TradingMarkets Monday Stock Movers

Stocks are off to a volatile start to begin the week, though the major market indexes are up from their pre-market lows.

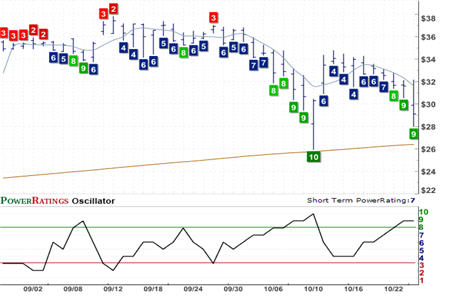

Alpharma Inc.

(

ALO |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 9. RSI(2):

Increasingly, I am seeing those few stocks that are trading above their 200-day moving averages start to pull back, some dramatically so. As such, this week’s Monday Stock Movers has more than a few potential trading opportunities for swing traders looking for buying opportunities in this difficult market.

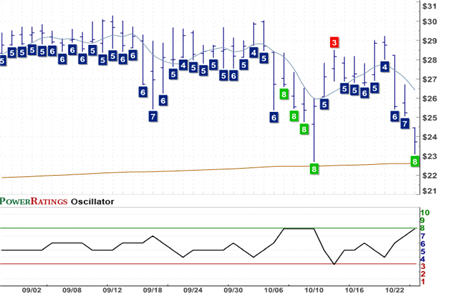

Green Bankshares Inc.

(

GRNB |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2):

Stocks that have lost 10% or more in the past few days are often attractive swing trading candidates to the long side — particularly when these stocks are trading above their 200-day moving averages. Looking to buy stocks that have pulled back and are becoming cheaper is consistent with our fundamental approach to swing trading: buying strong stocks that are experiencing profit-taking, and then selling them back into strength as demand picks back up.

Click here to read more about stocks that have lost 10% or more in the past five days.

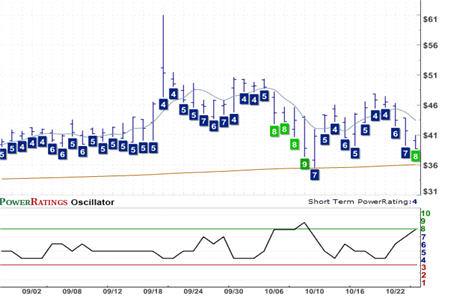

LHC Group LLC

(

LHCG |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2):

Of the five stocks in today’s report, four have Short Term PowerRatings of 8 and one has a Short Term PowerRating of 9. Our historical backtesting of millions of simulated stock trades indicates that stocks with Short Term PowerRatings of 8 have outperformed the average stock by a margin of more than 8 to 1 after five days.

Stifel Financial Corporation

(

SF |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2):

Stocks with Short Term PowerRatings of 9 have performed even better, besting the average stock by a margin of more than 13 to 1 after five days according to our research on stocks between 1995 and 2007.

Thoratec Corporation

(

THOR |

Quote |

Chart |

News |

PowerRating) Short Term PowerRating 8. RSI(2):

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.