PowerRatings Trading Strategy for Stocks: PBY, NDN, MYL

Early strength has a number of our Top PowerRatings stocks rallying above their 5-day moving averages on an intraday basis. Traders will need to stick around until the close to see if this strength holds, but in the meantime, here are a few high PowerRatings stocks that buyers have not yet moved into. These are among the stocks that high probability mean reversion traders should be focusing on over the next few days.

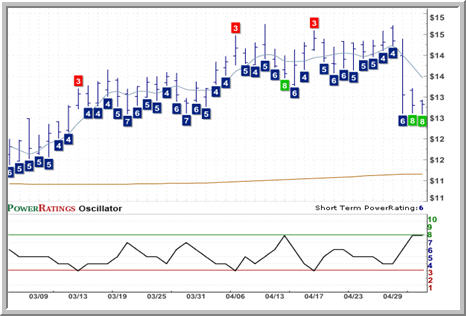

Down three days in a row and five out of the past six is Pep Boys: Manny, Moe and Jack

(

PBY |

Quote |

Chart |

News |

PowerRating). This auto repair shop is trading at breakeven levels a few hours into trading on Monday and currently has a 2-period RSI of less than 7 intraday. PBY’s 2-period RSI was also less than 7 when the stock closed on Friday.

PBY has a PowerRating of 9.

99 Cents Only Stores

(

NDN |

Quote |

Chart |

News |

PowerRating) has a PowerRating of 8 and has pulled back from gains made early in the Monday morning session. The stock has closed lower for three days in a row going into Monday’s trading, and had a 2-period RSI of less than 2 as of Friday’s close. While early buying has helped relieve the oversold condition in the stock, NDN is still potentially an attractive opportunity on continued weakness.

Lastly, Mylan Inc.

(

MYL |

Quote |

Chart |

News |

PowerRating) has closed lower for four consecutive trading days going into Monday and, as such, has developed a low, 2-period RSI of less than 12.intraday on Monday (MYL had a 2-period RSI of less than 2.

Recall that stocks with PowerRatings of 9 have outperformed the average stock by a margin of more than 13 to 1 after five days. Stocks with PowerRating of 8 have also been strong, besting the average stock by a margin of more than 8 to 1 over the same time period. This is based on our testing of thousands of simulated stock trades going back more than a decade.

Does your stock trading need a tune-up? Our highest Short Term PowerRatings stocks have outperformed the average stock by a margin of nearly 17 to 1 after five days.

| Click here to start your free, 7-day trial to our Short Term PowerRatings! |

Whether you have a trading strategy of your own that could use a boost or are looking for a way to tell the stocks that will move higher in the short term from the stocks that are more likely to disappoint, our Short Term PowerRatings are based on more than a decade of quantified, backtested simulated stock trades involving millions of stocks between 1995 and 2007. Click the link above or call us at 888-484-8220, extension 1, and start your free trial today.

David Penn is Editor in Chief at TradingMarkets.com.