How to Cut Risk But Still Capture Big Moves

Much has been made of the recent surge in volatility and how it has caught

many institutional investors by surprise. Wall Street’s biggest investment banks

and a number of well known hedge funds have reported substantial losses after

their quantitative trading systems went awry.

Recently, Goldman Sachs

(

GS |

Quote |

Chart |

News |

PowerRating) led a group of investors that injected $3

billion to prop up one of its funds that had lost 30%. Even the

legendary Jim Simons, founder of Renaissance Technologies, was forced to

write a “Dear Investor†letter explaining recent losses.

The Wall Street Journal reported the global head of quantitative

equity strategies for Lehman Brothers

(

LEH |

Quote |

Chart |

News |

PowerRating) as saying, “Events that

models only predicted would happen once in 10,000 years happened every day for

three days.”

While that sounds like the type of news to put investors off quantitative

investment strategies for life, it’s important to point out that not everyone

using these methods lost money. At TradingMarkets, we have many different

quantitative investment strategies, each designed to capitalize on different

market conditions.

One of our systems, Raptor II, is designed to take advantage of

precisely the type of conditions witnessed recently. Raptor II is

designed to capture stocks that have fallen too far, too fast, often resulting

in an explosive upside reversal.

Our real money Raptor II trading account hit equity highs last week (8/13/07)

and is currently up more than 29% since inception.

If you would like to learn more about Raptor II, join TradingMarkets

CEO and Founder Larry Connors for a special presentation on Wednesday, August

22, 04:30 PM ET.

Click

here to learn how to trade our best performing system.

Recent Trades

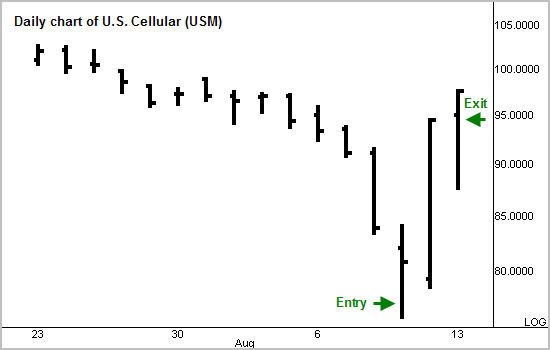

U.S. Cellular

(

USM |

Quote |

Chart |

News |

PowerRating) triggered a Raptor II buy signal on 8/9/07

at $77.19. Two days later, we exited the trade at $94.95 for a gain of 23%.

Verigy

(

VRGY |

Quote |

Chart |

News |

PowerRating) signaled a Raptor II buy signal on 8/1/07 at

$22.50. We exited the trade six days later at $24.86 for a gain of 10.5%.

Obviously, not all trades work out this well but the actual performance of

our account shows the strength of this trading system. There are several reasons

for this, but the main one is that we were able to quantify the characteristics

common to stocks that drop rapidly and then snap back to the upside.

To find these stocks on a daily basis, Raptor II applies 7 filters using

trend, volatility, maximum excursion (what we also call “stretch”), liquidity

and other key characteristics. While each one of these filters provides a

potential edge, we believe the statistical edge increases exponentially when all

7 are present in a stock.

Ashton Dorkins is Editor-in-Chief of TradingMarkets.com.

Sign-up for a 14-day free trial to the Raptor II Trading Signals.