Monday Stock Movers: 3 Funds for ETF Traders

Premarket futures were indicating that the 5-day winning streaks in the Dow industrials and S&P 500 were likely to come to an end on Monday. And within the first hour of trading, those futures have correctly anticipated the resumption of selling pressure with the Dow down more than 300 points less than 30 minutes after the open.

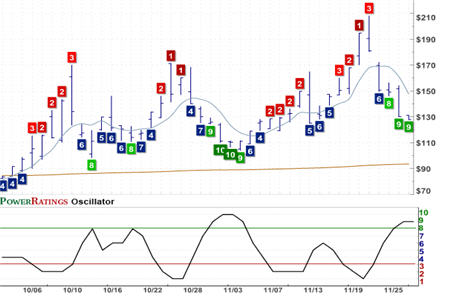

Rydex 2X Inverse S&P 500 ETF

(

RRZ |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 7.00

There’s no denying how overbought the markets have become. Based on a number of metrics – both statistical and anecdotal – stocks are as supersaturated with buyers as they have been in weeks. Actually, stocks are about as overbought as they have been since the beginning of November, right before the last leg down in the year-long bear market.

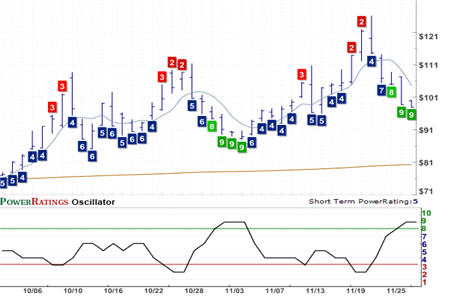

ProShares UltraShort Russell 2000 ETF

(

RWM |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2): 5.85

What does this mean for swing traders looking to buy stocks and ETFs on weakness? Most importantly, as we have for the past few months, when stocks are dramatically overbought, we turn to ETFs rather than to individual stocks for our trades. We have had some excellent success looking to take advantage of ETFs that are overbought, and will continue to make them the primary vehicle for making good trades when stocks – and ETFs – have gone too far too fast to the upside.

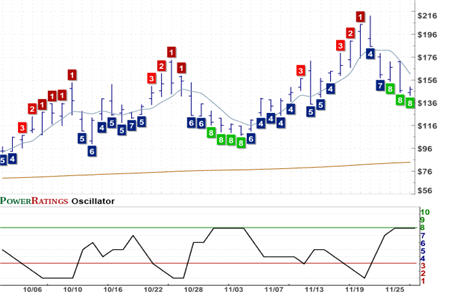

ProShares UltraShort Semiconductor ETF

(

SSG |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 24.19

Additionally, all five exchange-traded funds in today’s report were part of one of our TradingMarkets Indicators – specifically, the indicator for stocks or ETFs that have been down by 10% or more in the past few days. In the same way that our research has indicated that there is an edge in buying stocks that are trading above their 200-day moving averages, but have pulled back by 10%. We have found that this edge is consistent with ETFs, as well.

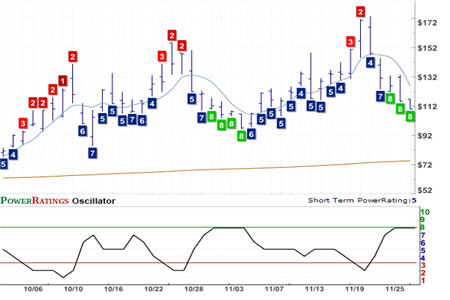

ProShares UltraShort Financials ETF

(

SKF |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 6.53

Additionally, all five ETFs have Short Term PowerRatings of 8 or 9. Our research indicates that stocks – and ETFs – with Short Term PowerRatings of 8 or 9 have outperformed the average stock or ETF by a significant margin over five days.

ProShares UltraShort Industrials ETF

(

SIJ |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2): 5.89

Back by popular demand, our momentum trading strategy, the 5x5x5 Portfolio Method, has had an average compound annual return of 118.79% for more than 7 years, with 71% profitable trades since 2001. Click here to find out more about the 5x5x5 Portfolio Method Today!

David Penn is Editor in Chief at TradingMarkets.com.