How Would You Like To Trade a Strategy That Looks Like This?

Introducing The Connors Research Trading Strategy Series; high performing systematic strategies intended for you to achieve higher returns with significantly less risk.

Dear Trader,

In our book The Alpha Formula, we conclusively showed that having high performing, minimally correlated strategies has led to superior risk adjusted performance for over 15 years, including the bear market of 2008.

You’ve seen this for years and likely decades; no one can predict where the market is going next week, next month or next year!

The Key To Success

Having strategies in place ahead of time for the times markets go up, markets go down, and when markets go through times of stress is better than guessing which direction the market is heading.

By having strategies in place ahead of time there’s no guessing involved. As the market moves in any direction, you ideally already have strategies in place to profit from those market conditions.

What Is the Connors Research Trading Strategy Series?

The Connors Research Trading Strategy Series are individual systematic high-performing strategies and portfolios for you. Each individual strategy and portfolio is backed by up to 18 years of historical test results as you saw above.

Highlights include:

- Superior risk-adjusted returns

- Each strategies rules are fully disclosed to you

- Each strategy is simple to apply

- Each strategy is backed by up to 1 ½ decades of historical test results.

- High Sharpe ratios

- Minimal drawdowns

- Daily signal code is provided for you to begin trading immediately

- Free backtesting code

- No future costs or subscription fees

- Email customer support to assure you’re up and running with each strategy

Who Is The Connors Research Trading Strategy Series For?

The Connors Research Trading Strategy Series is for disciplined money managers, family offices, and high net-worth individuals, who are seeking superior systematic trading strategies to improve their returns no matter what the market conditions are.

If you have a science, technology, engineering or math background (STEM) or you rely upon data to make your trading and investing decisions and are looking for high performing systematic strategies, these strategies and portfolios are specifically intended for you.

Are You A Systematic Trader and Investor Who Makes Your Decisions Based On Data Driven Results and Not Emotion?

Applying data driven, scientific concepts successfully used by the likes of billionaire Ray Dalio, who founded the largest hedge fund in the world, AQR, the second largest hedge fund in the world, and other giants in quantitative investing, you will learn how to invest like the smart money does.

Backed by dozens of academic studies both in finance and behavioral science, along with decades of data, you will learn new high-performing systematic strategies you can apply immediately.

Who Is Behind the Research?

The research and strategies are developed by Larry Connors, a four-decade industry professional and author of a number of top-selling books on trading, and Chris Cain. CMT, Senior Quantitative Researcher for Connors Research and creator of the best-selling course, Python Programming For Traders.

Larry, Chris, and Connors Research were selected as the 2020 winners of the prestigious Charles H. Dow Award from the CMT Association for their groundbreaking research on systematically combining fundamental, technical and quantitative analysis. These proprietary strategies are derived from this award winning research.

Everyone Is Required to Sign a Non-Disclosure Agreement (NDA)

Due to the fact that these strategies are not in the public domain, everyone will be required to sign a non-disclosure before receiving the strategies. This is to better assure that the concepts and the historical edges you’ll learn do not get spread throughout the internet.

Here is a Description of Each of the Strategies and Their Historical Test Results

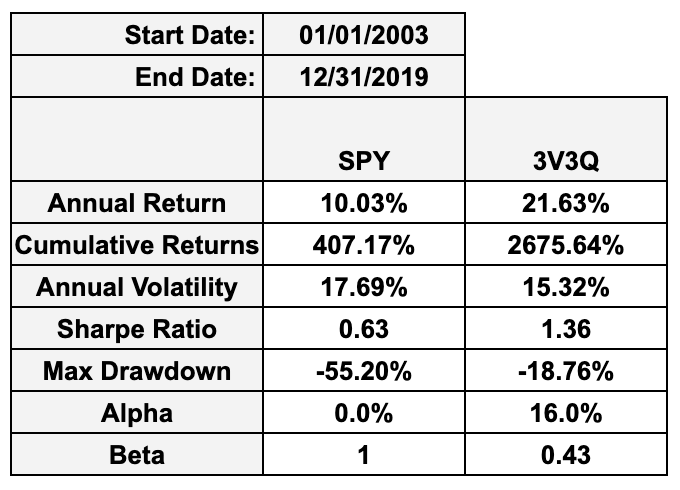

Strategy One: 3V3Q – Our Highest Performing Strategy

Strategy Name: 3V3Q

Trading Style – Applies the award-winning Quantamentals strategy of combining fundamental analysis, with technical analysis, and quantitative analysis on the 500 most liquid US stocks.

Time Frame Holding Period – Approximately 1-3 months

Includes

- Full rules disclosure

- Free daily signal code

- Free backtesting code

- Instructions on how to update the results on an ongoing basis

- Recording on how to trade the strategy

- No additional costs or subscription fees

- Email customer support to assure you’re up and running with the strategy

Strategy Two: Sharpe Mean Reversion – Especially For Short-Term Traders

Strategy Name: Sharpe Mean Reversion

Trading Style – Mean reversion in the most liquid 500 US stocks.

Time Frame Holding Period – 3-7 days

Identifies Pullbacks in historically high performing buying zones in higher quality liquid stocks

Historical Test Results (2003-2019)

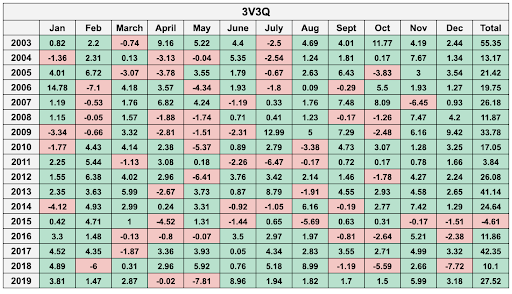

Monthly/Yearly Returns:

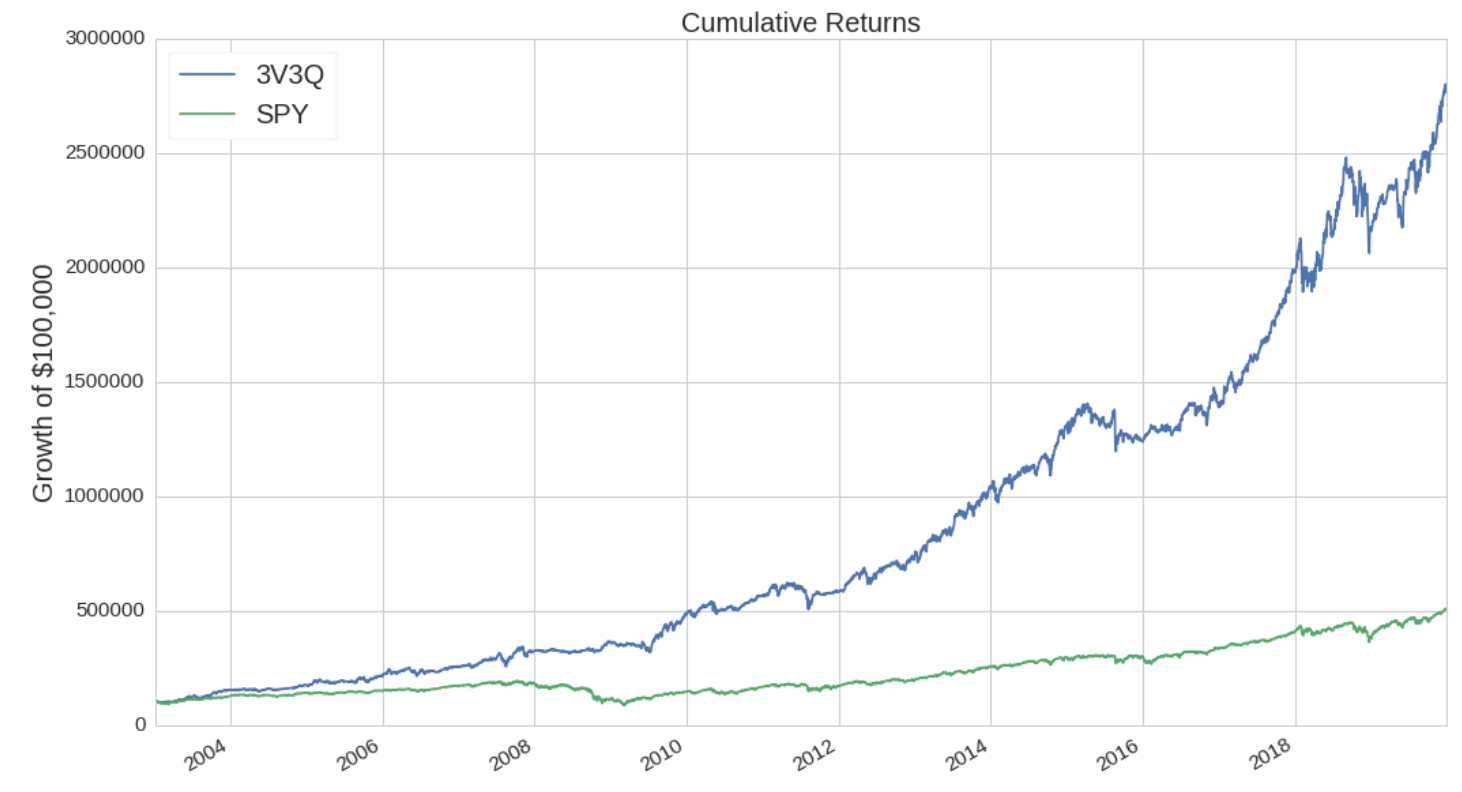

Cumulative Equity Curve:

Includes

- Full rules disclosure

- Free daily signal code

- Free backtesting code

- Instructions on how to update the results on an ongoing basis

- Recording on how to trade the strategy

- No additional costs or subscription fees

- Email customer support to assure you’re up and running with the strategy

Strategy Three: QAS – A Short Only Strategy

Strategy Name: QAS

Trading Style – Selectively shorts the 500 most liquid US stocks.

Time Frame Holding Period – Approximately 2-7 days

Highlights – This strategy is intended to profit on the short side, especially during bear markets.

Summary Statistics:

Monthly/Yearly Returns:

Cumulative Equity Curve:

Includes

- Full rules disclosure

- Free daily signal code

- Free backtesting code

- Instructions on how to update the results on an ongoing basis

- Recording on how to trade the strategy

- No additional costs or subscription fees

- Email customer support to assure you’re up and running with the strategy

Special Bonus – Order 3V3Q and one additional strategy, and receive the third strategy for free.

Here Is How Gain Access To The Strategies

- Select the strategy or strategies you are interested in and add them to your cart.

- After you check out you will receive an NDA from us.

- Please read, sign, and return the NDA via email.

- Upon receipt, you will gain access to the strategies you ordered.

Thank you. If you have any questions, please call us at 973-494-7311 ext 616, or email us at tradingseries@cg3.com