Do You Trade Stock Gaps?

“If I could only trade one strategy, it would be early morning gaps.” — Kevin Haggerty, Former Head of Trading Fidelity Capital Markets

Gap Trading Is A “Core Strategy” For Most Successful Traders

For three decades, gap trading has been one of the most popular and successful strategies for traders who have identified when and how to trade stock gaps. The problem is that there are literally thousands of gaps every year. So how does the average trader know which ones to trade, where to enter them and where to properly exit the positions?

Now for the first time, you have the opportunity to learn what many professionals already know about gap trading: when it’s done correctly, it can be extremely lucrative.

Strong Results From Stock Gap Trading Strategies That Work

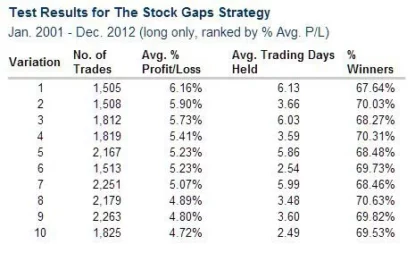

What you will learn with this strategy are dozens of short-term set-ups which have been correct greater than 68% of the time (a very high win percentage).

And the average gain per trade (this includes all winning and losing trades) has averaged up to 6.16% per trade since 2001!

If you rely on data, not opinion to make your trading decisions, and you want the ability to choose the best variations to trade your strategies, then this guide is for you.

Here are the test results for the top 10 best performing variations from Stock Gap Trading Strategies That Work:

Here Is What You Will Receive…

In the Stock Gap Trading Strategies That Work guidebook you will receive:

- The exact trading rules. This is not a black box – full disclosure of the rules is given to you.

- How to identify the best Stock Gaps set- ups.

- How to select the best entry levels that fit your trading style.

- Where to exactly place your orders each day.

- Where and when to exactly exit your orders.

The strategies within Stock Gap Trading Strategies That Work are traded on all liquid US stocks and with options (and it can be done on global markets as well).

Plus – For Options Traders, Too

And as a bonus we also added how to trade options with gaps to this strategy guide. This increases the number of opportunities you have to profit from your gap trading.

Download it for Free Today!

Whether you day trade, swing trade, or trade options, Stock Gap Trading Strategies That Work will make you a better, more powerful trader.

If you are looking to trade one of the most powerful gaps strategies available to traders today, fill out the form below to download Stock Gap Trading Strategies That Work.

Publisher’s Note on this edition: How to Trade High Probability Stock Gaps, first published in March 2012, is one of our most popular Strategy Guidebooks. This new edition has been renamed and updated with an additional year of historical test results that continue to corroborate the original strategy and trading rules.

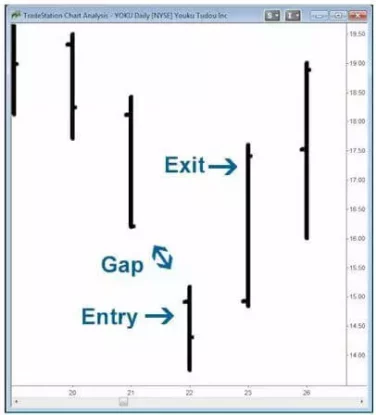

Sample Trade

YOKU: Here is a Long Entry (after 3% Gap) at 14.76 on 9/22/11. Exit signaled at 17.41 for 2.65 points on 9/23/11 for a 17.79% Gain.