Asymmetric Trading – Maximizing Your Returns With AI Single Stock Leveraged ETFs

- September 6, 2024

- Larry Connors

Larry Connors' Trading Lesson of The Day | September 6, 2024

What Is Asymmetric Trading and What Are Asymmetric Returns?

How To Combine A Revolutionary Technology, Single-Stock Leveraged ETFs, and Options Together for Asymmetric Returns

Let’s now walk through how to do this by combining AI stocks that have Single-Stock ETFs along with options.

1. This can be done with any Single-Stocks ETF, but because AI is a new revolutionary technology, we’ll focus on this area.

2. Identify the AI, or related AI company (a supplier to the AI industry for example), that has a Single-Stock ETF. A Single-Stock ETF is simply a leveraged version of the underlying stock.

3. In this example, let’s look at NVDA. If you buy NVDA and it rises 10%, you make 10%. If it drops 10% you lose 10%. This is very simple.

4. A more aggressive way to trade NVDA if you are bullish is to buy one of the Single-Stock ETFs on it. The three most popular were mentioned in yesterday’s trading lesson.

Each is offered by different ETF providers but they essentially all do the same. They will move approximately 2x the “daily” move of NVDA.

If NVDA moves up 2% for the day, these Single-Stock ETFs will move up 4% for the day (the reverse is true if NVDA declines 2% for the day).

As I mentioned in yesterday’s lesson, Single-Stock ETFs reset daily. This means that you receive double the daily move for that day only.

5. Now let’s get more aggressive and look to potentially make asymmetric returns in a short period of time.The single best way to do this is with long options. Long options allow you to “pre-determine your dollar risk”.

This is important because if you buy any security, you are likely locking up substantially more money to own it while at the same time risking a much larger dollar amount.

Here’s an example…

A) Stock XYZ is trading at $50/share.

B) You buy 1000 shares.

C) Not only are you tying up $50,000 of capital, you theoretically have the entire amount at risk.

Stops don’t always limit the loss potential. If something bad happens in the world overnight, or to the company, a stop at $45 is next to useless if the stock gaps down and opens at $20 (an important point many traders forget to take into account).

With long options, you can control a far larger amount of the stock, while often risking far less money.

Amplifying Your Returns

6. You can amplify this further with Single-Stock ETFs.

Here’s an example with NVDA:

A) NVDA is hypothetically trading $100.

B) Buy 1,000 shares of NVDA – you are both tying up, and theoretically risking, $100,000.

C) If NVDA rises 20 points you make $20,000.

This is not asymmetric trading!

Yes, we’d all like to make a 20% return, but we are theoretically risking $100,000 to do so.

Can we do better on a risk/reward basis? Yes. Here’s how:

7. Look at one of the Single-Stock ETFs on NVDA. In this example, let’s look at NVDU.

8. Assume it’s trading at $55. It will now move up or down daily 2x the amount of NVDA. This is better if you’re correct, but it still doesn’t provide us with an asymmetric return trade structure.

Here’s Where Asymmetry Comes In…

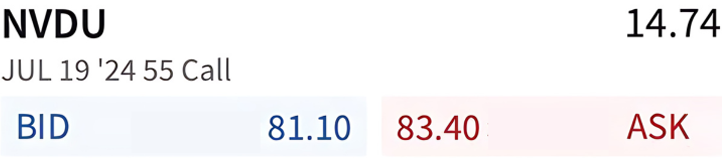

9. Look at the NVDU long call options. In the example below, they were trading at 14.74 when purchased.

For every $1,474 per contract risked, the options rose over 500% bidding $8,110 in a few months period of time.

If one purchased 10 contracts for example, they risked a total of $14,740. In this example, their value rose to $81,110.

When you’re correct on the long side, as in this example, you literally have unlimited upside in your position while risking a limited amount.

The risk is, of course, greater in order to gain the potential reward. Price and time risk is increased in exchange for the potential to make many times one’s money.

This is how many of the great hedge funds often structure their trades. Risk one Unit to make many Units. Do this successfully many times and you’re on the right path to wealth creation with your trading.

With AI being a revolutionary technology still in its infancy, and the possibilities of substantial gains in the future, structuring your AI trades with Single-Stock ETFs, and properly priced long options, places you in the position with the goal of achieving asymmetric returns.

If you’re interested in combining AI with asymmetric trading, my weekly AI Wealth Creation Traders Report identifies these AI companies for you along with ways to structure your trades with the goal of achieving asymmetric returns. Click here for additional information.