The Benefit of the International Contagion & 3 PowerRatings Stocks

As things are slowly improving within the United States, a creeping contagion is inching its way around the world. This dire economic issue is debt and the ability for the second tier powers to meet the debt with a floundering Euro.

Right now the focus is on Greece. France and Germany are approaching an agreement with the International Monetary Fund to extend aid to Greece. This creates concern that the European Union itself can’t assist Greece on its own.

A recent downgrade of Portugal’s debt combined with the Euro hitting 10-month lows against the U.S. Dollar has exasperated the worries. The drop in the U.S. stock market this morning and yesterday is clearly tied to the international situation.

I believe we can expect further tremors from the 2nd tier economies and perhaps even a few from the top tier as they work their way out of the muck. Changes are happening that may be a little painful to experience for these countries but they should emerge stronger and better on the other side. This in turn should work to trigger even more growth in the United States fulfilling the positive interconnection of the globe.

Fortunately, short term stock traders can use the tremors setting off in the international arena to create buying opportunities. This is actionable benefit of the contagion. We have developed an easy to use, 3 step system to locate companies that are setting up for short term gains.

This article will explain this simple process and provide 3 top Power Ratings stocks for your consideration.

The first and most critical step is to only look at stocks trading above their 200-day Simple Moving Average. This assures that a strong, long term up trend is in place, increasing the odds that you are not buying into a falling knife or catching a stock in a death spiral.

The second step is to drill deeper into the list locating stocks that have fallen 5 or more days in a row or experienced 5 plus consecutive lower lows. Yes, you heard me right, fallen 5 or more days in a row. I know this is counter-intuitive of conventional wisdom of buying stocks as they climb higher. However, our studies have clearly proven that stocks are more likely to increase in value after a period of down days than after a period of up days.

The third and final step is a combination of whittling the list down even further by looking for names whose 2-period RSI (RSI(2)) is less than 3 (for additional information on this proven indicator click here) and the Stock PowerRating is 8 or higher.

The Stock PowerRatings are a statistically based tool that is built upon 14 years of studies into the inner nature of stock prices. It ranks stocks on a scale of 1 to 10 with one being the most volatile and least likely for short term gains and 10 proven to be the most probable for gains over the next 5 days. In fact, 10 rated stocks have shown to have a 14.7 to 1 margin of outperforming the average stock in the short term.

The stocks that fulfill each of the above steps have proven in extensive, statistically valid studies to possess solid odds of increasing in value over the 1 day, 2 day and 1 week time frame.

Here are 3 stocks ready to for short term gains.

^TESO^

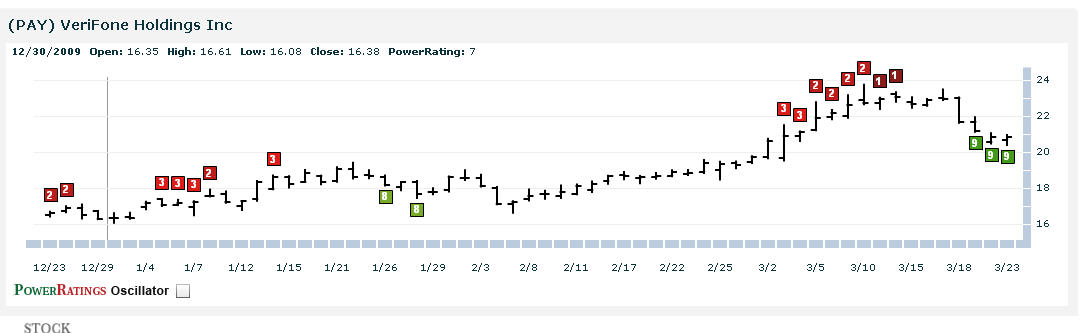

^PAY^

^FRZ^

Learn more strategies for trading stocks in the short term with a free trial to our PowerRatings! The highest rated stocks have outperformed the average stock by a margin of more than 14.7 to 1 after five days! Click here to launch your free PowerRatings trial today!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund.