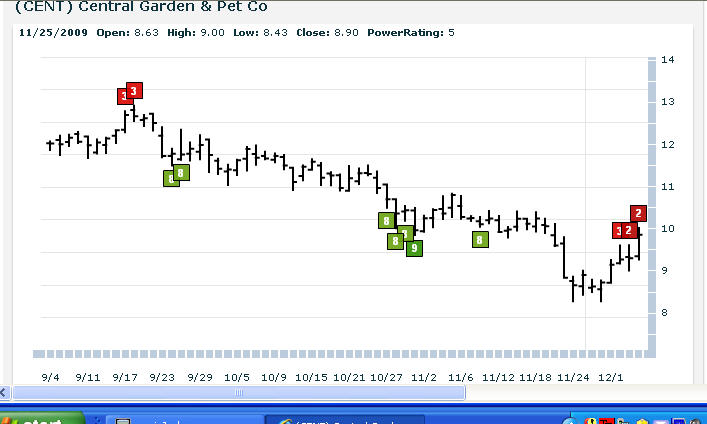

Central Garden & Pet

(

CENT |

Quote |

Chart |

News |

PowerRating)

CBeyond

(

CBEY |

Quote |

Chart |

News |

PowerRating)

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.