Swing Trading and Market Timing with PowerRatings: UFI, SLXP, AFAM

Stocks were higher in the first hour of trading on Friday, as dramatically oversold conditions induced buying — and short covering.

Most swing traders who use Short Term PowerRatings know and understand the idea of buying stocks with high Short Term PowerRatings of 8, 9, or 10 – particularly when they are pulling back above the 200-day moving average. Here I not only want to underscore how Short Term PowerRatings help swing traders anticipate potential oversold extremes from which stocks, based on our research, have a tendency to rally. I also want to remind swing traders of another way of using Short Term PowerRatings – especially low Short Term PowerRatings – to help anticipate when stocks might be more likely to pull back.

First up is Unifi Inc.

(

UFI |

Quote |

Chart |

News |

PowerRating), which has a Short Term PowerRating of 9. Here, we have a classic case of high Short Term PowerRatings anticipating an oversold low in the stock in early October.

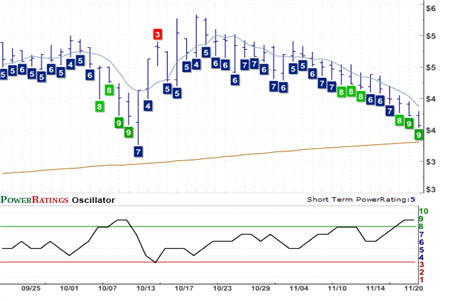

This is the more typical way to use Short Term PowerRatings. However, in the PowerRatings chart of Salix Pharmaceuticals

(

SLXP |

Quote |

Chart |

News |

PowerRating), we can see another potentially helpful approach. Notice how SLXP reacted shortly after its Short Term PowerRating was downgraded to 3.

While there is a modest example in early October, the truly interesting instance of low Short Term PowerRatings anticipating an overbought extreme comes in early November. This kind of analysis is beneficial both to traders who might have been long the stock as it rallied above its 200-day moving average, becoming overextended to the upside, as well as to traders not in the stock who were looking for an opportunity to buy on weakness. The appearance of low Short Term PowerRatings were a worthwhile signal for both traders.

Last, here is a PowerRatings chart of Almost Family Inc.

(

AFAM |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8.

Here we can see both uses of our Short Term PowerRatings in action: first, the high Short Term PowerRating pullback in early October as AFAM earned an upgrade to Short Term PowerRating 8, and second, the pullbacks in mid-October and early November that were signaled in advance by low Short Term PowerRatings.

Back by popular demand, our momentum trading strategy, the 5x5x5 Portfolio Method, has had an average compound annual return of 118.79% for more than 7 years, with 71% profitable trades since 2001. Click here to find out more about the 5x5x5 Portfolio Method Today!

David Penn is Editor in Chief at TradingMarkets.com.