Shorts in Bull Land & 3 Bearish PowerRatings Stocks

How high can this market go? This seems to be the question on every investor’s mind. Stocks have been on an absolute tear higher since the yearly lows in early February.

The Dow Jones Industrial Average has gained over 700 points in a little over a month. A huge move by any bull’s standard. Highs made in January are being approached by approximately 100 points. Some technical analysts are seeing a clear tight head and shoulders topping formation on the daily DJIA chart. Others are excited about the lack of movement over the last several days as this could indicate price exhaustion.

Regardless of the different analyst’s interpretations, the consensus is clear that stocks are due for a pullback. The question is how steep and when will it occur? No one knows exactly what the parameters of the pullback will be or even when it will occur. The best short term stock traders can do is to locate shares possessing the best odds of a short term pullback to sell short.

Our research has indicated that companies showing strength, yet still under their 200-day Simple Moving Average make the best short candidates. We further drilled down into this basic concept resulting in an easy to use 3 step system for locating these ready to drop companies.

The first and most critical step is to only look at stocks trading below their 200-day Simple Moving Average. This assures that the stock isn’t in a long term uptrend that may likely continue.

The second step is to drill deeper into the list locating stocks that have climbed 5 or more days in a row, experienced 5 plus consecutive higher highs, or are up 10% or more. Yes, you heard me right, stocks that are climbing. I know this fly in the face of conventional wisdom of selling stocks as they fall further. However, our studies have clearly proven that stocks are more likely to fall in value after a period of up days than after a period of down days.

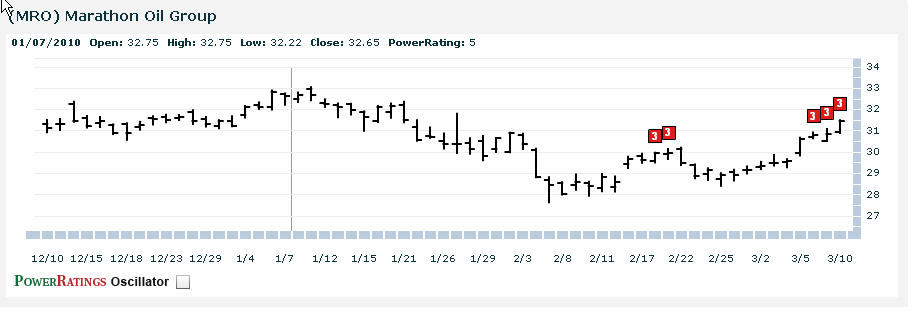

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is greater than 97 (for additional information on this proven indicator click here) and the Stock PowerRating is 3 or lower.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and most likely for short term drops and 10 proven to be the most probable for gains over the next 5 days.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of dropping in value over the 1 day, 2 day and 1 week time frame.

Here are 3 names looking primed for a quick drop:

^IRDM^

^MRO^

^GLF^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.