Connors Research Traders Journal (Volume 48): 7 Steps to Building a Superior Portfolio

In our new book: The Alpha Formula: High Powered Strategies to Beat the Market with Less Risk, we go beyond just investigating trading strategies/signals and comment on some best practices in building investment portfolios.

Portfolio construction is a very important topic, often overlooked by new systematic traders, and can lead to large improvements in the quality (think return/risk ratios) of your portfolio.

It’s not enough to just find a good setup or an indicator with strong historical test results. Investors then have to consider how to put different strategies together into a portfolio.

Building portfolios with First Principles in mind, using Ray Dalio’s “holy grail” principle of diversification and grounding your strategies in predictable human behavior that is unlikely to change leads to robust results and world-class performance.

Below, find 7 steps to take in order to build superior investment portfolios:

1. Have strategies that profit when equity markets go up.

A First Principle, or an objective, self-evident truth, is that equity markets go up, often trending higher for extended periods of time. You want to have one or several strategies in your portfolio designed to profit from such times.

2. Have strategies that profit when equity markets go down.

Unfortunately for buy and hold investors, the equity markets not only go up, but they also go down. Equity market declines are characterized by higher volatility, often declining markedly faster than they increased.

When a market is in a downtrend, it will tend to periodically experience extreme upward moves or short-covering rallies. These bursts of short term strength are often short-lived, with the market typically resuming its downtrend after the short-term optimism subsides.

We want to have strategies in our portfolio designed to profit when markets go down.

3. Have strategies that profit when markets go through times of stress.

The final First Principle applied to markets is that they often go through times of acute stress or short-term panic. These times typically lead to investors rushing to assets that are perceived as “safe havens”, with the most consistent safe haven asset being US Treasury bonds.

We want to have strategies in place that profit from the rush to safety that typically coincides with market stress.

4. Put together uncorrelated strategies to achieve increased risk-adjusted returns.

Putting together strategies that are uncorrelated to each other, ideally, strategies that attack each First Principle above, leads to a portfolio with greatly increased risk-adjusted returns. Ray Dalio, CEO and founder of the largest hedge fund in the world, calls this insight “the holy grail of investing.”

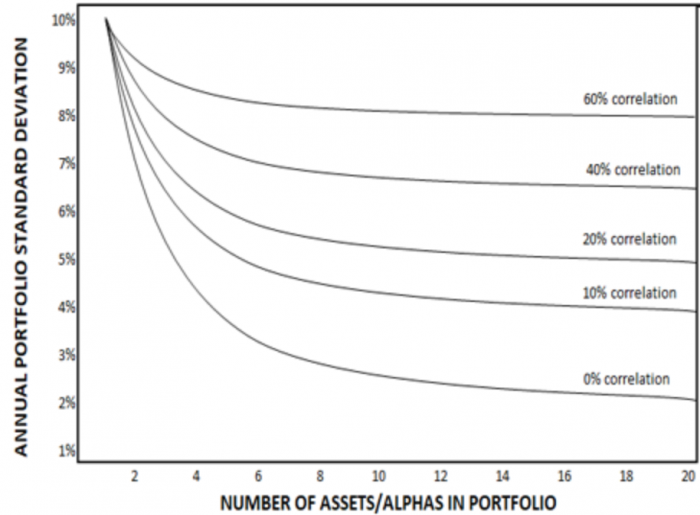

The chart below shows what happens to the volatility of a portfolio (a proxy for risk, Y-axis) when adding different return streams (think different trading strategies) with various correlations.

Notice how the risk of the portfolio decreases when more assets or trading strategies are added to the portfolio. The amount of risk reduction is a function of the correlation of the strategies, the more uncorrelated the better.

You don’t have to run the largest hedge fund in the world to use this insight! Put together multiple strategies with low correlations and enjoy the increased risk-adjusted returns yourself!

5. Have strategies built around inherent human behavioral biases that are unlikely to go away.

Edges in the marketplace often get arbitraged away when too many people are aware of a signal. One thing that we believe will never be arbitraged away, and that will never materially change for that matter, is human behavior.

Humans display a number of consistent and predictable behavioral biases in the marketplace, including but not limited to anchoring, confirmation bias, loss aversion, overconfidence, recency bias, relativity, and herding.

We view human nature to be behind some of the market tendencies traders have used to profit from for decades, such as long-term trend following and short-term mean reversion. Have human behavior serve as the bedrock for the market tendencies you are looking to profit from!

6. Have strategies that profit from both trend-following and mean reversion, and in the correct time frames.

Apply strategies aimed to profit from both the mean reversion and the trend-following nature of markets. These strategies should apply mean reversion to shorter-term time frames (think days to weeks) and trend-following to a longer-term time frame (think months to years).

7. See the trade, take the trade!

This one is straight forward. You can do all the quantitative work you want, but if you don’t follow that strategy in real-time, it will be all for not. If you make the decision to be a systematic, quantitative trader then you must follow your strategies no matter how bad the trade may feel. Oftentimes those trades that feel the worst turn out to be the most profitable trades!

Apply these 7 principles to your portfolio and you’ll be ahead of most investors and asset managers, especially those who are long-only and hope the market goes up forever. The smarter money knows that markets go up, down and through times of stress. We encourage you to build your portfolio around these truths.

If you’d like to learn how to further apply these 7 principles, you can find them in our new book, The Alpha Formula: High Powered Strategies to Beat the Market with Less Risk.

Larry Connors and Chris Cain, CMT