The Bullish Case for EUR/USD

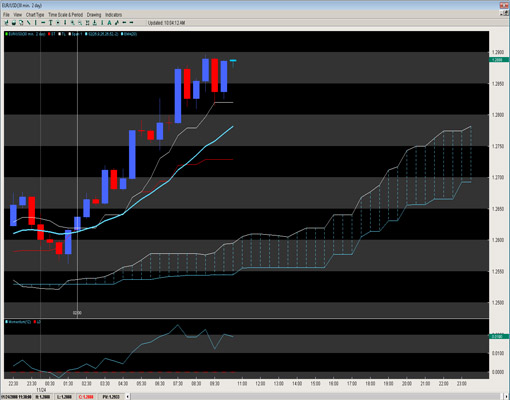

Ichimoku models suggest short term gains for EUR/USD. The EUR/USD and EUR/JPY benefited well from the Citigroup bailout and the climb in the Equity markets globally as both pairs were aggressively bullish with the EUR/USD giving the Ichimoku Tenkan line a brief kiss during the pairs ascent.

Starting with the Daily chart below on the EUR/USD, we see the pair not just breaking convincingly above the Tenkan (white line), but also forming what looks like the first daily close above the 20EMA since Sept. 26th. This should give the bulls some short term confidence and likely will pull in some technical players on the break of the 20EMA as it appears the 1.25 region has formed a short term bottom of sorts. We still have the Kijun (red line) above posting at 1.2929 which is likely the next line of resistance. A daily close above that suggests the 1.30 big figure may give it some challenges and the Cloud hovers above around the 1.35 region.

As time goes on, the cloud gets thicker suggesting that if the pair does not muster something huge soon, it will likely end the year below the 1.35 level and likely the ‘Kumo’ (cloud). Momentum is starting to form new swing highs and is pointing up nicely also hinting that there is some steam behind this stride.

A glance at the 30 minute chart shows the strength of this move as the pair creates a strong upward bullish cross of the Tenkan and Kijun lines around 2 a.m. PST and the pair never looks back only touching the Tenkan line once giving it a brief kiss before retesting the highs. The pair is far away from the Kumo which is starting to get thick below suggesting the short term line of least resistance is to the upside. Look for some unwinding and hopefully a weak bearish cross of the Tenkan and Kijun lines which could likely lead to another strong bullish cross giving us a good intraday buy signal.

Chris Capre is the Founder of Second Skies LLC which specializes in Trading Systems, Private Mentoring and Advisory services. He has worked for one of the largest retail brokers in the FX market (FXCM) and is now the Fund Manager for White Knight Investments (www.whiteknightfxi.com/index.html). For more information about his services or his company, visit www.2ndskies.com.