How to Improve Your Trading by Identifying Trending Stocks

Money in trading is made from catching a significant trend. Money lost in trading occurs by missing or being on the wrong side of trends. So the real question is how do we protect and preserve our trading capital as we position ourselves to catch the next profitable trend?

Click here to order your copy of The VXX Trend Following Strategy today and be one of the very first traders to utilize these unique strategies. This guidebook will make you a better, more powerful trader.

Significant trends are known to emerge from market consolidations, and it is during these consolidations that traders experience “whip-sawing”, leading to psychological trauma that can cause havoc in a trader’s life. This can cause the trader to miss the trend altogether!

It is said that markets trend approximately 35% of the time, meaning that 65% of the time they are trend-less. Consolidations are known to occur before many significant market trends, and to be a profitable trader you must learn how to exploit these trends while not losing your money when the market is trend-less.

Non-trending markets are lethal to trend traders!

Trend traders need to develop the abilities to:

1) Identify non-trending markets quickly to avoid trading losses and to preserve their capital

2) Identify and take advantage of non-trending markets:

a) Identify and Bracket the consolidation with support and resistance lines forming a clear visual channel, and wait for the market to break-out of this channel before trend trading again

b) Use options or scalp the consolidation for profits while you wait for the next trend to emerge

c) Move to another market or time frame to trade and come back once a trend emerges from the consolidation

Consolidation: a textbook definition

Let’s define a market consolidation. A dictionary definition of a market is “the world of commercial activity where goods and services are bought and sold; without competition there would be no market.”

A dictionary definition of a consolidation is “something that has consolidated into a compact mass; combining into a solid mass; an occurrence that results in things being united.”

Reading these two text book definitions leads one to believe that a market consolidation is one where the competition between buyers and sellers unite to form a compact mass. A trader’s definition of a market consolidation is one where prices have remained range bound within a narrow price channel.

Is market consolidation an area where little or no new information has come into the market, causing a greater disagreement of value or perceived value which would move prices? Do trends occur because the value or perceived value is changing so much that the price must change to represent the new value? Answering yes to these questions leads to the conclusion that market consolidations are areas where no new value perceptions are being generated. Thus, prices remain “tight” or range bound. Consolidations are also known “Bracketed”, “Channeling”, or “Range-Bound” markets.

The nature or psychology of market consolidations

Consolidations by their very nature can not last too long since they become increasingly unstable with time. Most traders view consolidations as a stabilization of price, but consolidations actually become increasingly unstable with time. In fact, the longer a market remains consolidated, the more unstable it becomes. Market consolidations have their own cycles. During their initial formation traders are undecided as to the value the price oscillation. If this condition continues, traders’ perceptions of this asset’s value remain the same until new information enters the market to change perceptions. Until new information arrives, the consolidation becomes narrower and narrower to a point where the consolidation is now very unstable, and this is where new trends are born.

The longer or more mature the consolidation is, the larger the trend usually is as well. Lengthy or mature consolidated markets are so unstable that even just a whisper of new information coming into a consolidated market can make it move, but a shout of information can make it trend fast!

Once you spot a mature consolidation, your trading approach should be to bracket the upper and lower part of the consolidation. This helps to avoid unprofitable “whip-sawing” trades within the consolidation channel caused by insignificant trading reactions from minor market information. It is important that your trading approach not react to every “whisper” of information that the market ultimately finds meaningless.

By bracketing your trade entries above and below the consolidation channel, you automatically eliminate unnecessary losing trades. If you are an aggressive trader who welcomes the additional risk of a few losing trades within the channel to achieve a superior trade entry price, then you should wait for the mature consolidation to get very tight, and thus very unstable.

This will increase your odds of successfully timing the next significant trend and therefore reward your aggressive entry approach. Just as important as the length or time of the consolidation is the low Average True Range, or volatility of prices in recognizing the mature end of the consolidation before a significant new tend emerges. COMPRESSED price bars representing low volatility, and a low Average True Range can be significant in determining that the consolidation may be near its end and the new trend may be significant. Any new information coming into a market with compressed price bars could cause that market to move quickly. It is important to note that not all significant trends emerge only from market consolidations. But if you recognize a consolidation in the market, the potential is great for a significant trend to emerge if the consolidation has become so consolidated that it has now also become unstable.

Finding and monitoring market consolidations

The first step is to find markets that are in consolidation so you can be ready to trade the breakout when it occurs. To find these consolidated markets, it will be best to scan for markets with low volatility and narrow price movement. Look for a consolidation with at least 20 price bars before considering it for a potential trade based on “bracketing the high and low of the channel.

On daily charts markets can consolidate for weeks and some for even months, so you will want to monitor several markets simultaneously while they are in consolidation, this way you do not have to wait a long time before entering a trade.

On intraday charts markets that consolidate for 20 price bars my last 20 minutes or more depending on the intraday time frame you are using

Active traders can use this technique to scan for trade setups, and with 9,000 + stocks the trader can be quite active! If you’re a day trader, you can scan intraday charts looking for consolidations as well.

Trading market consolidations

Once you have identified the consolidation of at least 20 price bars, the next thing to do is draw a line on the top and the bottom of the consolidation channel, effectively “bracketing” the consolidation. Then place your long trade entries above the upper consolidation band, and your short trade entry below the lower consolidation band.

There is a high probability of significant trends emerging from markets that have been bracketed for 20 price bars or more! And price bars that are compressed within a bracketed market have a higher probability of a significant trend occurring when prices break the upper or lower part of the consolidation.

Note on this chart how compressed the price bars are BEFORE the market breaks below the consolidation.

Where to place your stops

Once the market breaks and begins to trend, stops can be adjusted according to market activity, with the initial stop-loss being placed on the opposite side of the consolidation channel in relation to which way the market started to trend.

Trade example combining bracketing

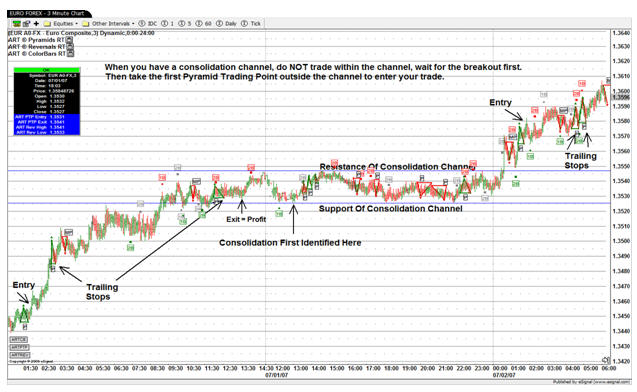

The stock chart below illustrates a market consolidation in Nortel’s stock with upper and lower lines drawn that bracket the consolidation. Trend traders should not attempt to trend trade during a bracketed market and should therefore not take any trades inside the drawn support and resistance lines.

Trade entries should then be placed above and below the consolidation. On this chart we are using the ART Software for specific entries and exits using ART’s Pyramid Trading Point triangles for both entries and exits and risk control.

Also note how prices become even more compressed towards the end of the consolidation just before this market begins to trend. This occurs often since markets usually spring from compressed price consolidation.

Here is another example of how to bracket a consolidation to avoid trading within the bracketed area. On this chart, do not trend trade between the upper and lower blue horizontal lines representing the top and bottom of the consolidation.

How to quickly identify non-trending markets!

This is a skill that all traders should master. Let’s take a look at the stages of identification:

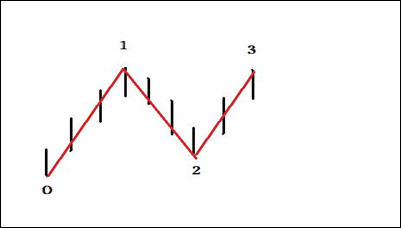

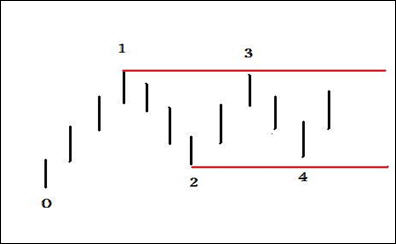

The set-up for a non-trending market occurs when you can see a 1, 2, 3 pattern develop as shown below. Note that #3 does not exceed #1 and #2 does not go below #0 at this stage:

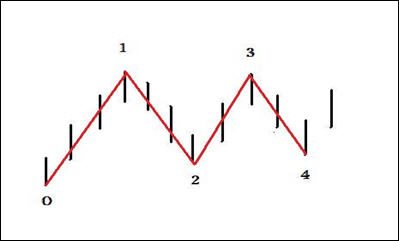

Once #4 is in place and does not go below #2, we have a confirmed bracket in place as illustrated on this chart:

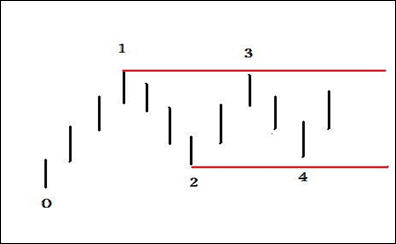

You now can drawn-in support and resistance lines as in this chart:

Conclusion

Sometimes one good technique is all we need to be profitable traders. Trading from market consolidations may just be the trading technique you have been looking for.

Whether you’re a futures trader, stock trader, day trader, or position trader, adding these trading concepts to your trading toolbox should prove worthwhile.

Bennett A. McDowell, founder of www.TradersCoach.com, began his financial career on Wall Street in 1984, and later became a Registered Securities Broker and Financial Advisor for Prudential Securities and Morgan Stanley. Bennett is considered an expert in technical analysis; he frequently lectures and recently authored the bestselling book The ART of Trading.