Easy As Flipping a Switch: 3 Overbought PowerRatings Stocks

Just yesterday everything seemed rosy in the financial world. Most news was being spun with a bullish tilt and optimism ran rampant on the Street of dreams. Even entrenched issues like unemployment and credit concerns have been glossed over in favor of the runaway bull market.

Today is a prime example of how fast things can change in the financial markets. The mainstream press is calling the rise in jobless claims unexpected and several major names posted worse than expected earnings results. Just as easy as flipping a switch, the environment has turned short term bearish. There is no rhyme or reason behind the sudden change in sentiment.

Even in the bullish frenzy there was enough negative news to depress stock prices. However, the fickle media pushed these stories to the side, focusing on the positive. It’s impossible to predict these changes in sentiment and how the market will react to various outside stimuli. Fortunately, short term traders don’t need to worry about the ever changing whims of the media or even the overall market movements. The key to success is simply to locate those stocks most likely to move in the desired direction over the next 5 days. Provided the bearish nature of the day this article will focus on how to locate stocks to sell short over the short term. Â

We have developed a simple 3 step process to assist short term traders locate overbought stocks that are most likely to fall in value over the next 5 trading days. This system has been proven to place the odds firmly in your favor over the short term.

The first and most critical step is to only look at stocks trading below their 200-day Simple Moving Average. This assures that the stock isn’t in a long term uptrend that may likely continue.

b>The second step is to drill deeper into the list locating stocks that have climbed 5 or more days in a row, experienced 5 plus consecutive higher highs, or are up 10% or more. Yes, you heard me right, stocks that are climbing. I know this fly in the face of conventional wisdom of selling stocks as they fall further. However, our studies have clearly proven that stocks are more likely to fall in value after a period of up days than after a period of down days.

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is greater than 97 (for additional information on this proven indicator click here) and the Stock PowerRating is 3 or lower.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and most likely for short term drops and 10 proven to be the most probable for gains over the next 5 days.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of dropping in value over the 1 day, 2 day and 1 week time frame.

Here are 3 oversold stocks fitting the 3 steps for your short selling consideration:

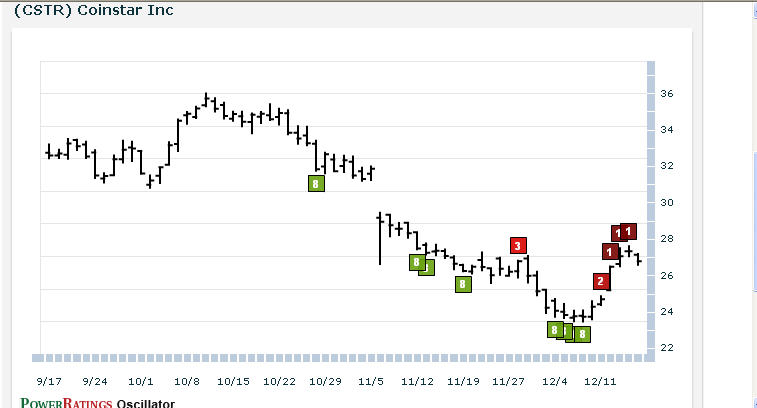

Coinstar Inc

(

CSTR |

Quote |

Chart |

News |

PowerRating)

Quanta Services

(

PWR |

Quote |

Chart |

News |

PowerRating)

General Cable

(

BGC |

Quote |

Chart |

News |

PowerRating)

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.