Marc Dupee Chats With Goran Yordanoff About Shorting In The Zone

Goran Yordanoff has had more than a few thought-provoking things to say the past few weeks concerning recent market commentary. Despite the fact that many analysts have a very different view regarding current market conditions, he has successful navigated these treacherous waters. This week I had the opportunity to talk to Goran about the market, the analysts and most importantly, several trades he made in the past week (3/5-3/9).

Marc: Goran, with the Dow down 600 points this week, and nearly 1,000 points from Friday, your call to short the Dow to me is obviously the trade of the week. How did you see this trade setting up?

Goran: Essentially, by analyzing the daily, monthly and weekly charts and applying technical analysis to some of the longer-term time frames, you were able to see that the technicals of the Dow were clearly diverging from their price action. In addition, I have never in my career observed such certainty that the Dow was going to go higher. The view was that any pullback in the Dow was only temporary until we hit 11,000 again and broke out. Essentially, everyone was 100% sure that the Dow would go higher.

But it wasn’t only the technicals — technicals don’t always come to fruition right away. There were other things that showed me. The psychology of the market and the fact that they pulled out Abby (Goldman Sachs Chief Equity Analyst, Abby Joseph Cohen) last week (3/5-3/9) and tried to give it the old college try one more time — to get the euphoria going — that was key. And last Thursday (3/8) when I observed that that big blow-up rally at the end of the day was simply driven by Dow buy programs and no S&P buy programs, that was another factor. Dow buy programs are a lot cheaper than S&P buy programs and when the Dow was running without the S&P index, I knew the (late Thursday Dow) move was being “engineered and manufactured.” If there was really money coming into the market, they would have had the S&P buy programs there, too, but they are too damn expensive.

Marc: Could you explain what you looked at to know that last Thursday’s Dow rally wasn’t for real?

Goran: Last Thursday I saw the Dow Jones running non-stop into the close. But at the same time, the S&P index wasn’t moving. We also had extreme tick readings on the Dow, which convinced me that they were selectively buying the Dow 30, throwing out buy programs because they are much cheaper to run than S&P programs. I didn’t see real money — real buying — coming into the market, showing me that it was a manufactured run and only in the Dow. If big money comes into the market, it doesn’t come into only (the Dow) 30 stocks. They ran the Dow. They strategically played that to the top, yet at the same time, the S&P wasn’t participating. This led me to conclude that the Dow was being artificially pumped up with buy programs that are far cheaper for the institutions to initiate than S&P buy programs.

Marc: And with the late pump up of the Dow, it was supposed to create the erroneous perception that we would have an early-morning rally the following day, when in fact, the Dow tanked the following day.

Goran: Yes, we had a 200-point down day. And once again, psychology — everyone on CNBC was, “This is nothing to worry about. We’re just giving back a little bit after a good week. We’re still up on the week. Ahh, don’t worry about it. It looks a lot worse than it is.”

Marc: Why do you suppose they say these things?

Goran: (Laughing) No, he’s out for us. He’s out to help us make money. All of these guys are there to help us. You know, free money. And the funny thing is Friday (3/9) morning, when we just started selling off, when we were down like 100-something, Pisani (CNBC commentator Bob Pisani) came on and says, “Yeah, I talked to a lot of traders who said they are all covering their shorts because nobody wants to be short over the weekend.” And I just started putting them out there like it was nobody’s business. I was shorting everything I could get my hands on. It’s interesting. People disregard what’s being said on TV. But I think, psychologically, there are some very important messages delivered during the day. It’s a very, very important contrarian indicator.

Marc: Yes, it sounds like you fade everything that comes out of their mouths.

Goran: I don’t fade everything. It has to be in my head, first of all. But when I see people talking the other direction — like the retailers. For the past three weeks everyone is pumping retailers. I called a trend reversal, and we got a trend reversal (in the retailers), and no one called a trend reversal! Everyone seemed to all elect on the pullback from highs, everybody. You know, “It’s a pullback from highs. Buy here on the pullback.” But it was a change of trend. Didn’t anyone identify that? No one identified it, but it was a change in trend, and changes in trend do occur. Everybody thinks that whatever trend (is currently in place) will go on into infinity — up or down. Trends change. So that was another thing. ^RLX^ had broken its up-trending line. And the retailing index was like the backbone of the Dow, just like the semiconductors had been the backbone of the Nasdaq for the longest time, the leadership group. That’s pretty much it.

Marc: In your call for the Dow to turn over, what pattern did you see that made you think the Dow would collapse?

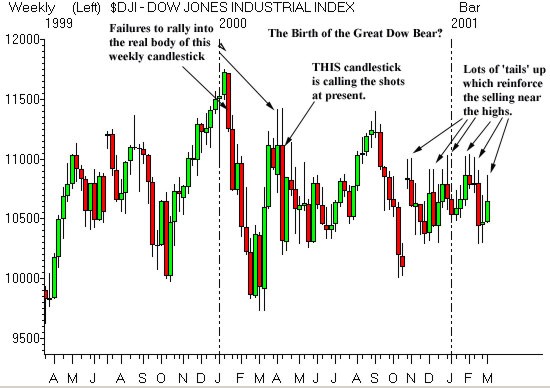

Goran: I think the very important thing that I observed that I mentioned in my (March 10) commentary was that when you looked at the weekly chart of the Dow, the weekly chart showed you a lot of tails up on the weekly candlesticks. And those tails up told us that even though the index had visited those price levels early in the week, the index was being sold late in the week. And that is typical activity of a bear market: early strength, late weakness. That was one of the clear, clear signs that the Dow was about to tank. And then earlier in the week I declared the end of the bull market in the Dow (in an article titled The Bull Is Dead, Long Live The Bull). You see signs of a bear market starting to manifest itself with the Dow’s trading activity. That is, early-in-the-week strength, late-in-the-week selling off.

Marc: Did you short the Dow futures

^DJM1^, ^DIA^, or what?

Goran: I shorted everything — I was short the world. There are various vehicles you can use. You can short Dow 30 stocks; you can use futures; you can do it with

^OEX^ (S&P 100) options. I pretty much targeted a handful of stocks I thought were significantly overvalued and the charts were very extended. I targeted ^THC^, which went down 10%. A lot of the stocks I’d mentioned (in the commentary) dropped about 15% to 20% — retailing and apparel stocks like ^RL^ and ^JNY^.

^COCO^ went down almost 20% in two days. Everything I mentioned that I thought was stretched, I took it in short.

Marc: When you entered those positions short, what did you use as a stop loss?

Goran: Well, see, that’s a hard question. A lot of traders are told to use stop losses. If you’re a daytrader, stop losses are essential. If you are a positional trader, like I am right now, I don’t really use them (in the traditional way), because I am accumulating multi-thousand share — 10,000- to 20,000-share — positions in each and I scale in. I get short three to four thousand in each.

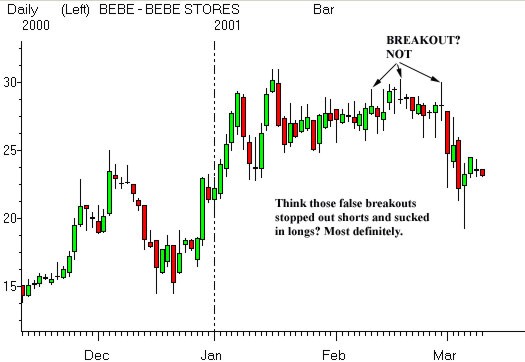

And topping, you can never top-tick, just like you can never bottom tick, and I said that in my commentary on Saturday. When people say you can never pick the bottom, well, you can never pick the top either. If you see topping activity taking place, scale into your positions, get short, and hold on it — as long as you’re not taken out. I showed another example, ^BEBE^, which is a $30 stock that I recommended shorting that went to $19. And you see the chart pattern. You see how they try to head fake you out and get you stopped out, based on taking out the prior day of the prior week’s high. This would have stopped you out of the trade. And I say, “they always turn it the other direction and try to stop you out before they take the stock on the money trade.” They always try to get you out.

The game has gotten a little more sophisticated than it was a few years ago. Two or three years ago, everyone was playing the, you know, go long over the five-minute consolidation base, or sell it here, or buy it over this base, buy it over the pair of five-minute bars. That’s all shot to hell because everyone caught on to that.

Marc: What would you have used then to say, “Hey I’m wrong then on the short trades, and I’ve got to get out?”

Goran: If the technicals reversed. If the technicals reversed and started giving me higher readings and confirmed the price action, I would have gotten out. But keep in mind that all of the entries that I had were so extended on the upside, that the most heat that you would take would be 5%, 7%, 10%, max! I mean not even 10%. Like I try to stress, if you want to play the short-side like 95% of professionals do, you need to learn to be wrong at first. You need to learn to take heat.

I’ve never been in a short my whole life — and I have to be honest with you, the only buy tickets I’ve written for the past 12 months have been to cover my shorts — I’ve never shorted anything that went down for me right away because it can’t. You have the up-tick rule to contend with. You can’t get short when they turn down.

Everyone puts out their picks — like short it under this. You can’t get short under that. You’re going to chase it down 2 or 3 points. It’s impossible. So I try to short in a zone: This is a zone of resistance. Or this is an area that you should be looking at to scale into your shorts. I can’t top-pick it just like no one can bottom-pick it. You’ve got to get short at that level and wait for the eventual break. Sometimes, it can take weeks. Sometimes, it can take months.

I remember I was short ^MRK^. Everyone loved #$!*’in Merck at the beginning of the year. Everyone loved it. It was $96 a share. Everyone was refusing to believe and was saying, “Oh, you’re short Merck.” “Hold on. It’ll break,” I’d say. It is now at $72 a share after being at $96. No one talks about the drugs anymore. But they loved them at the beginning of the year; drugs were recession-proof. I was in that trade for almost two weeks before it finally changed for us.

Marc: So unless the technicals change . . .

Goran: So unless the technicals change and negate my original finding. I think it’s important for you to say this: Before entering the trade, the trader needs to make a determination about A) is he scalping it? B) Is he swing trading it? or C) Is he taking it as a positional trade? Because a positional trade isn’t a swing trade. A positional trade can last months. This is like Jesse Livermore stuff or (George) Soros stuff: positional trades.

How do you turn a scalper into a swing trader? Have the position go against him or her! If you’re scalping, I suggest you have very, very tight stops. If you are going to trade from a swing perspective or a positional perspective, you need to determine what your pain tolerance is more so than a stop: what’s your pain tolerance.

Marc: Do you have a rule for your pain tolerance? Ten percent?

Goran: No. I think that’s all BS, all the percentage stuff. Everybody caught on to the standard 8% stop loss. Everyone knows it, man. The market makers, they all know it. They’re all taking 8 1/2%, 9%. I was going over that with a hedge fund manager about three weeks ago and we were looking at some trades that we were in and all of them moved about 8 1/2% to 9% from entries that were obvious entries.

The market is a continually morphing animal. Things change and your approach needs to change and all of these theories about stop losses and stuff need to change too, because the game is evolving every day. We need to evolve our approach to the market as it evolves.

For The Best Trading Books, Video Courses and Software To Improve Your Trading, Click Here.