Free Trading Webinar on Thursday, January 9, 2025

- January 6, 2025

- TradingMarkets Editors

You’re invited to attend a free trading webinar I’m holding this Thursday, January 9, at 1 pm EST.

The topics will include:

1. 2025 Trading Opportunities – I‘ll share with you what to expect in the market for this year, especially as the new administration begins implementing their broad-reaching economic policies.

Also, with AI touching nearly every industry, whether directly or indirectly, we’ll look at what I believe to be substantial opportunities for both short-term and longer-term trading.

Historical trading patterns emerge when revolutionary technologies occur (AI and, now most recently, Quantum Computing), and we’ll look at these patterns and the ways to trade them.

2. Explosive AI Stocks – Over the past 1 ½ years, my webinars have focused on this revolutionary technology and the stocks and industries most likely to profit from this incredible, once-in-a-lifetime breakthrough.

From NVDA to Data Centers to the Power Industry, many of the companies we’ve focused on in my earlier webinars have appreciated significantly; a number of them achieving triple-digit returns.

At Thursday’s webinar, we’ll look at the AI stocks I believe now have the greatest potential for gains in the upcoming year.

I’ll also touch upon constructing positions with the goal of achieving asymmetrical returns (risking one unit to make many units).

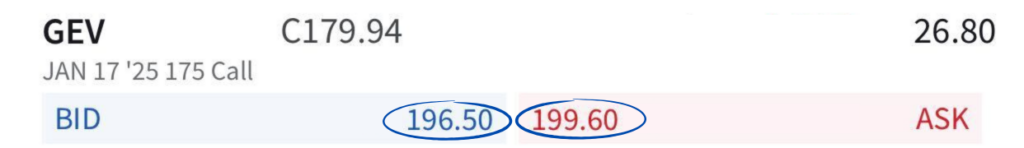

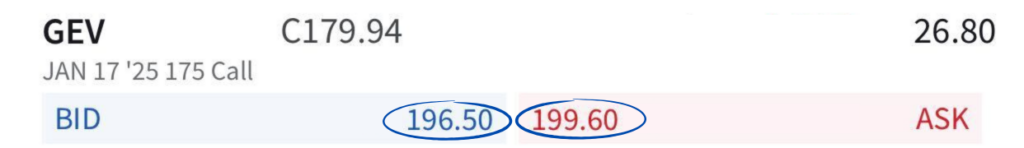

This is an example of a trade I’m currently in with a power company stock that is leading the charge in servicing AI energy – GEV (GE Vernova).

As you can see, the option position was purchased at $26.80. As of this writing, it’s trading over 700% higher…

Even though I can’t promise you’ll achieve these same returns, asymmetrical trading is the backbone of most successful professional traders and hedge funds.

I’ll cover this further in Thursday’s webinars in order for you to learn how to trade like this.

3. The Advancement of AI and How It Can Positively Impact Your Trading, especially with OpenAI launching their new o1 version, which includes logic and reasoning for the first time.

After 44 years in this industry, I can confidently say – There is more Alpha to be found in ChatGPT than anywhere else in the history of the financial markets!

This breakthrough in AI applying logic is possibly the most important breakthrough AI has seen, and it will have a tremendous effect on improving your trading, especially if you know how to apply it.

In fact, I’ve been on a Bloomberg terminal since 1989. My $30,000-a-year subscription officially ended last month because of what the new ChatGPT o1 version can do for my trading.

I’ll teach you a handful of ways on how to improve your trading, and also how to find better hedge fund level trading opportunities because of AI and ChatGPT o1.

4. The Exciting New Opportunities in Trading Quantum Computing Stocks – Quantum Computing is now a reality, thanks to the incredible breakthrough Google made last month.

Many of these Quantum Computing stocks have had major moves, and in the webinar, I will share with you the two companies that will potentially become the next NVDAs of Quantum Computing.

5. We’ll wrap up the webinar discussing how AI, especially ChatGPT, can rapidly transform your trading.

AI is revolutionizing the world – it has just begun to revolutionize trading. You’ll see how to easily learn ways to use AI with the goal of making you a more successful and more profitable trader.

If you’re interested in joining, please register early to ensure a spot is reserved for you.

To secure your spot, please click here and register now.

I look forward to being with you at the webinar!

Larry