How to Invest with ETFs in a Declining Market

Almost every financial magazine and talking head spouts the benefits of “buy and hold,” of “investing for the long run,” and “staying the course” because “it’s impossible to beat the averages.”

Well, as an active investor and newsletter writer, I have to humbly disagree. And, as an active trader, I’m sure you may, too. Here’s why.

In March, 2000, the S&P 500 broke 1500 for the first time, just before starting its long decline of the 2000-2002 bear market and was not to see that lofty level again until October, 2007. And then, that “new record” was short lived as that point marked the start of the decline that led abruptly into the Bear Market of 2008. So, in a nutshell, as the end of 2008 comes into view, the S&P 500 is actually below where it was 8 years ago before the start of the 2000 bear market. The chart below, courtesy of BigCharts.com, painfully illustrates this dismal, disappearing decade.

Factor in inflation, and you can see how “buy and hold” rewarded you with a negative rate of return over the last ten years. In other words, most investors have lost nearly a decade of their investment lives. And, of course, 2008 has been a tough year on investors with all major indexes down as they entered the 4th Quarter and volatility at all time highs.

But, still, many active investors have been able to see opportunity in problems. And one of the best ways to do that has been to use inverse ETFs, or ETFs that move opposite to market direction. A leader in inverse Exchange Traded Funds is ProShares, a division of ProFunds Group, a $28 Billion provider of mutual funds and Exchange Traded Funds. ProShares manages approximately 85% of the short and leveraged fund assets in the United States today.

Starting just two years ago, the firm’s assets now exceed $20 Billion and make it the fifth largest ETF provider in America and the seventh largest in the world, and so far, in 2008, Proshares ranks second in growth among all U.S. ETF funds. They have 64 ETFs that offer short exposure and double exposure in a wide range of investment options including major indexes and major sectors like Oil and Gas, Financials, International and even Treasury Bonds.

And investors can use these funds in all sorts of different ways. They can gain exposure to directional moves they think might occur and they can also hedge positions in which they hold stock by buying the inverse ETF to hedge a downside move. Some examples of how this has worked so far in 2008 are clearly seen in the accompanying charts.

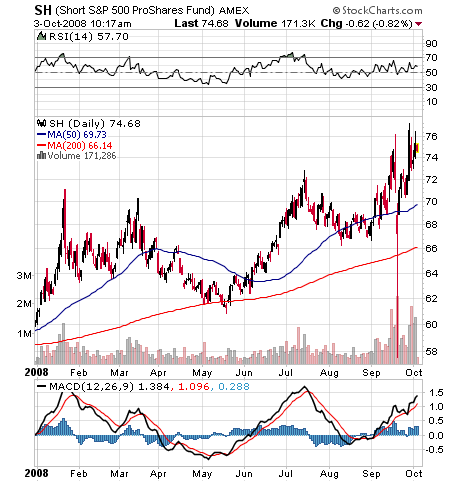

While most investors have been suffering through a bear market in 2008, investors who bought SH, the Short S&P 500 PowerShares fund, have experienced a very positive year. And these inverse ETFs also give you the option of “shorting” a particular sector as evidenced in the chart of SSG, an ETF that tracks the ProShares Short Semi Conductor Index.

The benefits of these new funds are many, including the ability to “short” the markets inside of IRAs and 401k plans which traditionally don’t allow shorting of stocks. But the hazards can also be significant as these are highly volatile, fast moving funds that need to be actively managed with effective trading programs.

So, the sky is almost the limit when it comes to new alternatives for investors. Many investors will continue with the “buy and hold” mantra of Wall Street and so could continue to see time and the markets working against them if this disappearing decade continues.

But there are clearly other options available to investors who are able to educate themselves and bring patience and discipline to their trading activities. With new flexibility offered by inverse funds, knowledgeable investors have more opportunities than ever to seek profits during market declines.

John Nyaradi is publisher of Wall Street Sector Selector, an online newsletter specializing in sector rotation trading using exchange traded funds.