It’s a Free Market, or It Isn’t

With all of the recent turmoil in world stock, commodity, and currency markets, some traders are looking for investments that offer a safe haven during troubled times. This is evidenced by the recent rally in gold and the current low yields on short term Treasuries.

But while safety is a concern for some, others see the current crisis as an opportunity. The question is this – are you trading in a market that will allow you the freedom to take advantage of that opportunity, or one that will hinder you from making the difficult choices that traders need to make?

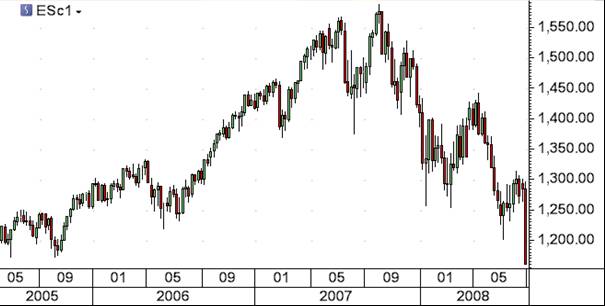

There are several reasons why stock and futures traders may want to consider venturing into the currency markets. For example, take a look at the daily chart of the S&P 500, and you’ll see a topping formation followed by a persistent downtrend over the past year. During that time, trend traders have done well by selling into strength, taking advantage of violent but brief bear market rallies (see figure 1).

Figure 1 — Three year chart of the S&P 500. Source: Saxo Bank

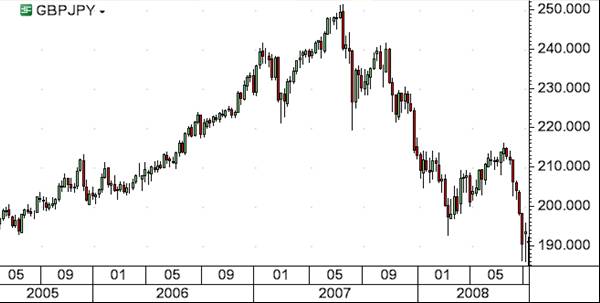

As someone who traded equities for years before entering the Forex arena, I cut my teeth trading trends on stocks and stock sectors. If you favor this type of trading, you might want to consider currencies. Compare the downtrend in the S&P 500 to the trend in GBP/JPY, and you’ll notice more than a few similarities in the two charts (see figure 2).

Figure 2: Three-year chart of GBP/JPY. Source: Saxo Bank

In every currency trade, you are long one currency and short another. Traders who have taken advantage of the current downtrend in GBP/JPY are actually shorting the Great Britain Pound and going long the Japanese Yen. As you can see by the chart comparison, traders who bought Yen as the stock markets fell were on the right side of this trade. In some ways, you could say that shorting the GBP/JPY can be used as a substitute for shorting the S&P 500.

So why make a change? Another reason to consider a move to Forex is the rising call for greater regulation of the equity markets amid the current crisis. Many in the industry – especially pundits who were pounding the table for investors to buy financial stocks six months ago – are calling for a reinstatement of the Uptick Rule, which would make it harder to short stocks. This is all part of the current “blame the speculators” mentality and mania.

While there have been abuses and possible manipulation in the form of so-called “naked” short selling — due to lax enforcement of rules that are already on the books — it is not the fault of traders, be they long or short, that many financial institutions decided to load up on subprime toxic waste. Anyone who manipulates stocks should be punished, but let’s not brand all speculators and short sellers as manipulators.

In the final analysis, a trading market is either a free market, or it isn’t. While the equity markets drift further away from free market principles, the major pairs in the currency markets remain relatively devoid of these types of obstacles. There are no rules against shorting a currency, period. Trading in major currencies is never halted. Keep these things in mind when you ask yourself, “am I trading in a free market?”

Ed Ponsi is the President of www.FXEducator.com and www.EdPonsi.com. He has appeared on CNN, CNBC, the BBC and Fox Business News, and is a frequent guest lecturer at trading events and seminars around the world. Ed has advised hedge funds, institutional traders, and individuals of all levels of skill and experience. Ponsi is featured on the FXEducator.com DVD series, Forex Trading with Ed Ponsi, and is the author of the best-selling book Forex Patterns and Probabilities.