What’s Up, What’s Down: Softs Futures

Comments for Friday, September 24, 2010

Looking Ahead to Today by Reflecting Back at Thursday’s Price Action

Futures and options trading is speculative in nature and involves substantial risk of loss. Futures and options trading is not suitable for all investors.

SOFTS:

LUMBER: NEW HOME SALES. Lumber (November) made its best high since May 25th before breaking hard and settling sharply lower ahead of the new home sales report coming out on Friday. There is really very little resistance up to 2600 and good support under 220 BUY SIGNAL. CALL FOR DETAILS!

COCOA: Cocoa made its best close this time since August 24th getting close to a buy signal while forming a possible bottom. SELL SIGNAL. CALL FOR DETAILS!

SUGAR: Sugar made a new CONTRACT HIGH AND CLOSE but still has its key reversal intact. Stand aside for now although the trend since May is obviously up. If sugar makes a new contract high and close then my buy signal will be reinstated but call me for proper entry points.

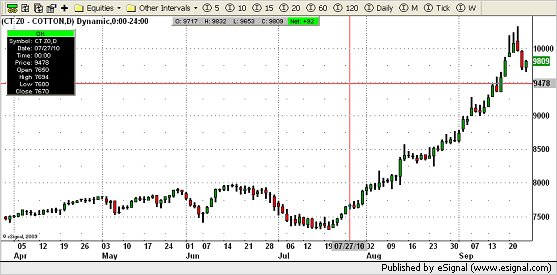

COTTON: Cotton followed through lower form its reversal type action on Wednesday but a retracement has long been overdue. We’ve seen this type of action all the way up. Will this be the top at this time? Stay tuned. BUY SIGNAL. CALL FOR DETAILS!

COFFEE: Coffee had a narrow trading range this time settling higher. The overall trend is obviously up but I did have a sell signal on Wednesday as mentioned before. Call me for the best area to sell and limit your risk while having at least a 3:1 risk reward ratio. SELL SIGNAL. CALL FOR DETAILS!

ORANGE JUICE: OJ had another huge trading range settling lower this time but still looking very strong overall. This action reminds me of the old days! BUY SIGNAL. CALL FOR DETAILS!

Is open-outcry going away? Do you know exactly how much futures trading is executed on electronic platforms like Globex? Download my Trading Volume report at https://www.zaner.com/3.0/ralexVolume.asp (or copy & paste this link into your browser).

Rick Alexander has been a broker and analyst in the futures business for over thirty years. He is a Vice-President for Sales and Trading at the Zaner Group (www.zaner.com) a Chicago-based futures brokerage firm. Email Rick at ralexander@zaner.com.

The information in this Report and the opinions expressed are subject to change without notice. Neither the information nor any opinion expressed constitutes a solicitation by Rick Alexander or the Zaner Group of the purchase or sale of any futures or options. Futures and options trading is speculative in nature and involves risks. Spread trading is not necessarily less risky than outright positions. Futures and options trading is not suitable for all investors.